Options trading is a vast and dynamic field that demands a solid understanding of analytical tools and strategies to make informed decisions. Enter option trading analytics, the gateway to deciphering the intricate web of market complexities. In this comprehensive guide, we will delve into the world of option trading analytics, unraveling its history, fundamentals, real-world applications, and future horizons. Prepare to be empowered as we embark on a journey that will revolutionize your approach to options trading.

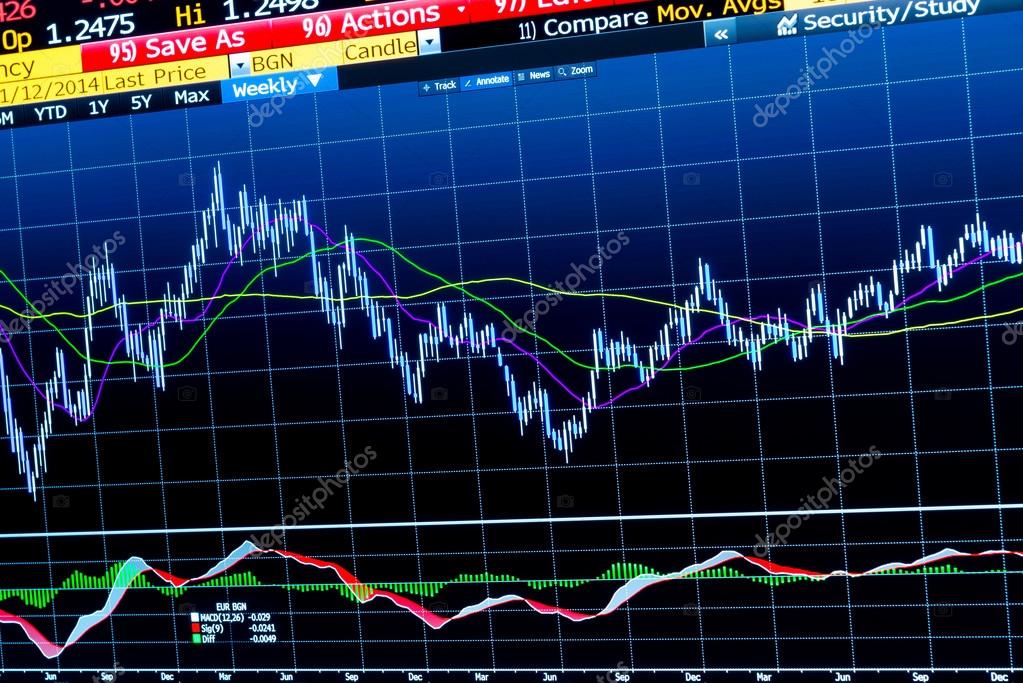

Image: blog.dhan.co

Unveiling the Genesis of Option Trading Analytics

The advent of option trading analytics can be traced back to the seminal work of Fischer Black and Myron Scholes in 1973. Their groundbreaking paper, “The Pricing of Options and Corporate Liabilities,” laid the foundation for modern option pricing theory. This theory revolutionized the industry, enabling traders to quantify the value of options and make more informed trading decisions.

Unveiling the Essentials of Option Trading Analytics

At the core of option trading analytics lies a deep understanding of the intricate relationship between various factors that influence option prices. These factors include the underlying asset’s price, strike price, expiration date, and volatility. Option traders leverage sophisticated analytical techniques such as the Black-Scholes-Merton model and Monte Carlo simulations to assess these factors and determine an option’s fair value.

Bridging Theory and Practice: Real-World Applications

The practical implications of option trading analytics are profound. Traders can use these analytical tools to:

-

Price Options: Determine the intrinsic and extrinsic value of an option, providing a solid basis for pricing strategies.

-

Hedge Risk: Construct option portfolios to offset the risk of adverse price movements in the underlying assets.

-

Generate Income: Employ option strategies like covered calls and cash-secured puts to generate additional income streams.

-

Enhance Returns: Identify undervalued or overvalued options using advanced screening techniques, leading to potential profit opportunities.

Image: www.closeoption.com

Evolving Landscape of Option Trading Analytics

The field of option trading analytics is constantly evolving, driven by technological advancements and the need for ever-more sophisticated trading strategies. The advent of big data and machine learning algorithms has opened up new avenues for analyzing vast amounts of market data, uncovering hidden patterns and predicting future price movements.

Option Trading Analytics

Image: punjiguide.com

Empowering the Trader: A Call to Action

Mastering option trading analytics is not a mere abstract pursuit; it is an investment in your financial future. By embracing these analytical tools and strategies, you can gain a competitive edge in the dynamic options market. Seize this opportunity to enhance your trading capabilities, unlock the full potential of options, and embark on a journey towards informed and successful trading.