The world of finance is volatile and complex, and yet, within its intricacies lies a realm of opportunity. Hedge fund options trading has emerged as a sophisticated strategy for investors seeking to navigate this dynamic landscape and maximize returns while managing risk.

Image: www.cnbc.com

Options trading, in its essence, grants the holder the right, but not the obligation, to buy or sell an asset at a specified price before a predefined expiration date. In the context of hedge funds, this strategy is employed to enhance portfolio performance and mitigate risk through precise market positioning.

Unveiling the Convergence of Hedge Funds and Options Trading

Hedge funds, renowned for their nimble investment strategies, have found a natural synergy with options trading. This alliance empowers fund managers to exploit market inefficiencies, capitalize on price movements, and hedge against potential losses. By leveraging options, hedge funds can construct tailored portfolios that navigate market uncertainties while pursuing superior returns.

Delving into the Mechanics of Hedge Fund Options Trading

Hedge fund options trading involves a judicious combination of call and put options, which confer the rights to buy or sell the underlying assets, respectively. These options are carefully calibrated to align with the fund’s investment objectives, such as generating income, managing risk, or enhancing overall returns. By orchestrating complex options strategies, hedge funds can implement market-neutral, arbitrage, or directional trading approaches.

- **Market-neutral strategies:** Aiming to capitalize on price discrepancies between related securities, these strategies seek to maintain a neutral market position, limiting exposure to directional market movements.

- **Arbitrage strategies:** Capitalizing on price inefficiencies, arbitrageurs exploit mispricing opportunities, profiting from the simultaneous purchase and sale of the same or similar assets in different markets.

- **Directional trading strategies:** Positioned to capitalize on anticipated market trends, these strategies involve the judicious use of options to enhance returns or hedge against potential losses in a specific market direction.

Navigating the Ever-Evolving Landscape of Hedge Fund Options Trading

The realm of hedge fund options trading is constantly evolving, driven by market fluctuations, technological advancements, and regulatory changes. To thrive in this dynamic environment, hedge funds continuously research market trends, monitor emerging investment opportunities, and adapt their strategies accordingly. By keeping abreast of industry updates, participating in industry forums, and leveraging social media platforms for insights, hedge funds can stay ahead of the curve and optimize their options trading strategies.

Image: realeconomy.rsmus.com

Harnessing the Expertise of Hedge Fund Options Trading

Experienced hedge fund managers, with their intimate knowledge of options trading and financial markets, can offer invaluable tips and expert advice to investors seeking to navigate this complex landscape.

Unveiling Insights from Hedge Fund Options Trading Experts

- **Embrace a multifaceted approach:** Employ a combination of options strategies tailored to specific market conditions and investment goals.

- **Exercise meticulous risk management:** Vigilantly monitor positions, adjust strategies as needed, and implement stop-loss orders to mitigate potential losses.

- **Capitalize on market anomalies:** Identify and capitalize on market inefficiencies and price discrepancies, exploiting opportunities for superior returns.

- **Seek out professional guidance:** Consider consulting with a qualified financial advisor specializing in hedge fund options trading to navigate complex strategies and optimize decision-making.

Frequently Asked Questions About Hedge Fund Options Trading

Q: What distinguishes hedge fund options trading from traditional options trading?

A: Hedge funds employ sophisticated strategies, combining multiple options to pursue specific investment objectives and manage risk, going beyond the basic buy-and-hold approach common in traditional options trading.

Q: Is hedge fund options trading suitable for all investors?

A: Hedge fund options trading, due to its complexity and potential risks, is generally appropriate for experienced and knowledgeable investors. It requires a deep understanding of options trading, financial markets, and risk management techniques.

Hedge Fund Options Trading

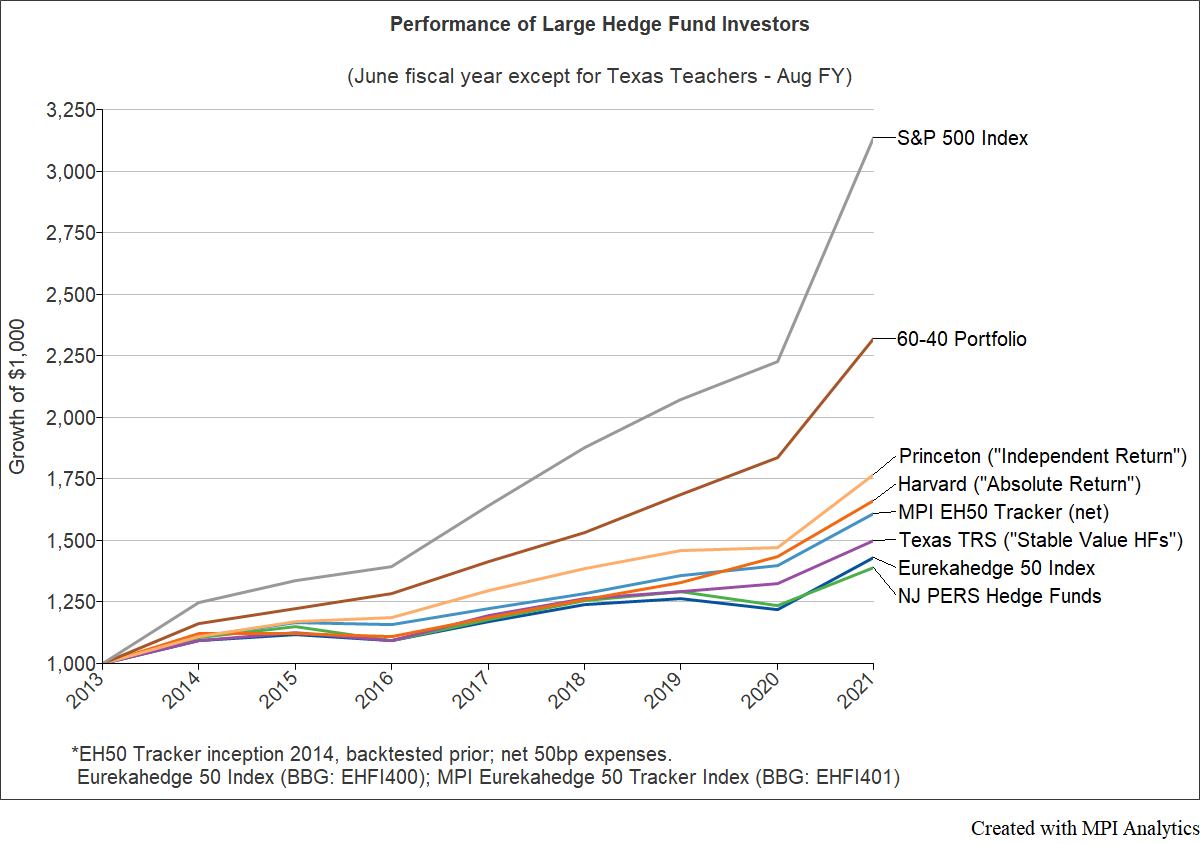

Image: www.markovprocesses.com

Conclusion: Navigating the Hedge Fund Options Trading Landscape

Hedge fund options trading presents a powerful tool for investors seeking to enhance portfolio performance and mitigate risk in a dynamic financial environment. By understanding the intricacies of this strategy, employing expert advice, and adapting to the evolving landscape, investors can navigate the complexities of hedge fund options trading and harness its potential for financial success.

Are you intrigued by the world of hedge fund options trading and eager to delve deeper? Explore our comprehensive resources, engage with our expert insights, and embark on a journey of financial growth.