In the realm of investing, options trading offers a nuanced and dynamic approach to managing risk and potential returns. Scotia iTRADE stands out as a leading platform that empowers traders with access to a wide range of options strategies. Whether you’re a seasoned trader or just starting to explore the world of options, this comprehensive guide will equip you with the knowledge and understanding to navigate the intricacies of Scotia iTRADE options trading.

Image: www.scotiabank.com

Understanding Scotia iTRADE Options Trading

Scotia iTRADE is an online brokerage platform that provides a user-friendly and comprehensive suite of trading tools and services. Options trading through Scotia iTRADE allows investors to speculate on the future price movements of underlying assets such as stocks, indices, or commodities. By purchasing or selling options contracts, traders can potentially generate profits from price fluctuations while also managing their risk exposure.

Basic Concepts in Scotia iTRADE Options Trading

-

Call Options: Represent the right, but not the obligation, to buy an underlying asset at a specific price (strike price) on or before a certain date (expiration date).

-

Put Options: Represent the right, but not the obligation, to sell an underlying asset at a specific strike price on or before the expiration date.

-

Option Premium: The price paid to purchase an option contract.

-

Expiration Date: The date on which an option contract expires, rendering it worthless if not exercised or sold.

-

Exercise Price: The price at which an option holder can buy or sell the underlying asset if the option is exercised.

Strategies for Scotia iTRADE Options Trading

Options trading offers a multitude of strategies that cater to varying risk appetites and market scenarios. Some common strategies include:

-

Call Options Buying: Buying call options grants the trader the potential to profit from an asset’s price appreciation above the strike price.

-

Call Options Selling: Selling call options involves the obligation to sell the underlying asset at the strike price if assigned. In exchange, the seller receives an option premium.

-

Put Options Buying: Buying put options provides protection against potential losses from asset price declines below the strike price.

-

Put Options Selling: Selling put options carries the obligation to buy the underlying asset at the strike price if assigned. In return, the seller earns an option premium.

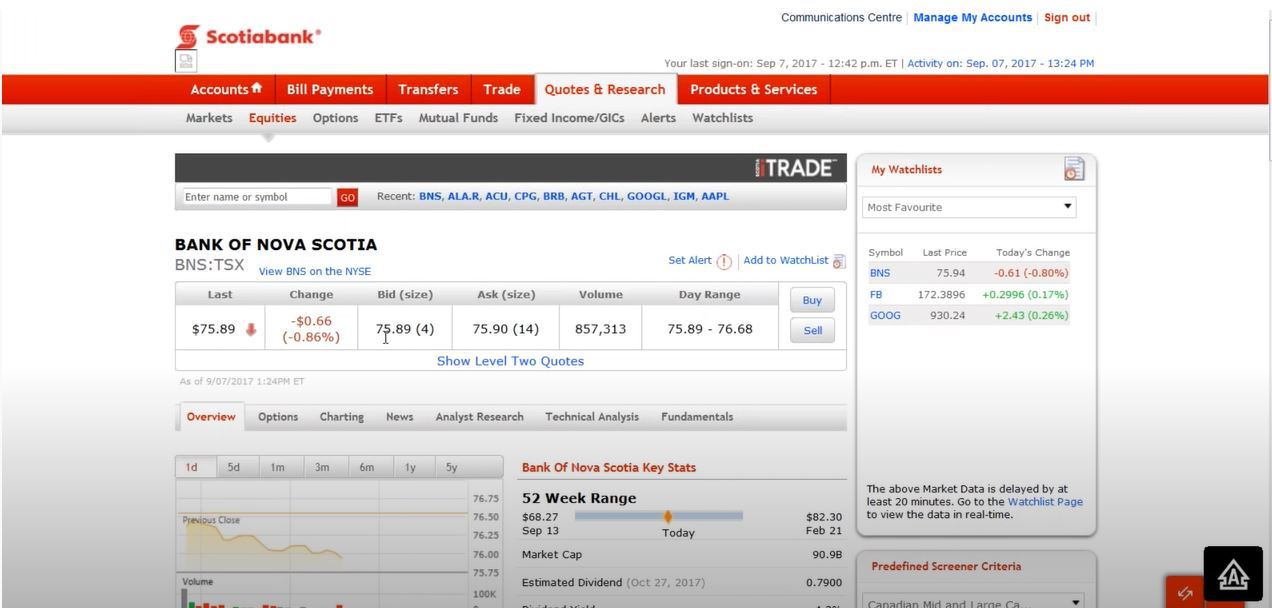

Image: seriousmarkets.com

Advanced Scotia iTRADE Options Trading Techniques

Beyond basic strategies, Scotia iTRADE offers advanced trading techniques that enhance risk management and profit potential. These include:

-

Spreads: Combine multiple options contracts with varying strike prices to create strategies with specific risk/reward profiles.

-

Straddles: Simultaneous purchase of both call and put options with the same strike price and expiration date. Straddles profit from significant price volatility in either direction.

-

Strangles: Similar to straddles, but with different strike prices for call and put options. Strangles have a lower cost but require a larger price movement to become profitable.

-

Butterfly Spreads: Complex spreads that involve four options contracts with overlapping strike prices. Butterfly spreads are often used for directional bets or volatility trading.

Tips for Successful Scotia iTRADE Options Trading

-

Educate Yourself: Thoroughly understand the concepts and strategies involved in options trading.

-

Research and Analysis: Conduct meticulous research on underlying assets and market conditions.

-

Risk Management: Options trading carries inherent risk. Manage your risk by setting clear stop-loss levels and position sizing appropriately.

-

Discipline and Patience: Options trading requires discipline and patience to avoid emotional decision-making.

-

Practice with Paper Trading: Hone your skills and test strategies through paper trading before risking real capital.

Scotia Itrade Options Trading

Image: milliondollarjourney.com

Conclusion

Scotia iTRADE options trading empowers investors with a versatile tool to navigate financial markets. By embracing the principles and strategies outlined in this guide, you can harness the potential of options trading to enhance your investment returns while managing risk. Remember, education, practice, and a disciplined approach are essential for long-term success in this dynamic realm.