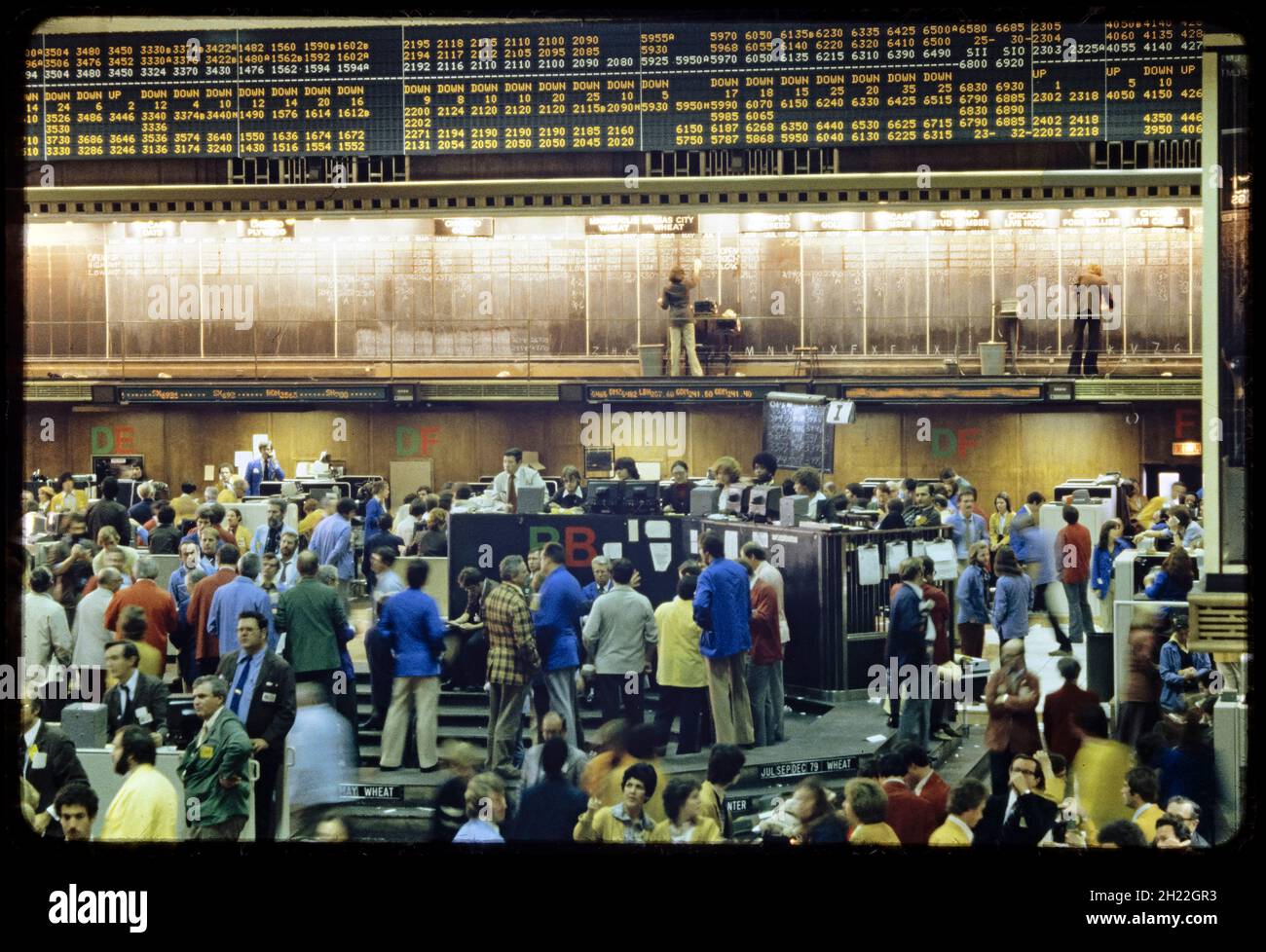

As I stepped onto the legendary trading floor of the Chicago Board of Trade (CBOT), I couldn’t help but be awed by the vibrant energy and palpable history that permeated the room. For centuries, this iconic institution has been a cornerstone of the global financial landscape, serving as a crucible where traders have shaped the destiny of markets.

Image: www.chicagobusiness.com

A Historical Landmark: The Birthplace of Futures Trading

Established in 1848, the CBOT is widely recognized as the birthplace of futures trading. It was here that the world’s first standardized futures contract was developed, revolutionizing the way commodities were bought and sold. Farmers sought to mitigate the uncertainties of harvest and price fluctuations, leading to the creation of a centralized exchange where buyers and sellers could hedge their risks.

Over time, the CBOT’s offerings expanded beyond agricultural commodities to encompass a wide range of financial instruments, including options. Options contracts provide traders with the right, but not the obligation, to buy or sell an underlying asset at a specific price on a future date. Their versatility and ability to hedge risk and speculate on price movements have made them a popular choice among traders of all levels.

The Trading Floor: A Hub of Activity and Expertise

The trading floor of the CBOT is a symphony of motion and noise. Traders clad in colorful blazers and headsets huddle around trading pits, their voices rising and falling in unison as they execute orders. The air crackles with anticipation and excitement, as each transaction brings the potential for substantial gains or losses.

Despite the technological advancements that have automated many aspects of trading, the human element remains central to the CBOT’s trading floor. The pit traders possess a deep understanding of market dynamics and utilize their expertise to negotiate the best possible deals for their clients. Their experience, intuition, and ability to assess risk in real time are invaluable assets in the fast-paced world of options trading.

Striking a Balance: Technology and Tradition

In recent years, technology has had a transformative impact on the CBOT trading floor. Electronic trading platforms have emerged as a formidable complement to the traditional open outcry system, providing traders with greater speed, liquidity, and access to global markets.

However, despite these advancements, the pit traders have not been rendered obsolete. They remain a critical part of the CBOT’s ecosystem, bringing their unique skills and market knowledge to the electronic trading landscape. By seamlessly blending tradition with innovation, the CBOT has successfully navigated the ever-evolving world of financial trading.

Image: mromavolley.com

Emerging Trends and Innovations

The CBOT options trading floor is not immune to the changing landscape of the financial industry. The rise of cryptocurrency and blockchain technology is driving the development of new and innovative products, such as Bitcoin options and decentralized options exchanges.

Artificial intelligence (AI) and machine learning algorithms are also playing an increasingly vital role in options trading. These technologies enable traders to analyze vast amounts of data, identify trading opportunities, and automate execution, enhancing efficiency and profitability.

Tips and Expert Advice for Aspiring Traders

If you aspire to become a successful options trader, it is essential to understand the risks involved and approach the market with a disciplined mindset. Here are a few tips and expert advice:

- Educate yourself: Study market dynamics, options pricing models, and trading strategies thoroughly before placing trades.

- Manage your risk: Always consider your risk tolerance and position size carefully. Don’t bet more than you can afford to lose.

- Seek guidance from mentors: Experienced traders can provide invaluable insights and support on your trading journey.

Frequently Asked Questions (FAQs)

Q: What is an options contract?

A: An options contract is a derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on a specified date.

Q: What are the different types of options?

A: There are two main types of options: calls and puts. Call options give the holder the right to buy, while put options give the holder the right to sell.

Q: How do options traders make money?

A: Options traders can profit from price fluctuations in the underlying asset. Calls rise in value when prices rise, while puts rise in value when prices fall.

Q: What are the risks associated with options trading?

A: Options trading involves substantial risk, including the potential for losses exceeding the initial investment.

Chicago Board Of Trade Options Trading Floor

Image: www.alamy.com

Conclusion

The Chicago Board of Trade options trading floor stands as a testament to the enduring power of human expertise and adaptability. Through the seamless integration of tradition and innovation, the CBOT has remained a global leader in options trading for over a century. As the financial industry continues to evolve, the CBOT is poised to remain a hub of activity and innovation, shaping the future of options trading for generations to come.