The grain business has always been subject to wild price fluctuations. Farmers faced much uncertainty about how much their crops would be worth when they reached the market. Futures contracts provided protection against these uncertainties by providing a pre-determined price for when crops were sold. Options contracts took things a step further, giving farmers the choice of whether or not to sell at the pre-determined price at the time of harvest.

Image: grains.org

CBOT Grain Options on Futures

The Chicago Board of Trade (CBOT) introduced the first grain options on futures contracts in 1984. It was a partnership with the Chicago Mercantile Exchange (CME) since the CME was more established and better equipped to handle more trading volume. Grain options on futures quickly gained popularity, as they offered farmers a variety of new ways to manage their risk.

In the years since their inception, CBOT grain options on futures have become even more sophisticated. This is due in part to the rapid advancements in computer technology, making it possible to trade options electronically. As a result, the volume of grain options trading has increased dramatically.

Advantages of Grain Options on Futures

There are several advantages to using CBOT grain options on futures contracts. First, they provide farmers with a way to manage their risk. Farmers can use options to lock in a price for their crops at a time when prices are favorable. This can help protect them from losses if prices decline before they can sell their crops.

Second, grain options on futures can be used to generate income. Farmers can sell options to other farmers or to speculators who are looking to profit from price fluctuations. This can provide farmers with additional income regardless of how prices ultimately move.

Third, grain options on futures can be used to speculate on price movements. Speculators can buy or sell options in an attempt to profit from changes in the market. This can be a risky strategy, but it can also be profitable if you make the right trades.

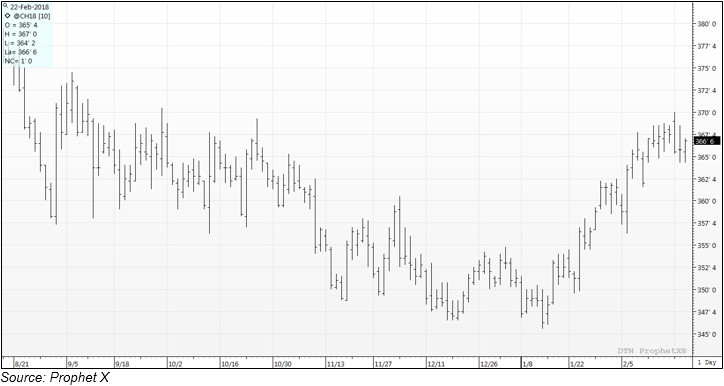

Image: www.researchgate.net

What Year Did Cbot Grain Options On Futures Begin Trading

Image: crmagri.co.uk

Conclusion

CBOT grain options on futures have become an important tool for farmers and speculators alike. They offer a variety of ways to manage risk, generate income, and speculate on price movements. In the doing so, they promote stability and growth within the agriculture industry.

Are you interested in learning more about CBOT grain options on futures? If so, there are a number of resources available to you. You can contact the CBOT directly, or you can visit the website of the National Grain and Feed Association.