In the heart of the bustling metropolis of New York City, amidst skyscrapers and the pulse of Wall Street, lies a world of high-stakes financial maneuvering—the realm of hedge fund options trading.

:max_bytes(150000):strip_icc()/Investopedia-terms-hedge-fb11c495608344c395cafdb63213a1a7.jpg)

Image: www.investopedia.com

Unveiling Hedge Fund Options Trading Positions

Options trading involves complex financial instruments that allow investors to speculate on the future movements of an underlying asset, such as a stock or currency. Hedge funds, known for their sophisticated investment strategies and aggressive risk-taking, have made options trading a cornerstone of their operations.

1. Lead Options Trader

The lead options trader orchestrates the trading strategy, directing a team of analysts and traders. Deeply versed in options markets, this individual possesses exceptional mathematical skills and a keen understanding of market dynamics.

2. Senior Options Trader

Senior options traders take primary responsibility for executing trades and managing the fund’s portfolio. Their analytical acumen and trading experience enable them to make swift and decisive decisions.

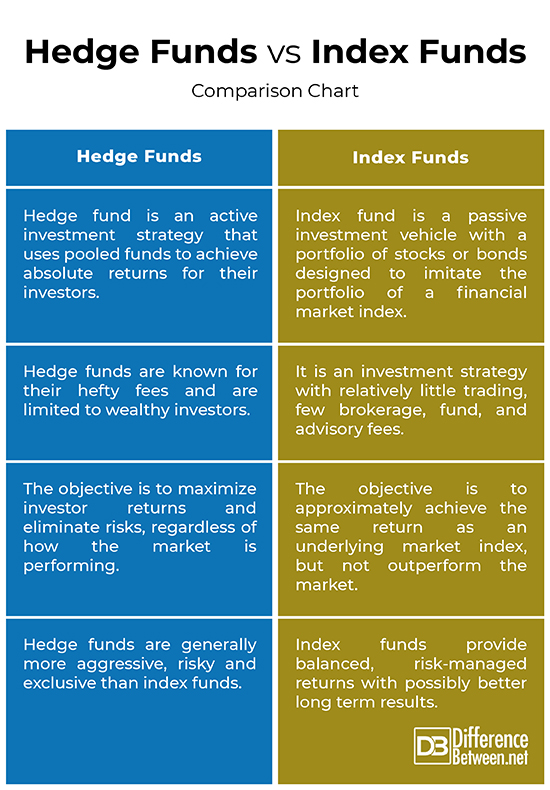

Image: www.differencebetween.net

3. Junior Options Trader

Junior options traders are aspiring professionals honing their skills. They assist senior traders, conduct research, and stay abreast of market trends.

4. Options Analyst

Options analysts provide incisive market insights and detailed research reports. Armed with statistical modeling expertise, they decipher patterns and quantify potential returns.

5. Options Risk Manager

Options risk managers safeguard the fund by assessing the potential losses associated with trading positions. They implement measures to mitigate risk and protect the firm’s capital.

Leveraging Expertise and Insights

The presence of these skilled professionals in hedge fund options trading positions fuels the industry’s dynamism and creativity. Their combined insights and expertise translate into informed decisions that seek to exploit market opportunities.

– Knowledgeable Decision-Making:

Traders analyze market data, research company fundamentals, and apply complex mathematical models to make informed decisions about their trades.

– Calculated Risk-Taking:

Hedge funds leverage options to implement sophisticated trading strategies that involve both potential gains and risks. Risk managers meticulously monitor these positions to safeguard the fund’s investments.

– Time-Sensitive Strategies:

Options have specific expiration dates, which necessitate both precision and agility in trading operations. Traders closely monitor the countdown clock to maximize profits.

These aspects underscore the challenging yet captivating nature of hedge fund options trading positions in New York City, where lightning-fast decision-making and the allure of substantial returns coexist.

Navigating the Career Landscape

If the world of hedge fund options trading fascinates you, consider these recommendations to embark on this thrilling career path:

– Acquire Education and Skills:

Excel in quantitative fields like mathematics, statistics, or finance. Pursue relevant certifications in finance, such as the Chartered Financial Analyst (CFA) designation.

– Network and Seek Mentorship:

Attend industry events, connect with professionals on LinkedIn, and actively seek mentors who can guide you and unlock opportunities.

– Start with an Entry-Level Role:

Apply for analyst or junior trader positions in asset management companies, banks, or hedge funds. Gain real-world experience and hone your skills.

– Demonstrate Excellence and Dedication:

Go the extra mile in your work, take on additional responsibilities, and continuously strive to improve your knowledge and abilities.

Hedge Fund Options Trading Positions Nyc

Image: www.zonebourse.com

Conclusion

Hedge fund options trading positions in New York City offer an exhilarating and intellectually stimulating career path. Driven by the expertise and insights of seasoned professionals, this industry presents both lucrative opportunities and the challenge of navigating volatile markets. By mastering quantitative skills, embracing continuous learning, and cultivating mentorship relationships, aspiring traders can seize upon the possibilities that await them.