In the realm of investing, the allure of options trading beckons many eager investors seeking to amplify their returns and hedge their financial risks. But amidst the seemingly complex jargon and intricate strategies, understanding the fundamentals of options trading is paramount. This comprehensive guide will demystify the world of options, empowering you with the knowledge to make informed decisions and embark on your options trading journey with confidence.

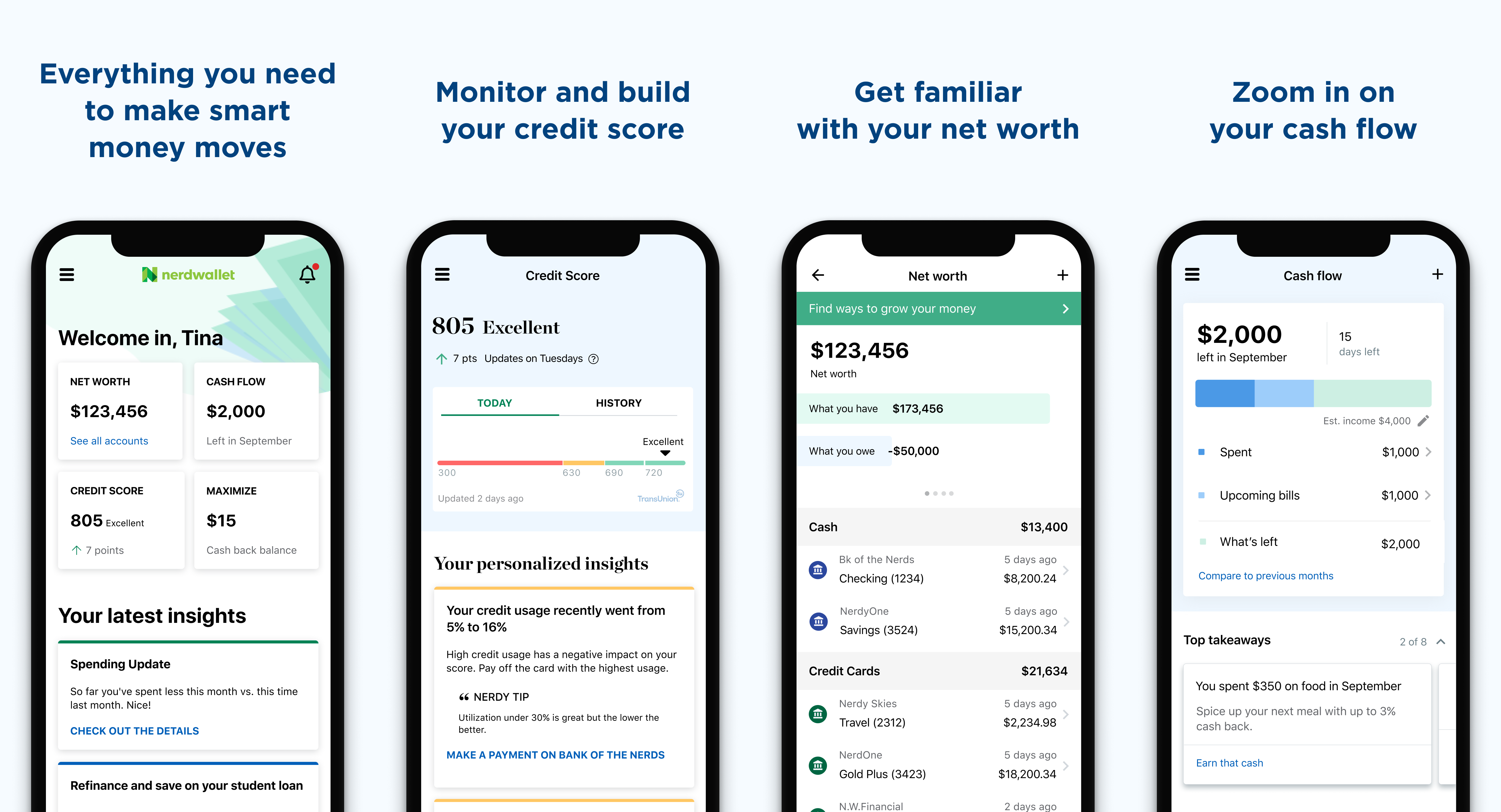

Image: www.nerdwallet.com

Options 101: A Definition

Options contracts grant you the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined time frame. Think of options as a customizable investment tool, providing you with flexibility and the potential for significant gains. By understanding the types, strategies, and mechanics of options, you can unlock their power to enhance your portfolio’s performance.

Types of Options Contracts

-

Call Options: Grant the right to buy an underlying asset at a specified price (strike price) on or before a certain date (expiration date). When the underlying asset’s price rises above the strike price, call options gain value.

-

Put Options: Grant the right to sell an underlying asset at a specified price (strike price) on or before a certain date (expiration date). When the underlying asset’s price falls below the strike price, put options gain value.

Options Trading Strategies

-

Covered Call Strategy: This strategy involves selling call options when you own the underlying asset. If the asset’s price rises above the strike price, you can profit from both the increase and the sale of the call option.

-

Protective Put Strategy: This strategy involves buying put options when you own the underlying asset. If the underlying asset’s price falls below the strike price, the put options will increase in value, providing a hedge against potential losses.

-

Bull Call Spread Strategy: This multi-leg strategy involves buying a call option at a lower strike price and selling a call option at a higher strike price with the same expiration date. It aims to profit from a significant increase in the underlying asset’s price.

Mechanics of Options Trading

-

Option Premium: The price you pay to purchase an option. It reflects the market’s expectation of the underlying asset’s price movement and incorporates factors such as time to expiration and volatility.

-

Expiration Date: The date by which an option contract must be exercised or expires worthless. Time decay reduces the value of options as they approach expiration.

-

Exercise: If an option’s price is favorable, you can exercise it to buy or sell the underlying asset at the strike price. This decision requires calculating potential profits and risks.

Conclusion

Options trading can be a powerful financial instrument, but it also carries inherent risks. By understanding the types of options, strategies, and mechanics outlined in this comprehensive guide, you can confidently navigate the world of options trading. Remember to conduct thorough research, seek expert advice when necessary, and invest judiciously. Embrace the potential and challenges of options trading, and unlock the opportunity to enhance your investment returns.

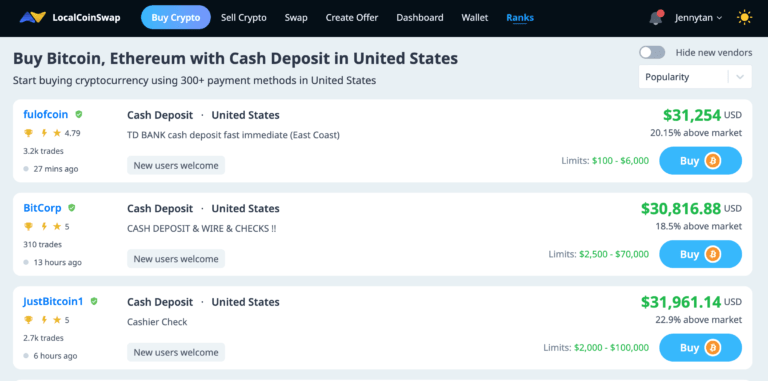

Image: www.youtube.com

Https Www.Nerdwallet.Com Blog Investing Options-Trading-101

Image: thinkmaverick.com