Introduction

The legendary investor Warren Buffett has amassed a fortune estimated at over $100 billion with his unparalleled value investing approach. But what is the ‘Buffet Trading Options’ strategy that seems to work magic in the world of finance? In this article, we’ll delve into the intricacies of Buffet’s trading options tactics, exploring its history, key concepts, and practical applications. For investors seeking to emulate Buffett’s remarkable returns, understanding these techniques is crucial.

Image: talkmarkets.com

What Are Buffet Trading Options?

Buffet trading options are investment techniques employed by Warren Buffett to achieve substantial returns. Buffett is a value investor, meaning he seeks companies that are trading at prices significantly低于 intrinsic value. Options provide him with an alternative way to bet on undervalued stocks, offering both leverage and protection against loss.

Buffet’s Favorite Option Strategy: Protective Puts

One of Buffett’s preferred option strategies is the purchase of protective puts. This involves purchasing put options to protect a long position in a stock. Put options give the buyer the right to sell a stock at a set price within a certain timeframe. By purchasing a put option, Buffet can hedge against potential declines in the stock value.

Benefits of Buffet Trading Options

- Reduced risk: Options provide a way to limit potential losses, as the investor can choose to exercise the option only if the stock price falls below a certain level.

- Leverage: Options can be used to increase the potential return on investment, as they allow the investor to control a larger number of shares with a smaller amount of capital.

- Flexibility: Options offer flexibility in terms of timing and execution, allowing the investor to adjust their strategy based on market conditions.

Image: finance.yahoo.com

How to Implement Buffet Trading Options

- Identify undervalued stocks: This is the cornerstone of Buffett’s value investing approach. Look for companies with strong fundamentals, such as consistent earnings growth, low debt, and a competitive advantage.

- Analyze option prices: Determine the appropriate strike price and expiration date for the put option based on the stock price and your investment horizon.

- Monitor market movements: Keep track of the stock price and the option premium to adjust your strategy as needed.

- Manage risk: Limit the amount of capital allocated to option trading and diversify your portfolio to reduce overall risk.

Real-World Applications

Buffett has successfully implemented his option trading strategies in a variety of real-world settings. For example:

- In 2008, Berkshire Hathaway purchased $5 billion worth of protective put options on the S&P 500 Index, providing downside protection during the financial crisis.

- In 2016, Buffett used options to leverage his investment in Apple stock, acquiring control of a larger number of shares while limiting his risk.

Tips for Success

- Start with a small amount of capital to gain experience and minimize risk.

- Understand the risks involved, including the potential for losing the entire investment.

- Use options as a complement to a well-diversified portfolio.

- Seek professional advice from a financial advisor if needed to ensure a personalized and appropriate strategy.

Buffet Trading Options

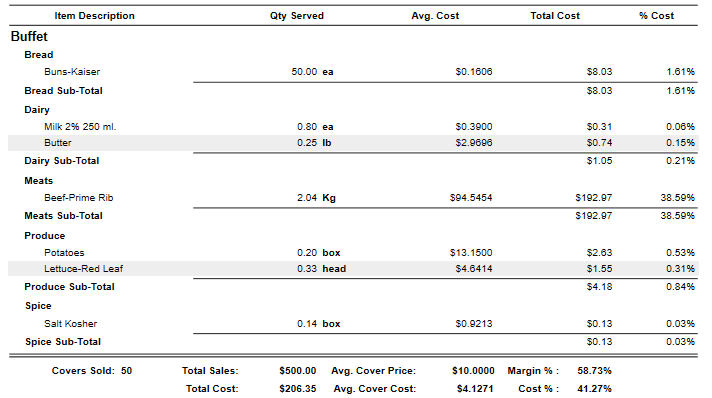

Image: learn.tracrite.net

Conclusion

Understanding Buffett trading options is essential for investors seeking to incorporate Warren Buffett’s value investing principles into their own strategies. By purchasing protective puts, investors can hedge against potential losses and capitalize on opportunities presented by undervalued stocks. While options can enhance returns, they should be used cautiously, with a clear understanding of the risks involved. By following the principles outlined in this article and monitoring market trends, investors can strive to emulate Buffett’s impressive track record of success in the financial markets.