A Tale of Calculated Risk and Financial Prowess

In the fast-paced, adrenaline-fueled realm of financial trading, junior options traders occupy a unique position. These individuals blend razor-sharp instincts with analytical precision to navigate the intricate world of options contracts. While the risks are undeniable, the potential rewards can be tantalizing, making this a coveted career path for those with the right mix of talent and ambition.

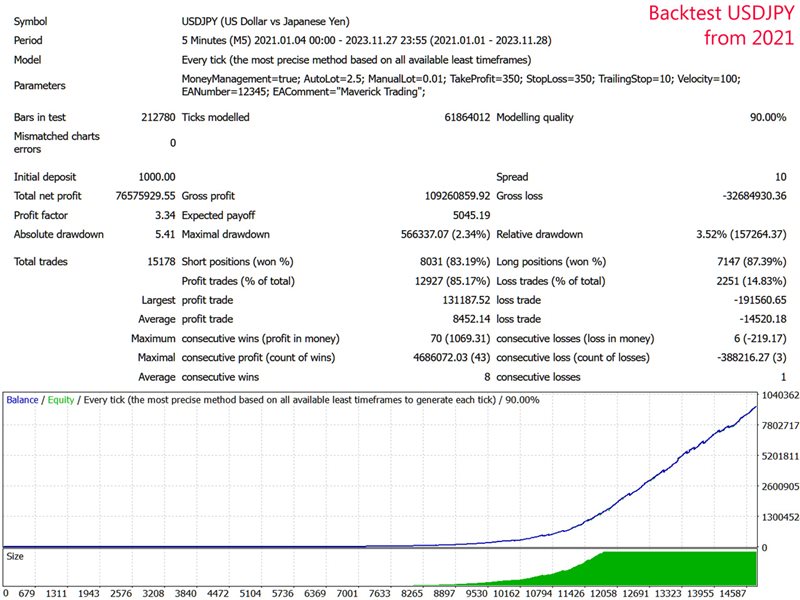

Image: www.mql5.com

Delving into the Labyrinth of Options Trading

Options trading involves the buying or selling of contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. The nature of these contracts introduces an element of leverage, allowing even junior traders to control significant positions with relatively modest capital. However, the inherent volatility of options markets demands a deep understanding of risk management and the ability to make quick decisions under pressure.

The Journey from Novice to Maverick: The Essential Skills and Traits

Becoming a successful junior options trader requires a multifaceted skillset and a deep-seated commitment to continuous learning. A robust understanding of market dynamics, quantitative analysis, and trading strategies is paramount. Junior traders must also possess a keen eye for spotting opportunities, coupled with the ability to manage risk prudently. Beyond technical expertise, emotional resilience, self-discipline, and the capacity for rapid decision-making are crucial attributes for navigating the unpredictable world of options trading.

The Anatomy of a Lucrative Career: Unveiling the Earning Potential

The compensation structure for junior options traders typically comprises a base salary supplemented by bonus incentives tied to performance. While these salaries can vary depending on experience, skill level, and the size and profitability of the firm they work for, junior traders can expect to earn a comfortable six-figure salary early in their careers. As they gain experience and demonstrate consistent profitability, their earning potential has no ceiling. Top-performing junior traders can command compensation packages well into the seven-figure range.

Image: tradingproperly.com

Market Trends and Opportunities: Shaping the Future of Options Trading

The options trading landscape is constantly evolving, presenting both challenges and opportunities for junior traders. Technological advancements have democratized access to trading platforms and data analysis tools, empowering even junior traders with the resources to compete on an equal footing with more experienced players. Additionally, the rise of algorithmic trading and the increasing popularity of exchange-traded funds (ETFs) have introduced new trading strategies and volatility patterns.

Expert Tips and Advice: Navigating the Perils of Options Trading

Seasoned options traders have navigated the treacherous waters of financial markets, accumulating a wealth of invaluable wisdom. Here are some expert tips for junior traders seeking to enhance their craft:

-

Master risk management: Identify potential risks and devise effective strategies to mitigate them, ensuring your capital is protected even in volatile markets.

-

Embrace continuous learning: Attend workshops, read industry publications, and engage with mentors to broaden your knowledge base and stay abreast of market trends.

-

Stay disciplined: Adhere to your trading plan, avoid emotional decision-making, and maintain a consistent approach to risk management.

Frequently Asked Questions: Demystifying Options Trading

Q: What is the difference between a call and a put option?

A: A call option conveys the right to buy an underlying asset, while a put option conveys the right to sell an underlying asset.

Q: What factors influence the price of an option?

A: The price of an option is determined by the price of the underlying asset, the strike price, time to expiration, interest rates, and volatility.

Q: How risky is options trading?

A: Options trading can be highly risky if not managed prudently. It is essential to understand the potential risks involved and to implement robust risk management strategies.

Maverick Trading Junior Options Trader Salary

Image: www.youtube.com

Conclusion: Embracing the Thrill of Options Trading

The allure of options trading lies in its potential for significant rewards, but it also demands unwavering commitment, relentless learning, and a calculated approach to risk. If you possess the necessary skills, passion, and discipline, a career as a junior options trader can open doors to a world of financial freedom and professional fulfillment.

Are you ready to seize the opportunities and face the challenges that come with being a maverick options trader?