Navigating the Complexities of Options Trading

Options trading, a dynamic financial strategy, offers investors the potential for significant returns. However, understanding the associated fees is crucial for making informed decisions. Enter Interactive Brokers, renowned for its extensive options trading platform. In this in-depth guide, we delve into the complexities of Interactive Brokers options trading fees, empowering you with the knowledge to optimize your investment strategies.

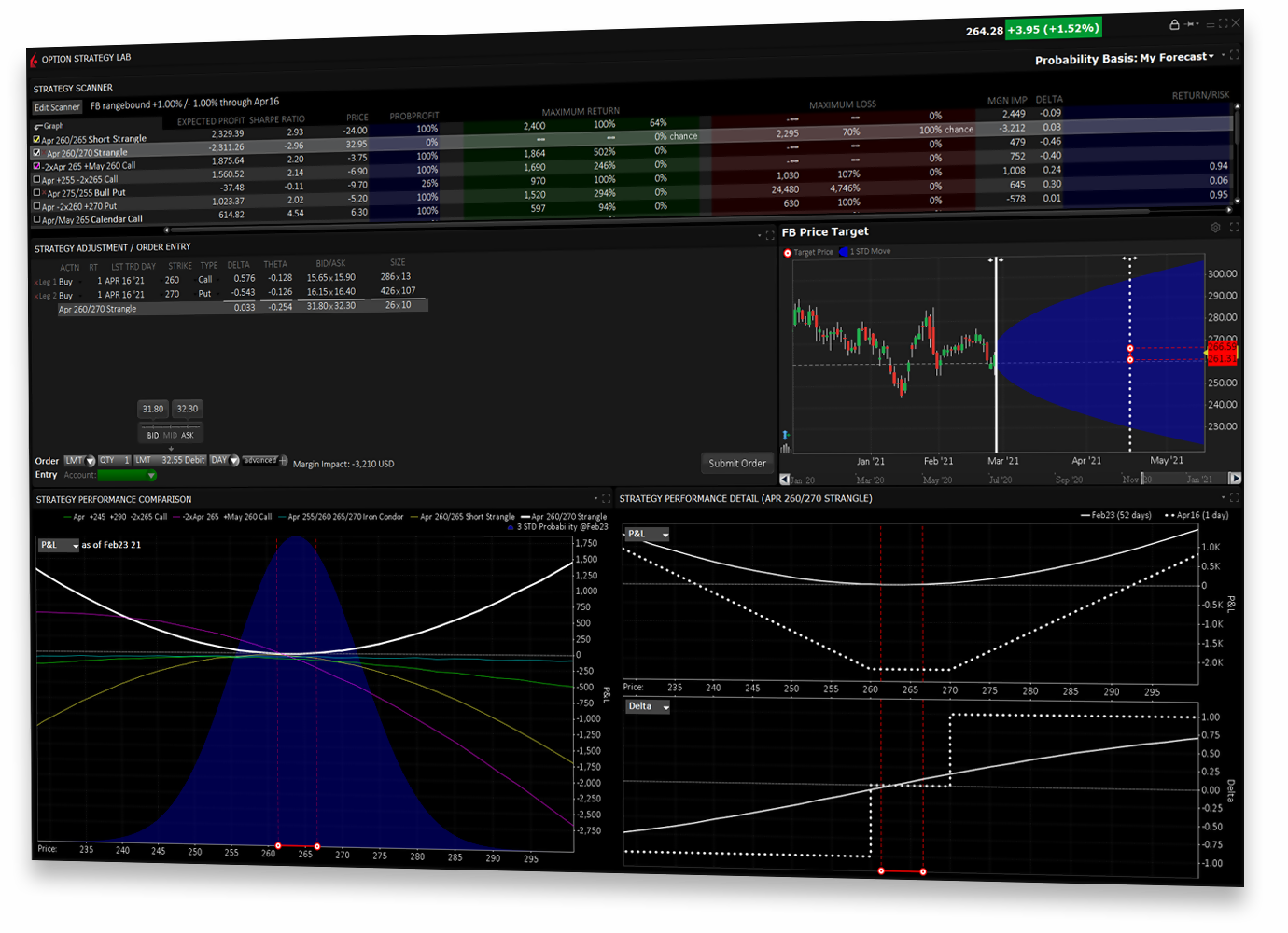

Image: www.rockwelltrading.com

Interactive Brokers: A Comprehensive Options Trading Hub

Interactive Brokers is a global brokerage firm delivering tailored services to individual investors and institutions alike. Its comprehensive options trading platform offers access to a vast array of options contracts, advanced trading tools, and research capabilities. However, with such sophisticated offerings come a range of fee structures that warrant careful consideration.

Dissecting Interactive Brokers Options Trading Fees

Understanding the various fee components involved in options trading with Interactive Brokers is essential:

Base Fees

-

Option Exchange Fees: Exchanged-based fees are charged by the exchanges where options contracts are traded. Interactive Brokers simply acts as a conduit and passes these exchange fees on to clients.

-

Brokerage Fees: These fees compensate Interactive Brokers for executing and servicing your options trades. The brokerage fees vary based on the contract type, underlying security, and trading volume.

-

Regulatory Fees: These fees cover the costs associated with regulatory compliance and are imposed by governing bodies.

Image: www.interactivebrokers.com

Fixed Fee Schedule

For small trades, a fixed fee schedule applies:

-

Less than 5 contracts: $1 per contract

-

5-24 contracts: $0.85 per contract

-

25-99 contracts: $0.75 per contract

-

100+ contracts: $0.65 per contract

Tiered Pricing Structure

Interactive Brokers employs a tiered pricing structure for larger trades:

- Tier 1: Less than 250 contracts – $0.65 per contract

- Tier 2: 250-499 contracts – $0.60 per contract

- Tier 3: 500-999 contracts – $0.55 per contract

- Tier 4: 1000+ contracts – $0.50 per contract

Margin Interest and Exercise Fees

-

Margin Interest: Margin is a loan extended by Interactive Brokers to cover part of a trade’s cost. Margin interest is charged on the amount borrowed.

-

Exercise Fees: These fees are incurred when an investor exercises an option contract prior to its expiration date.

Expert Tips for Minimizing Fees

-

Bulk Trading: Consolidate multiple trades into larger orders. Tiered pricing offers economies of scale.

-

Strategic Trading: Analyze options chains and consider trading options with narrow bid-ask spreads to minimize per-contract fees.

-

Utilize Limit Orders: Place limit orders instead of market orders. This allows you to control the price at which your orders are executed, potentially reducing fill fees.

Frequently Asked Questions on Interactive Brokers Options Trading Fees

Q: How can I access Interactive Brokers’ fee schedule?

A: The complete fee schedule can be found on Interactive Brokers’ website.

Q: Are there any hidden fees associated with options trading?

A: No, Interactive Brokers discloses all applicable fees in its fee schedule.

Q: Can I negotiate my fees with Interactive Brokers?

A: Some brokers offer fee discounts for high-volume traders. It’s worth contacting Interactive Brokers directly to inquire about potential discounts.

Interactive Brokers Options Trading Fees

Conclusion

Understanding Interactive Brokers options trading fees is paramount for optimizing your investment strategies. By carefully considering the various fee components and implementing expert tips, you can minimize your costs and maximize your returns. Remember, successful options trading requires not only market knowledge but also a deep understanding of the associated fees.

Are you ready to delve into the world of options trading with Interactive Brokers? Join the conversation online using the hashtag #InteractiveBrokersOptionsTradingFees and share your experiences and insights with fellow investors.