Embrace the Power of Options Trading with thinkorswim

The allure of stock market riches captivates many, but navigating the complexities of options trading can be daunting. One powerful tool that empowers traders in this realm is thinkorswim, a comprehensive trading platform renowned for its user-friendly interface and robust capabilities. In this guide, we embark on a guided expedition, unlocking the secrets of setting up thinkorswim for options trading.

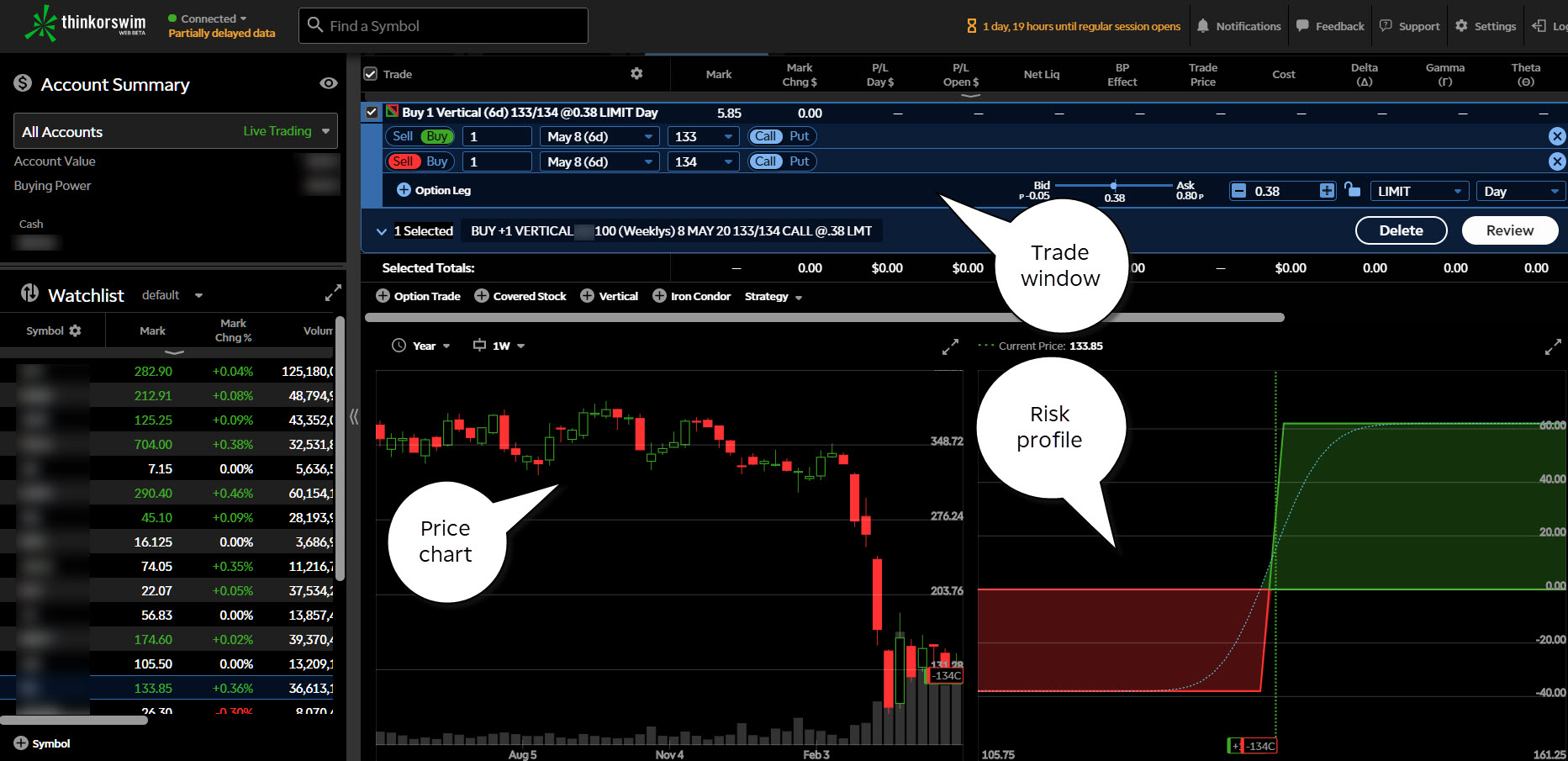

Image: www.youtube.com

Step 1: Create Your thinkorswim Account

Embarking on your options trading journey begins with establishing an account with TD Ameritrade, the creators of thinkorswim. Navigate to their official website, complete the registration process, and embrace the platform’s cutting-edge offerings.

Step 2: Understanding the Options Chain

The options chain lies at the heart of options trading, presenting an array of contracts with varying strike prices and expiration dates. Familiarize yourself with the intricacies of this structure; it holds the key to comprehending the intricate dance of options pricing.

Step 3: Configuring Your Platform

Personalize your thinkorswim interface to align with your trading preferences. Discover the vast array of customizable features, from charting styles to order types, and tailor the platform to suit your unique trading style.

Step 4: Adding the Probability Calculator

Unleash the power of probability with the indispensable Probability Calculator. This instrumental tool harnesses real-time market data to determine the likelihood of options expiring in-the-money, providing an invaluable edge in assessing risk and maximizing profit potential.

Step 5: Mastering the Trade Ticket

The trade ticket stands as the gateway to executing your options strategies. Delve into its multifaceted components, encompassing options legs, margin requirements, and conditional orders. A thorough understanding of the trade ticket empowers you to execute trades with precision and confidence.

Step 6: Analyzing Options Charts

Unlock the secrets of options charts and decipher their intricate patterns. Study candlestick formations, moving averages, and support and resistance levels to unravel the underlying market dynamics and make informed trading decisions.

Step 7: Employing PaperMoney for Risk-Free Trading

Embrace the invaluable opportunity to hone your options trading skills without risking real capital. PaperMoney, a simulated trading environment provided by thinkorswim, allows you to test strategies, evaluate market behavior, and refine your decision-making in a risk-free setting.

Conclusion

Your journey into the realm of options trading has commenced with this comprehensive setup guide. Armed with the knowledge of how to configure thinkorswim, you possess a formidable tool to navigate the financial markets with greater confidence. Remember, the path to success lies in continuous learning and unwavering practice. Embrace the challenges, adapt to the ever-evolving market landscape, and let thinkorswim empower you to unlock the true potential of options trading.

Image: thewaverlyfl.com

How To Setup Thinkorswim For Options Trading

Image: tradingskeptic.com