Options trading is a powerful financial strategy that can be used to generate income, hedge against risk, or speculate on the future price of an asset. LEAPS (Long-Term Equity Anticipation Securities) are a specific type of option contract that offers unique benefits and considerations. In this comprehensive guide, we will delve into the world of options trading LEAPS, providing you with the essential knowledge to make informed investment decisions.

Image: stockoc.blogspot.com

What Are LEAPS?

LEAPS are long-term option contracts with expiration dates that extend beyond one year, often with terms of two or three years. Unlike traditional options that expire within a month or a year, LEAPS provide traders with a longer period to capture potential profits from price movements. This extended time horizon also lowers the rate of time decay, reducing the erosive effect of time value on the contract’s premium.

Advantages of Trading LEAPS

- Extended Expiration: LEAPS offer greater flexibility and allow traders to capitalize on long-term market trends.

- Reduced Time Decay: The longer expiration dates minimize the impact of time value erosion, preserving the contract’s premium over a more extended period.

- Lower Margin Requirements: Compared to short-term options, LEAPS typically require lower margin requirements, allowing traders to leverage their capital more efficiently.

- Enhanced Leverage: LEAPS provide traders with substantial leverage, potentially amplifying gains if the underlying asset moves in their favor.

Considerations for Trading LEAPS

![LEAPS Options Strategies [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da2695784a3e95944a96a_LEAPS-Options-Strategies-Option-Alpha-Handbook.png)

Image: optionalpha.com

Higher Premiums

LEAPS command higher premiums compared to short-term options due to their extended time value. Traders must carefully weigh the potential rewards against the upfront cost of the contract.

Lower Liquidity

LEAPS are less frequently traded compared to short-term options, resulting in potentially lower liquidity. This reduced liquidity may make it more challenging to enter and exit positions at desired prices.

Latest Trends and Developments

The options market is constantly evolving, and LEAPS have emerged as a popular choice among experienced traders. Some of the key trends and developments related to LEAPS include:

- Increased Use of LEAPS for Long-Term Strategies: Traders are increasingly recognizing the potential of LEAPS for long-term investment and hedging strategies.

- Growing Popularity on Exchange-Traded Options: LEAPS are becoming more widely available on exchange-traded platforms, offering greater transparency and liquidity.

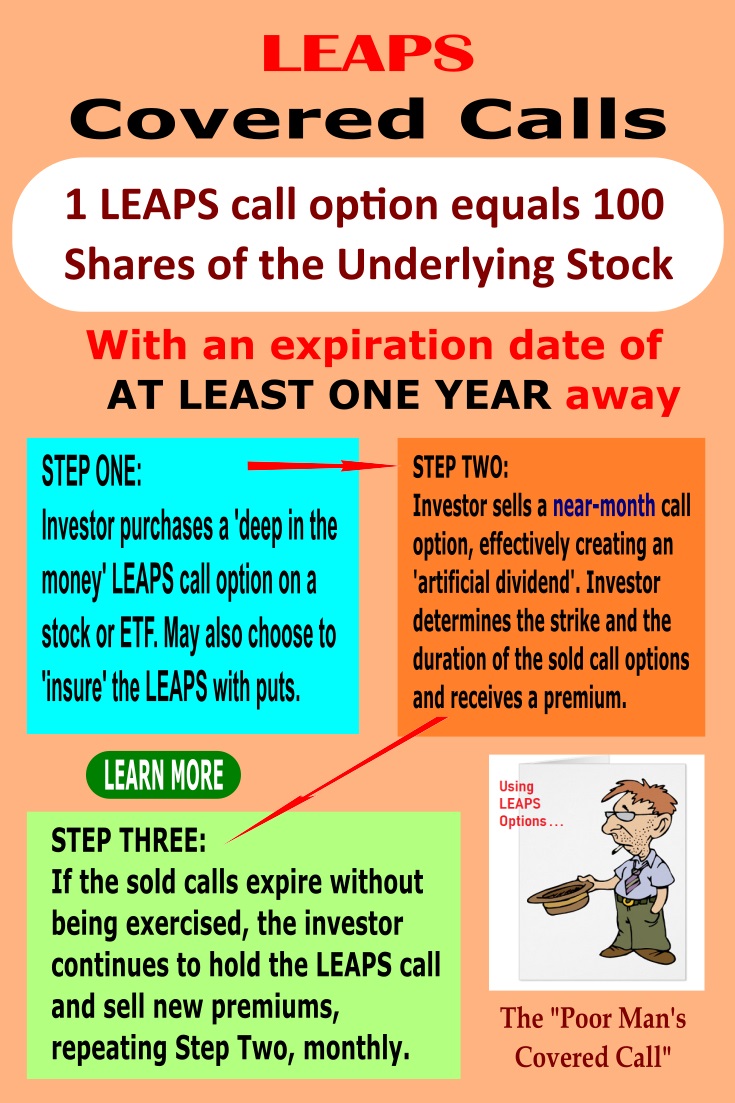

- Innovative Use of LEAPS for Income Generation: Advanced strategies such as covered calls and calendar spreads are being used to generate regular income through LEAPS.

Tips and Expert Advice

Choose Liquid LEAPS

Select LEAPS contracts that have adequate trading volume to ensure liquidity and ease of execution.

Understand Time Decay

Monitor the time decay associated with LEAPS to make informed decisions about the appropriate expiration date and strike price.

Use LEAPS as Part of a Diversified Strategy

Incorporate LEAPS as part of a balanced portfolio to spread risk and enhance overall investment performance.

FAQ

Q: What is the difference between LEAPS and other options?

A: LEAPS have longer expiration dates, typically extending beyond one year, while regular options expire within a month or a year.

Q: Can I hedge with LEAPS?

A: Yes, LEAPS can be used for hedging purposes, offering a flexible way to protect against potential losses

Options Trading Leaps

Image: www.options-trading-mastery.com

Conclusion

Options trading LEAPS present a compelling strategy for experienced traders seeking long-term investment opportunities or sophisticated hedging techniques. While LEAPS offer unique advantages, it is crucial to approach them with a comprehensive understanding of their benefits and considerations. Through proper due diligence, sound strategy, and expert guidance, traders can navigate the world of LEAPS effectively and potentially achieve their financial objectives. Are you ready to explore the exciting world of options trading LEAPS?