WSB and the Art of Options Trading

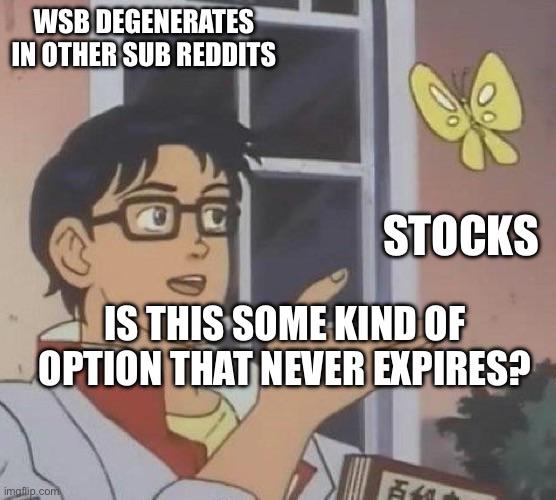

WallStreetBets (WSB) has emerged as a renowned community of retail investors known for their high-risk, high-reward trading strategies, particularly involving options. Options trading, a complex financial instrument, allows traders to speculate on the future price movements of an underlying asset without owning it directly. WSB’s unique approach to options trading has captivated the financial world, amassing followers and sparking significant market activity.

Image: www.timothysykes.com

Options Trading: Unveiling the Basics

In options trading, traders purchase contracts that grant them the right, but not the obligation, to buy (call option) or sell (put option) a specified asset at a set price (strike price) on or before a certain date (expiration date). The trader pays a premium to the seller of the contract as compensation for this right. The contract’s value fluctuates based on factors like the underlying asset’s price, time to expiration, and market volatility.

WSB’s Trading Philosophy

WSB members embrace a distinct trading philosophy characterized by its daring and often contrarian approach. They prioritize high-potential, sometimes speculative trades, often utilizing leverage to maximize profits. While this approach can yield substantial gains, it also carries a higher risk of losses. The community’s focus on short-term trades, based on technical analysis and market sentiment, further accentuates the risk-reward spectrum.

Trading Strategies and Tips

For beginners venturing into options trading, WSB recommends adopting a cautious approach, thoroughly understanding the risks involved, and gaining proficiency in managing risk effectively. Here are some tips to guide your journey:

- Start with Small Stakes: Initiate your trading with modest investments, allowing you to gain experience and mitigate potential losses.

- Choose Understandable Options: Opt for options with manageable strike prices and expiration dates; avoid complex contracts until you develop greater knowledge and proficiency.

- Learn to Manage Risk: Implement strategies like stop-loss orders to mitigate potential setbacks and limit losses. Monitor your options regularly and adjust your positions accordingly.

Image: www.timothysykes.com

Frequently Asked Questions (FAQs)

-

What is the best trading strategy for beginners? Start with small investments, and focus on learning the fundamentals of options trading before experimenting with advanced strategies.

-

How do I choose the right options contract? Consider the underlying asset’s price, time to expiration, and implied volatility when selecting an options contract.

-

What are the risks of options trading? Options trading carries significant risks. The potential for substantial losses is inherent, and it’s crucial to be aware of the potential before entering the market.

Wsb Options Trading Guide

Image: cadehildreth.com

Conclusion: Embracing the WSB Mentality

WSB’s options trading approach, while not suitable for all investors, has undoubtedly shaken up the financial landscape. Its emphasis on risk tolerance, psychological fortitude, and community-driven insights has attracted a loyal following. If you’re intrigued by the potential rewards of options trading and drawn to WSB’s unconventional approach, step into the arena with caution, embracing the spirit of learning, risk management, and the potential for extraordinary returns. Are you ready to join the WSB revolution?