Welcome to my blog, financial enthusiasts! Today, we embark on an illuminating journey into the world of options trading. Have you ever wondered if this financial instrument can pave the way to substantial returns? Let’s dive into the intricacies of options trading and unravel its secrets.

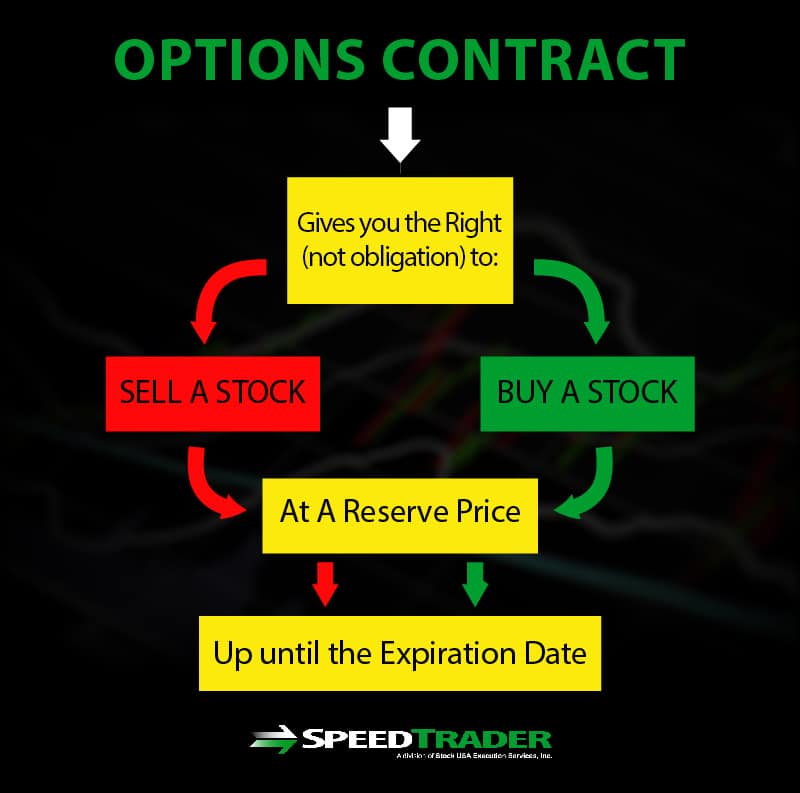

Image: speedtrader.com

Options trading, a sophisticated financial strategy, involves the purchase of contracts that grant the holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. These contracts offer investors the potential for both profits and losses.

The Mechanics of Options Trading

To delve deeper into the mechanics of options trading, let’s introduce some fundamental concepts:

Call Options

Call options bestow upon the holder the right to buy an underlying asset at the specified price (strike price) on or before the designated expiration date. They confer potential profits when the underlying asset’s price rises above the strike price.

Put Options

Put options, on the other hand, empower the holder to sell an underlying asset at the strike price on or before the expiration date. These options generate potential returns if the underlying asset’s price falls below the strike price.

Image: www.youtube.com

Options Premium

Options, like any other financial instrument, come at a price known as the premium. This premium represents the price paid for the right to execute the underlying contract. When buying an option, the premium is paid upfront and forms the investor’s maximum possible loss.

Factors Influencing Profitability

The profitability of options trading hinges on an intricate interplay of factors:

- Underlying Asset Price Movement: The direction and magnitude of the underlying asset’s price movement relative to the strike price.

- Option Type: Call options profit from price increases, while put options benefit from price decreases.

- Option Premium: The higher the premium, the greater the potential profit or loss.

- Time to Expiration: Options with longer expiration periods afford more time for the underlying asset’s price to move favorably, increasing the chance of profitability.

- Volatility: Options trading thrives on volatility, as greater price fluctuations enhance the potential for profit.

Tips and Expert Advice

To navigate the choppy waters of options trading, heed these invaluable tips and expert counsel:

- Thorough Research: Diligent research into underlying assets, market trends, and historical volatility is crucial for informed decision-making.

- Risk Management: Options trading can be a risky endeavor, so effective risk management strategies are paramount. Consider employing stop-loss orders and position sizing.

- Proper Strategy: Develop a well-defined trading strategy that aligns with your risk tolerance and financial goals.

- Emotional Discipline: The markets can be capricious, so cultivate emotional discipline to avoid impulsive trades based on greed or fear.

- Seek Professional Guidance: If you’re a novice trader, consider seeking mentorship from an experienced options trader or financial advisor.

FAQs

Q: Is options trading a suitable investment for everyone?

A: Options trading is not recommended for inexperienced investors or those with a low risk tolerance. It requires a thorough understanding of market dynamics and risk management strategies.

Q: Can options trading generate consistent profits?

A: While options trading has the potential for substantial returns, consistent profitability is not guaranteed. Success hinges on a combination of skill, experience, and a well-defined trading strategy.

Q: What’s the difference between options and futures contracts?

A: Options grant the right to buy or sell an underlying asset, while futures contracts obligate the holder to buy or sell at a specified price on a predetermined date.

Does Options Trading Make Money

Image: www.adigitalblogger.com

Conclusion

So, does options trading make money? The answer is both yes and no. While the potential for profit exists, so too does the risk of loss. Successful options trading demands a deep understanding of market dynamics, effective risk management, and a well-defined strategy. If you’re considering venturing into options trading, proceed with caution, do your homework, and seek professional advice if necessary. Remember, financial markets can be unforgiving, so tread carefully and always prioritize risk management.

Have you ever participated in options trading? Share your experiences and insights in the comments below!