Introduction

In the realm of investing, options trading offers an exhilarating yet complex path to potentially earn substantial returns. As a savvy investor, navigating the intricacies of option trading requires a comprehensive understanding of its nuances. This article aims to empower you with a step-by-step guide to option trading on the renowned thinkorswim platform, unlocking the potential for financial success.

Image: tickertape.tdameritrade.com

Comprehending Options: The Foundation of Success

Options, financial instruments derived from underlying assets like stocks, indices, or currencies, grant the buyer the right, but not the obligation, to engage in a transaction at a predetermined price. Options trading involves two fundamental types:

-

Calls: These options provide the buyer the right to purchase the underlying asset at a specific price (strike price) on or before a specified date (expiration date).

-

Puts: Puts grant the buyer the right to sell the underlying asset at a predetermined strike price on or before the expiration date.

Plunging into thinkorswim: Your Trading Arena

thinkorswim stands as one of the most powerful and widely used trading platforms, offering an intuitive interface and advanced analytical tools. Here’s a sneak peek into its key features:

-

Charting Maestro: Visualize historical price movements, identify patterns, and conduct technical analysis with their sophisticated charting capabilities.

-

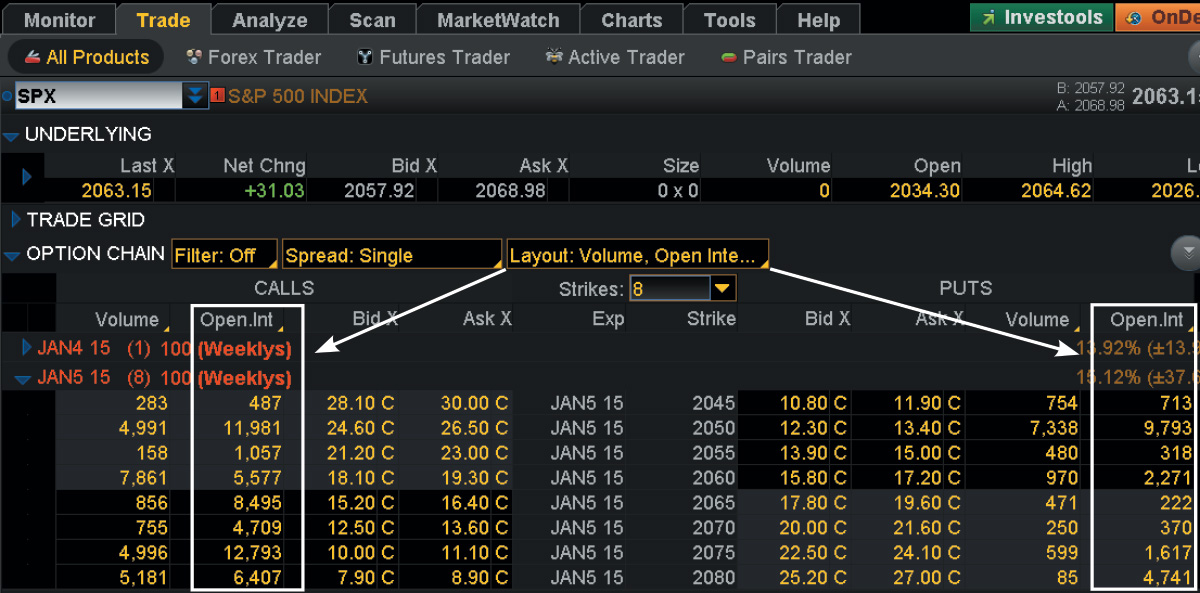

Option Chain Explorer: Seamlessly access and analyze comprehensive information on all available options for any underlying asset.

-

Strategizing with Probability: Harness the power of the Probability Calculator to assess the likelihood of option trades succeeding, providing invaluable insights.

Embarking on Your Option Trading Journey

-

Select Your Underlying Asset: Choose an asset you’re familiar with and has favorable market conditions.

-

Determine Your Strategy: Call or put options should be selected based on your prediction of the asset’s future price movements.

-

Define the Strike Price: Set a strike price that aligns with your expectations of the asset’s value at expiration.

-

Set the Expiration Date: Carefully consider the time frame within which you anticipate the predicted price movement to materialize.

Image: tickertape.tdameritrade.com

Managing Your Position Like a Pro

Once your trade is initiated, managing it is crucial for maximizing profits and minimizing losses.

-

Monitor Market Activity: Keep a vigilant eye on market news and price fluctuations to gauge the performance of your position.

-

Adjust Your Strategy: If market conditions change significantly, consider adjusting your strategy by modifying the strike price, rolling over the contract, or exiting altogether.

-

Stop-Loss Orders to the Rescue: These orders automatically close your position if the underlying asset reaches a predefined loss threshold, protecting you from excessive losses.

Harnessing the Power of thinkorswim’s Education Hub

thinkorswim goes beyond a trading platform, offering a treasure trove of educational resources to enhance your trading skills:

-

Webinars and Tutorials: Engage in interactive webinars and in-depth tutorials tailored to various trading levels.

-

Virtual Trading Tournaments: Immerse yourself in simulated trading environments, testing your strategies and honing your skills without risking real capital.

-

Live Support: Connect with expert traders anytime during market hours, seeking guidance and resolving queries promptly.

Step-By-Step Option Trading On Thinkorswim

Image: www.youtube.com

Conclusion

Venturing into option trading on thinkorswim opens doors to vast opportunities. By meticulously following the steps outlined, leveraging the platform’s robust features, and continuously educating yourself, you can confidently navigate the complexities of this dynamic market. Remember, knowledge is power, and with the right approach, you can unlock the transformative potential of option trading. Visit thinkorswim today and embark on your empowering trading journey!