Introduction

Hedge funds, known for deploying complex investment strategies, frequently utilize options trading as a powerful tool to enhance returns and mitigate risks. Options, financial instruments that provide the right but not the obligation to buy or sell an underlying asset at a predetermined price, offer hedge funds an array of opportunities and challenges. Understanding the intricacies of hedge fund options trading is essential for investors seeking to explore this dynamic and potentially lucrative arena.

Image: www.cmegroup.com

History of Hedge Fund Options Trading

The use of options by hedge funds has a long and storied history. As early as the 1970s, hedge funds such as George Soros’ Quantum Fund employed options strategies to increase exposure to desired market conditions while limiting downside risk. However, it was the explosive growth of the hedge fund industry in the 1990s and 2000s that propelled options trading to prominence within hedge fund portfolios.

Options Strategies for Hedge Funds

Hedge funds employ a wide variety of options strategies to meet their investment objectives. Some common strategies include:

1. Covered Call Writing:

Selling call options against a held underlying asset, generating income from option premiums while retaining the potential upside of the asset.

Image: pensionpulse.blogspot.com

2. Put Option Buying:

Protecting a portfolio from potential downside through the purchase of put options that grant the right to sell an underlying asset at a predetermined price.

3. Volatility Trading:

Leveraging options’ sensitivity to volatility to trade expected changes in the underlying asset’s price fluctuations.

4. Synthetic Long/Short:

Combining long call and short put options to create a synthetic long position while benefiting from potential premium income.

5. Convertible Arbitrage:

Investing in convertible bonds and purchasing call options on the underlying stock, aiming to profit from the conversion premium.

Real-World Applications of Hedge Fund Options Trading

The benefits of hedge fund options trading extend beyond theoretical potential. In practice, hedge funds have successfully utilized options strategies to achieve specific investment goals, such as:

1. Enhanced Returns:

Options strategies can enhance returns by generating premium income, benefiting from price appreciation, or mitigating losses.

2. Risk Management:

Put options and other defensive strategies protect hedge funds from market downturns, reducing portfolio volatility.

3. Alpha Generation:

Skilled hedge fund managers leverage options to identify and exploit market inefficiencies, delivering alpha (excess returns) for investors.

4. Market Neutrality:

Options strategies allow hedge funds to achieve market neutrality, mitigating exposure to overall market movements while still profiting from specific market segments.

5. Portfolio Diversification:

By incorporating options trading, hedge funds can diversify portfolios and reduce reliance on traditional asset classes.

Hedge Funds Options Trading

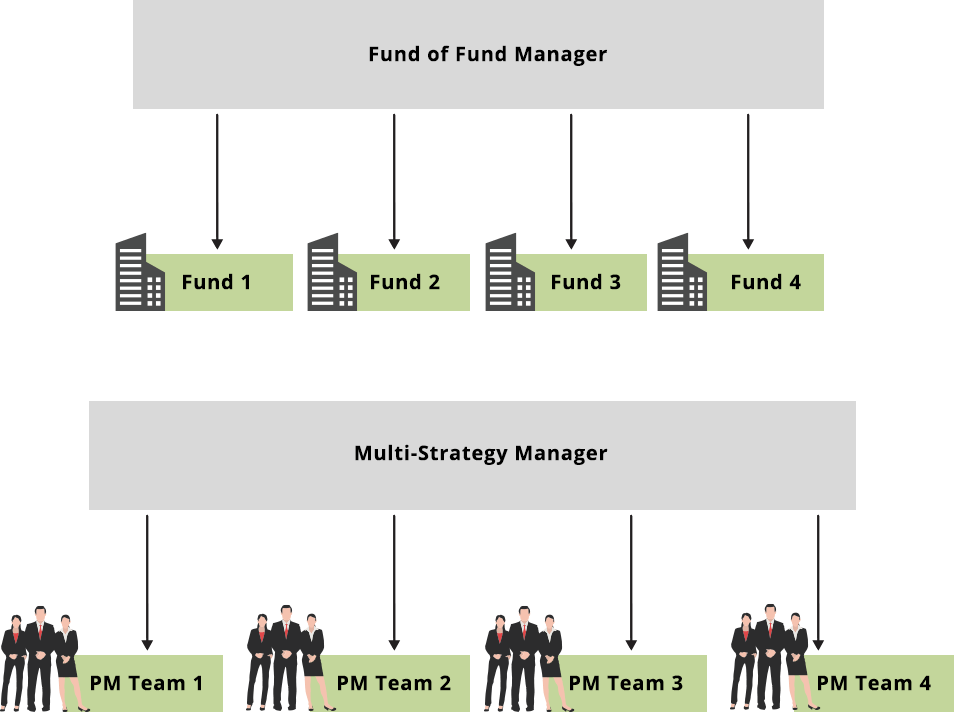

Image: www.crystalfunds.com

Conclusion

Hedge fund options trading is a sophisticated and multifaceted tool that empowers hedge funds to navigate market complexities and pursue a wide range of investment objectives. By understanding the history, strategies, and real-world applications of hedge fund options trading, investors can appreciate the potential and risks associated with this dynamic investment strategy. However, it is crucial to exercise caution and due diligence when evaluating hedge fund options trading opportunities, seeking professional advice from qualified financial advisors to ensure alignment with investment goals and risk tolerance.