Options trading can be an exciting way to potentially enhance returns and mitigate risks in your investment portfolio. If Interactive Brokers catches your fancy, understanding their trading options requirements is crucial. In this article, we delve into the ins and outs of these requirements and provide guidance to help you make informed decisions when trading options with this prominent broker.

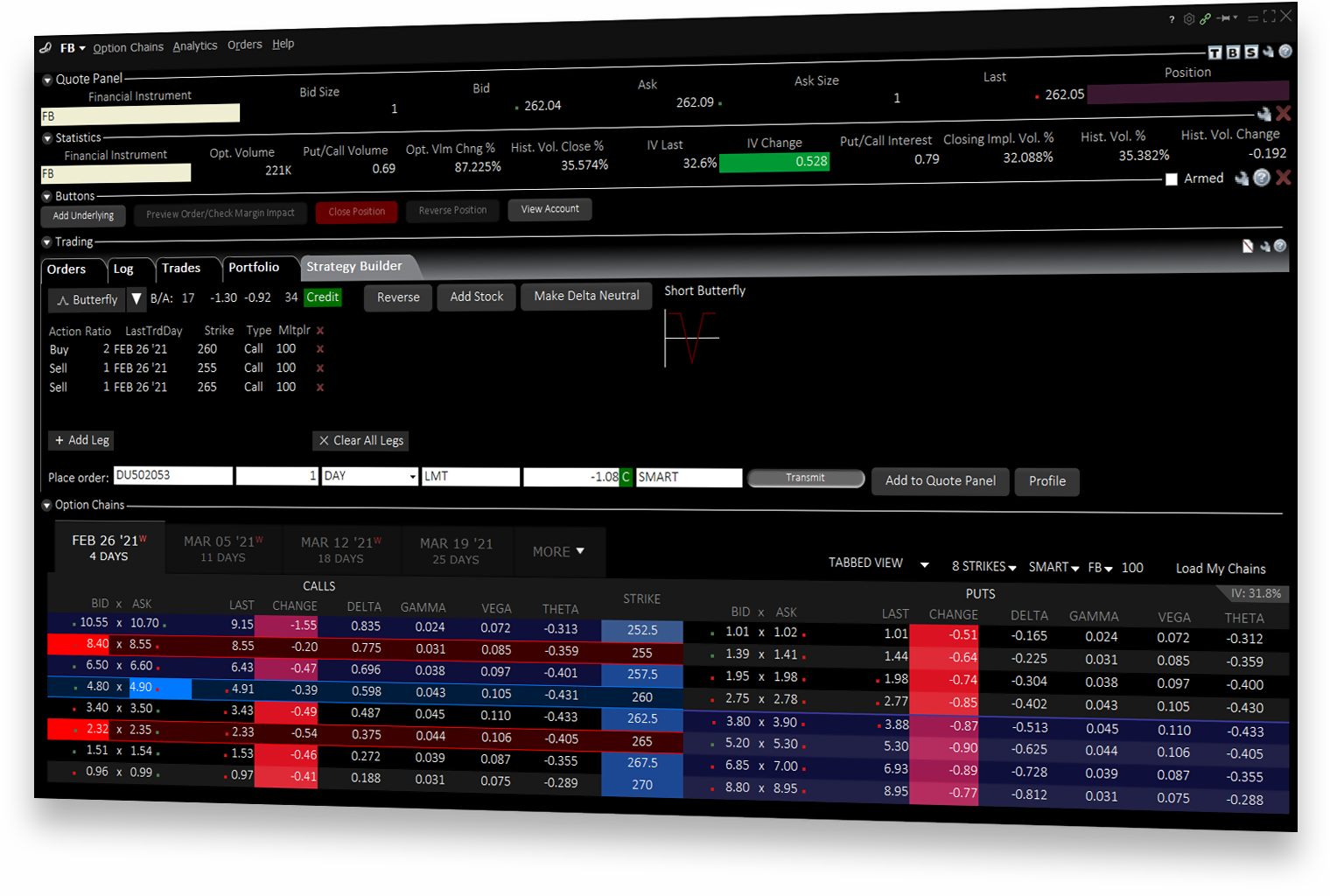

Image: www.interactivebrokers.eu

Introducing Interactive Brokers: A Pioneer in Options Trading

Interactive Brokers (IBKR) has made a name for itself as a leading electronic brokerage in the financial industry. The company, established in 1978, offers a comprehensive range of investment products and trading platforms, including advanced options trading capabilities. With its robust order execution system and extensive research tools, IBKR has become a haven for experienced options traders and institutional investors.

Navigating Interactive Brokers’ Multifaceted Options Trading Requirements

To trade options on IB’s platform, it’s essential to meet specific requirements tailored to your trading style and investment goals. These requirements encompass account approvals, margin eligibility, and options trading permissions. Understanding these requirements ensures a hassle-free trading experience and helps you make the most of IBKR’s offerings.

Account Approvals: Laying the Foundation for Trading Options

Before you can dive into the world of options trading with IB, you must obtain account approval. Different types of accounts require varying levels of clearance, depending on the trading strategies you plan to implement. A basic Individual account suffices for most retail investors looking to trade standard options contracts.

Image: www.interactivebrokers.com

Margin Eligibility: Utilizing Leverage for Enhanced Possibilities

Margin trading empowers you to leverage your account balance and potentially increase your trading power. However, options trading on margin necessitates margin eligibility. IB assesses your account’s risk profile and assigns a margin level based on factors such as account size, trading experience, and risk tolerance. Meeting IB’s margin requirements allows you to trade options using borrowed funds, but it also amplifies potential risks.

Options Trading Permissions: Unlocking Advanced Trading Capabilities

Interactive Brokers provides three levels of options trading permissions:

-

Level 1: This basic level allows trading in standard options contracts, including calls, puts, and covered calls. It’s ideal for beginner options traders or those with a lower risk appetite.

-

Level 2: This intermediate level grants access to more advanced options strategies, such as spreads, straddles, and strangles. Traders must demonstrate a higher level of options trading knowledge and experience to qualify for Level 2 permission.

-

Level 3: This highest level of permission opens the door to unrestricted options trading, including complex strategies and trading in certain exotic options contracts. It’s generally reserved for experienced options traders with a deep understanding of options markets and risk management.

Navigating the Application Process for Interactive Brokers’ Options Trading

To apply for options trading permissions, you must complete an options trading questionnaire. This questionnaire assesses your trading knowledge, experience, and risk tolerance. IB carefully reviews your responses and makes a determination based on your qualifications. In some cases, additional documentation or a phone interview may be required. Approvals can take several days or weeks, depending on the complexity of your application.

Tips for Successful Options Trading with Interactive Brokers

Here are a few valuable tips for maximizing your options trading success with Interactive Brokers:

-

Start Small: Begin with modest trades and gradually increase your position sizes as you gain experience.

-

Choose Carefully: Select options contracts that align with your risk tolerance and investment objectives.

-

Manage Risks: Use stop-loss orders to limit potential losses and closely monitor your positions.

-

Stay Informed: Continuously educate yourself about options trading strategies and market trends. Utilize IBKR’s educational resources and webinars.

-

Seek Professional Advice: Consider consulting with a financial advisor or experienced options trader for personalized guidance.

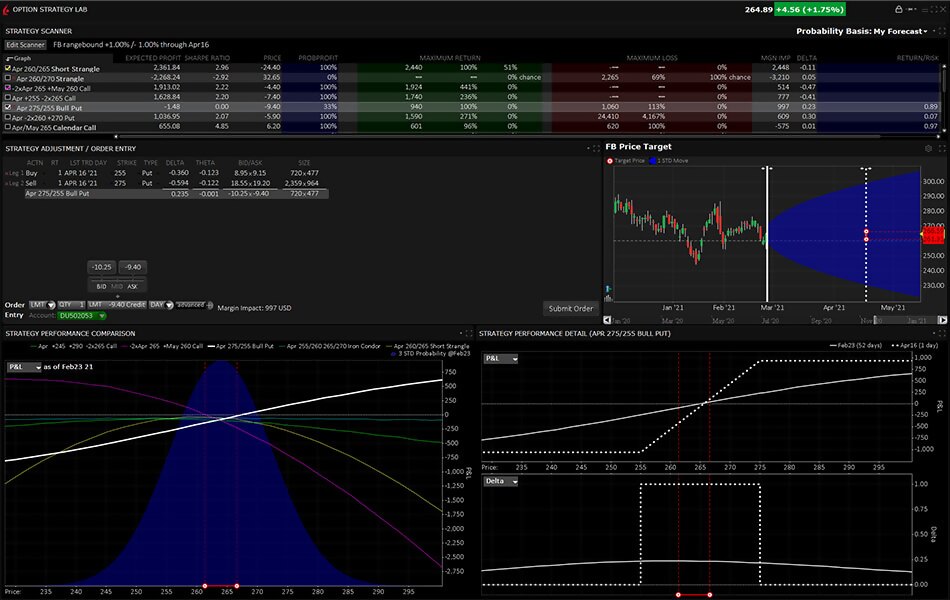

Interactive Brokers Trading Options Requirements

Image: www.youtube.com

Conclusion

Trading options with Interactive Brokers offers a world of opportunities for experienced options traders and institutional investors. By fulfilling the account approvals, margin eligibility, and options trading permissions requirements, you can unlock the full potential of IB’s trading platform. Remember to trade responsibly, manage risks, and continually enhance your knowledge to make the most of your options trading journey.