Introduction

Welcome to the world of options trading, a thrilling arena where risk and reward intertwine. In this comprehensive guide, we’ll delve into the intricacies of trading options using thinkorswim, a powerful platform that empowers you to navigate the financial markets with confidence.

Image: tickertape.tdameritrade.com

Getting Started with thinkorswim

thinkorswim is a sophisticated trading platform that seamlessly blends ease of use with advanced tools. Whether you’re a seasoned trader or a curious novice, thinkorswim has something for everyone. Its intuitive interface and comprehensive set of tools make it ideal for both beginner traders looking to master the basics and experienced veterans seeking cutting-edge trading strategies.

Understanding Options

Options are a flexible financial instrument that allows you to hedge against market volatility or make strategic bets on the future direction of stocks, currencies, or commodities. Think of options as contracts that give you the right (but not the obligation) to buy or sell an underlying asset at a predetermined price (the strike price) on a specific date (the expiration date).

The Options Trading Process

Trading options through thinkorswim is a relatively straightforward process. Here’s a step-by-step guide:

- Choose an underlying asset: Decide what you want to trade options on, whether it’s a stock, currency, or commodity.

- Select an option type: There are two main types of options: calls and puts. Call options give you the right to buy the underlying asset, while put options grant you the right to sell.

- Determine the strike price: The strike price is the price at which you can exercise your right to buy or sell the underlying asset.

- Set the expiration date: This is the date on which the option contract expires and becomes worthless.

- Execute the trade: Once you have the necessary information, you’re ready to execute your trade. Thinkorswim offers various order types to suit different trading strategies.

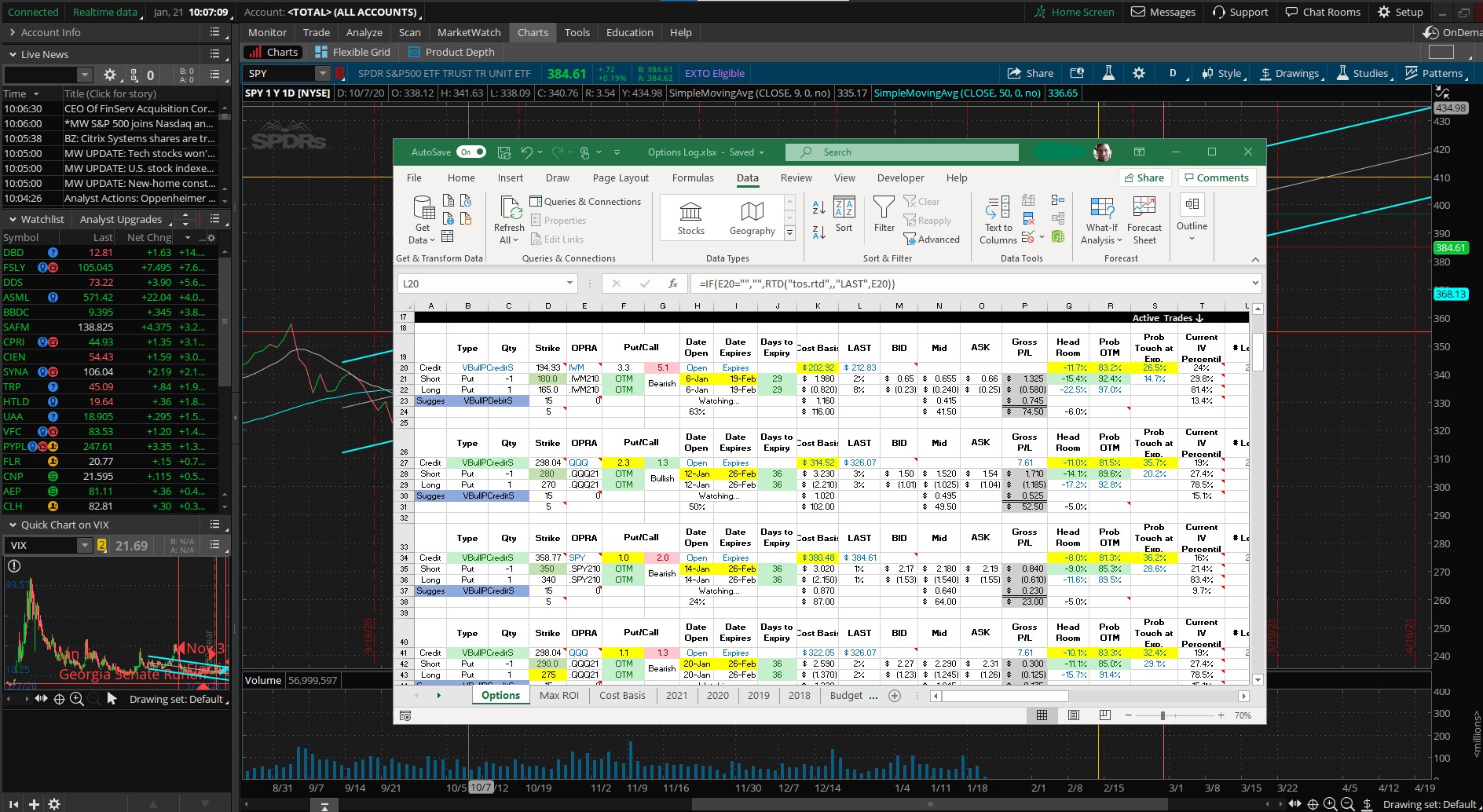

Image: optionstradesbydamocles.com

Advanced Options Trading Techniques

While understanding the basics is essential, to truly excel in options trading, you need to master advanced techniques. thinkorswim provides a wealth of resources and tools to enhance your trading prowess, including:

- Technical analysis: Use charts and indicators to identify trends and make informed trading decisions.

- Risk management: Employ strategies like stop orders and position sizing to mitigate risk.

- Options chains: Gain comprehensive insight into the availability and pricing of all options contracts related to an underlying asset.

- Paper trading: Practice your trading skills without risking real capital.

Expert Insights for Success

Leading options trading experts emphasize key strategies for consistent returns:

- Understand your goals: Define your investment objectives and risk tolerance before making any trades.

- Conduct thorough research: Analyze historical data and economic conditions before formulating trading decisions.

- Stay informed: Keep abreast of market news and events to make timely adjustments to your trading strategies.

- Manage emotions: Let logic guide your trading, not fear or greed.

Trading Options In Thinkorswim

Conclusion

Trading options can be an exciting and potentially lucrative endeavor with the right platform and mindset. thinkorswim provides you with the power to unlock the potential of options trading and take control of your financial future. Whether you’re a seasoned trader or just starting out, this guide has equipped you with the essential knowledge and strategies to navigate the market with confidence. Don’t let fear or inaction hold you back – embrace the boundless possibilities of options trading today and take your investment game to the next level with thinkorswim.