Options trading, a realm of strategic financial maneuvers, carries with it a complex web of tax implications. Understanding how taxes work with options trading is paramount for investors to optimize their returns and avoid costly surprises. This comprehensive guide unravels the complexities surrounding options taxation, empowering you to navigate the tax landscape with confidence.

Image: forextraininggroup.com

Demystifying Options Taxation: The Basics

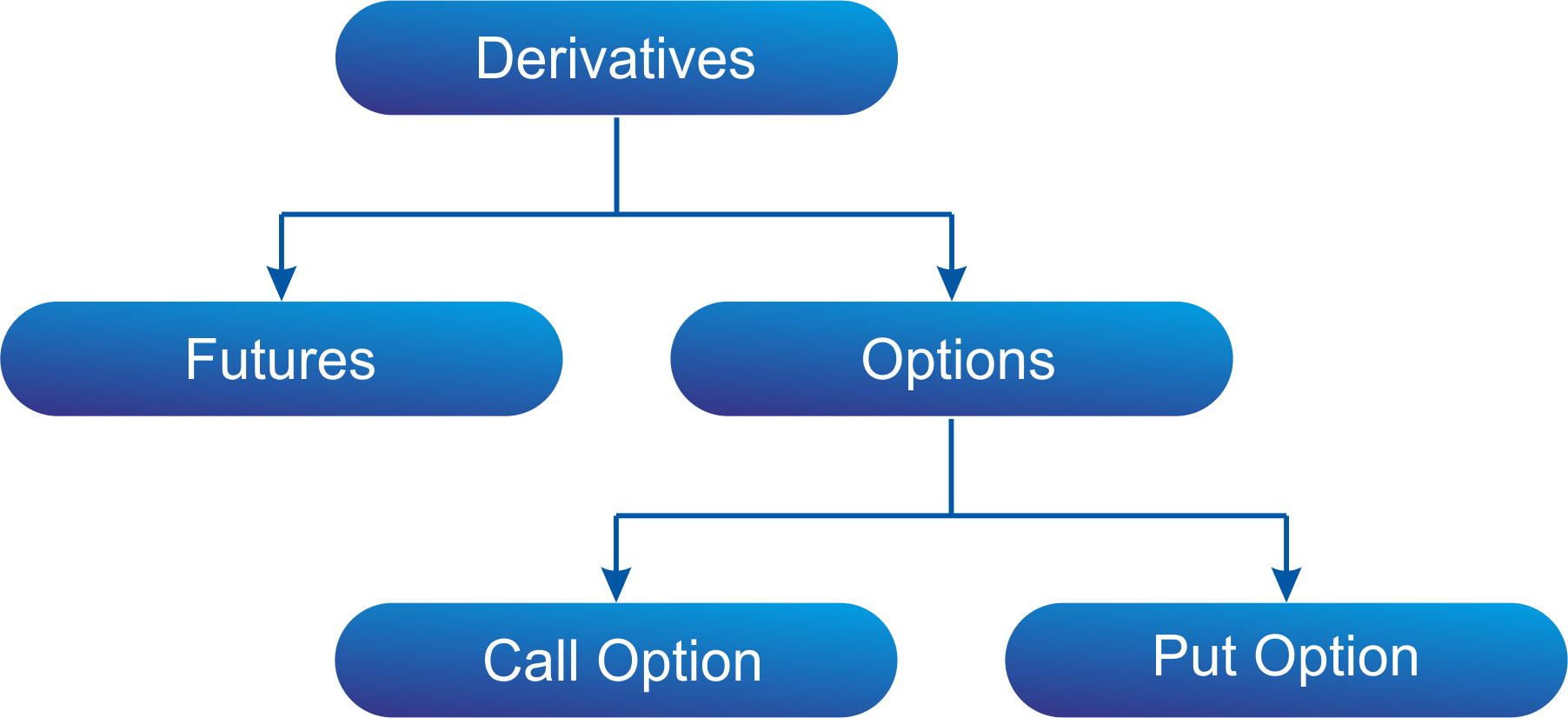

Options, derivative instruments representing the right but not the obligation to buy or sell an underlying asset at a specified price (strike price) on or before a particular date (expiration date), are subject to taxation upon certain events. These events can be broadly classified into two categories:

-

Short-term or Sale: Occurs when an option is held for less than one year and subsequently sold. The profit or loss is taxed as short-term capital gains or losses.

-

Long-term or Expiration: Happens when an option is held for more than one year before being either exercised (buying or selling the underlying asset) or expiring worthless. In this case, the profit or loss is taxed as long-term capital gains or losses.

Uncovering the Tax Treatment of Options Strategies

Options strategies, ingenious combinations of trades designed to achieve specific objectives, warrant a nuanced understanding of tax implications. Let’s explore the tax treatment associated with some prominent strategies:

-

Covered Calls: Selling (writing) a call option while possessing the underlying asset. Profits from such transactions are taxed as capital gains (short-term or long-term) upon option closure or expiration.

-

Naked Calls: Similar to covered calls but executed without owning the underlying asset, subjecting the writer to unlimited losses. Any profit is taxed as ordinary income (not as capital gains) at the time of option assignment by the buyer.

-

Put Options: Granting the buyer the right but not the obligation to sell the underlying asset, put options confer capital gains treatment upon sale or expiration, mirroring the tax treatment of call options.

-

Straddles: Simultaneous long and short positions on options with the same strike price and expiration date strive to profit from price swings without directional bias. Straddles are taxed as short-term capital gains or losses.

-

Stangles: Essentially a bullish call spread and a bearish put spread, stangles speculate on a contained price range and derive their profit from time decay. They are taxed as capital gains or losses.

Navigating the Tax Terrain: Tips for Tax Optimization

Understanding tax implications is crucial, but tax optimization requires proactive strategies. Here are some expert tips to minimize your tax burden:

-

Long-term Holding: Favor long-term options strategies, allowing for favorable long-term capital gains treatment after holding options for more than a year.

-

Offsetting Losses: Short-term capital losses can be used to offset short-term capital gains, potentially minimizing your overall tax liability.

-

Wash Sale Rule Avoidance: When selling an option at a loss, be mindful of the wash sale rule to avoid deferring tax recognition through subsequent repurchases.

-

Seek Professional Advice: Consulting a tax professional can provide personalized guidance tailored to your specific circumstances, ensuring tax compliance and optimizing your options trading strategy.

Image: probizadvisor.com

How Do Taxes Work With Options Trading

Conclusion

While the complexities of options trading may initially seem daunting, the world of options taxation becomes increasingly manageable with a clear understanding of its intricacies. By mastering these concepts and employing sound optimization strategies, you can navigate the tax landscape with confidence, capitalizing on the potential rewards while mitigating potential tax pitfalls. Remember, while this guide serves as a valuable foundation, seeking professional advice remains essential for tailored expertise and maximizing your financial success in the realm of options trading.