Introduction:

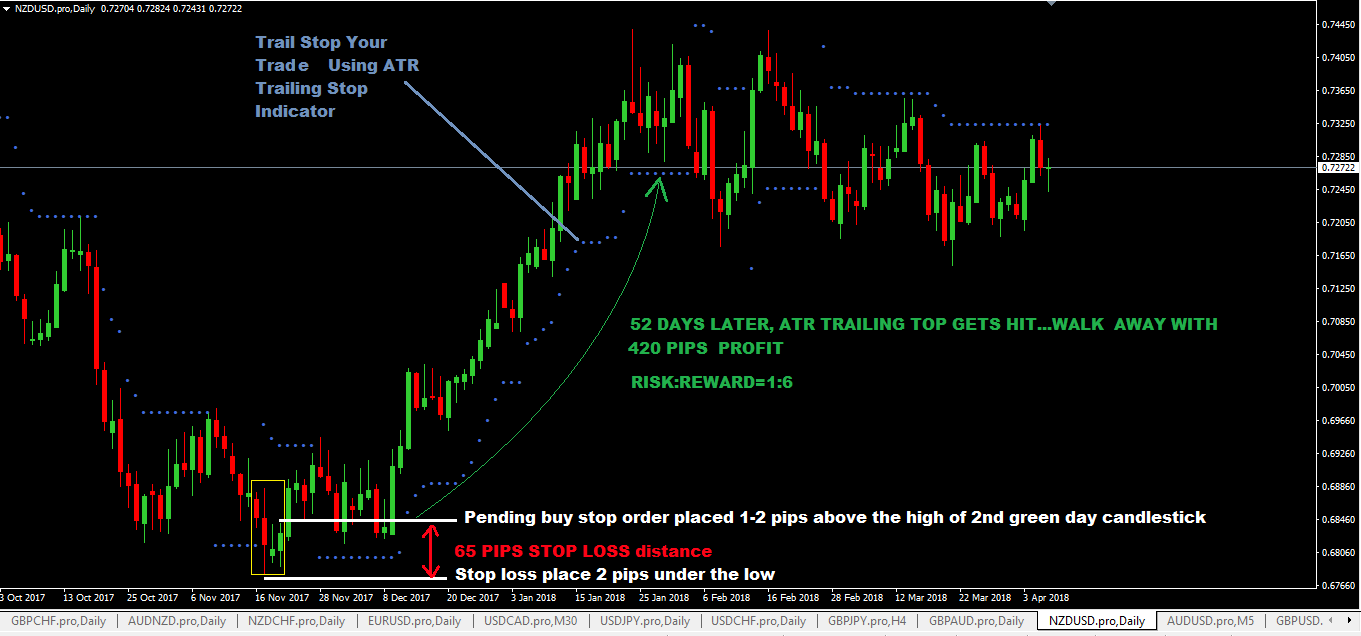

Image: www.forextrading200.com

In the labyrinthine world of finance, hedge funds have long wielded the scalpel of option trading strategies. These intricate maneuvers, once shrouded in mystery and allure, have evolved into a cornerstone of modern investment portfolios. As the tides of the market shift, savvy investors are turning to hedge fund options trading strategies to navigate treacherous waters and capture alpha.

Options, financial instruments that confer the right but not the obligation to buy or sell an underlying asset at a predetermined price, have become an indispensable tool for hedge funds. By employing complex combinations of options, these astute traders seek to maximize returns while minimizing risk in ever-fluctuating markets.

Section 1: The Essence of Options Trading

To grasp the essence of hedge fund options trading, it is imperative to delve into the mechanics of options themselves. Call options grant the holder the right to purchase an underlying asset, while put options afford the right to sell. The intrinsic value of an option is determined by subtracting the strike price from the current price of the underlying asset for a call option or vice versa for a put option.

Section 2: A Spectrum of Strategies

Hedge funds possess a vast array of options trading strategies at their disposal, each tailored to specific market conditions and risk profiles. Common strategies include:

- Covered Calls: Generating premium income by selling call options against an existing holding.

- Protective Puts: Hedging against potential losses by purchasing put options.

- Iron Condors: Simultaneous sale of out-of-the-money call and put options to capture premium.

- Strangles: Simultaneous purchase of out-of-the-money call and put options to bet on increased volatility.

Section 3: The Strategic Framework

Despite their allure, options trading strategies are not without their perils. Hedge funds mitigate these risks through a rigorous framework:

- Risk Management: Comprehensive risk management protocols are paramount, utilizing techniques such as value at risk (VaR) and stress testing.

- Market Analysis: In-depth analysis identifies trends, economic indicators, and market inefficiencies.

- Scenario Planning: Robust scenario planning anticipates market movements and develops contingency strategies.

Section 4: The Intersection of Technology and Innovation

Technological advancements have revolutionized hedge fund options trading. Advanced algorithms, sophisticated trading platforms, and data analytics empower traders to monitor markets in real-time, identify trading opportunities, and execute complex strategies with lightning speed.

Section 5: The Evolution of Hedge Fund Options Trading

The landscape of hedge fund options trading is constantly evolving, driven by shifting market dynamics and technological innovation. New strategies are being developed, risk management techniques are being refined, and the use of artificial intelligence (AI) is becoming increasingly prevalent.

Conclusion:

Hedge fund options trading strategies have become a potent weapon in the arsenal of investors seeking to navigate the intricacies of today’s markets. By harnessing the power of options, hedge funds can generate alpha, mitigate risk, and ultimately enhance the performance of investor portfolios. As the financial landscape continues to morph, hedge fund options trading will remain a dynamic and essential element of modern investing.

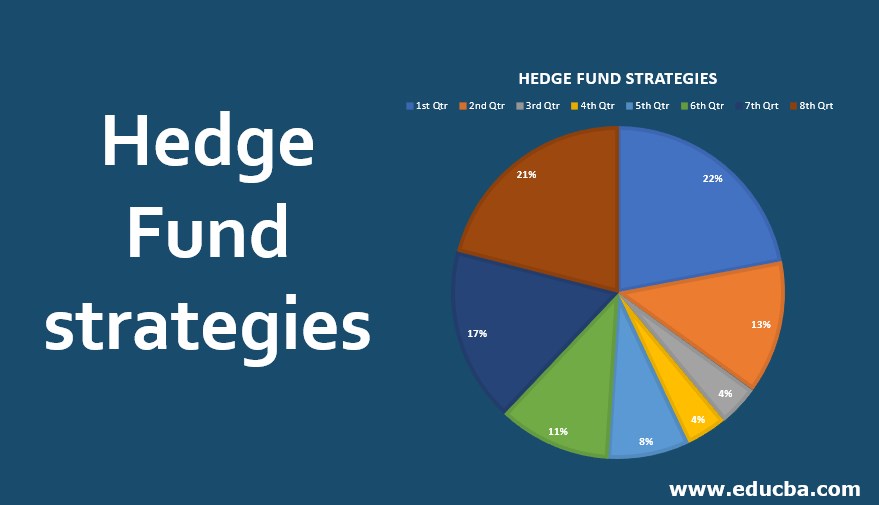

Image: www.educba.com

Hedge Fund Options Trading Strategies

Image: www.pinterest.com