Introduction

In the realm of options trading, understanding expiration dates is crucial for successful investment strategies. Option expirations determine the timeline within which traders must exercise or close their positions, and they have a significant impact on the potential returns and risks involved. This comprehensive guide delves into the most common option trading expirations and their implications for traders’ decision-making. Whether you’re a seasoned pro or a novice trader, this article will equip you with the knowledge necessary to navigate option expirations effectively and enhance your trading performance.

Image: marketwiseasia.com

Weekly Expirations: Short-Term Options for Dynamic Markets

Weekly expirations are highly prevalent in option trading and provide traders with short-term investment opportunities. These options expire every Friday, providing traders with the flexibility to adjust their positions frequently in response to market movements. Weekly expirations are particularly well-suited for traders seeking to capitalize on short-term market volatility or hedging strategies with a shorter time horizon. However, traders should be mindful of the higher trading costs and risks associated with weekly expirations due to the option’s shorter lifespan.

Monthly Expirations: Balancing Risk and Reward in Longer-Term Trades

Monthly expirations are another popular choice among option traders, offering a balance between short-term agility and longer-term investment horizon. These options typically expire on the third Friday of each month, providing traders with approximately one month to hold their positions. Monthly expirations allow traders to ride out market fluctuations while mitigating the risks associated with shorter-term expirations. However, traders should consider the potential opportunity cost and reduced liquidity that may accompany monthly expirations compared to weekly expirations.

Quarterly Expirations: For Long-Term Market Views and Less Frequent Trading

Quarterly expirations cater to traders with long-term market perspectives and those seeking less frequent trading. These options expire on the third Friday of March, June, September, and December, providing traders with up to four months to hold their positions. Quarterly expirations are often utilized for strategic positioning and reducing the frequency of trading decisions. However, traders should be aware of the extended time decay associated with quarterly expirations, which may impact their potential returns.

Image: www.cmegroup.com

Other Common Expirations: Adapting to Specific Strategies

In addition to weekly, monthly, and quarterly expirations, there are several other common expirations that traders may encounter, including:

- Two-Week Expirations: Offering a compromise between weekly and monthly expirations, two-week expirations provide traders with additional time to hold their positions compared to weekly expirations while maintaining a relatively short investment horizon.

- Semi-Monthly Expirations: Semi-monthly expirations fall on the second and fourth Friday of each month, providing traders with frequent trading opportunities while allowing for a slightly longer investment horizon than weekly expirations.

- Annual Expirations: Annual expirations occur once a year, typically on the third Friday of January. These options offer the longest investment horizon and are suitable for traders with a very long-term perspective.

Expiration Selection: Consider Trading Strategy and Market Conditions

The choice of option expiration depends on a variety of factors, including the trader’s trading strategy, risk appetite, and market conditions. Traders with short-term trading strategies or seeking to capitalize on market volatility may prefer weekly or monthly expirations. Those with longer-term perspectives or seeking to reduce trading frequency may opt for quarterly or annual expirations. It is essential to carefully consider the implications of each expiration and align it with the trader’s objectives and risk tolerance.

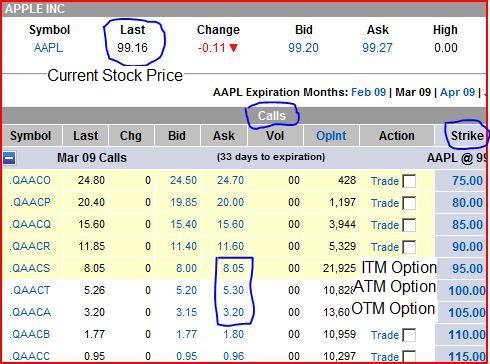

Most Common Option Trading Expirations

Image: www.learn-stock-options-trading.com

Conclusion

Understanding the most common option trading expirations and their implications is a vital aspect of successful options trading. By selecting the appropriate expiration for their trading strategies and market conditions, traders can optimize their chances of achieving their financial goals. Furthermore, ongoing monitoring of expiration dates and adjusting positions accordingly are crucial for maximizing returns and managing risks in the dynamic options trading environment. Embracing these principles will empower traders to navigate option expirations effectively and enhance their trading acumen.