Options trading, a sophisticated and potentially lucrative investment strategy, can be made accessible with the right platform. Interactive Brokers stands out as a leader in the industry, offering an extensive range of options trading capabilities tailor-made for experienced traders. In this comprehensive review, we dissect Interactive Brokers’ option trading platform to unravel its strengths, weaknesses, fees, and suitability for various trading styles.

Image: investingintheweb.com

Deep Dive into Interactive Brokers’ Option Trading Platform

Interactive Brokers’ Trader Workstation (TWS) is the cornerstone of its options trading platform. TWS empowers traders with a vast array of tools, including advanced charting capabilities, real-time market data, and customizable trade execution algorithms. The platform’s intuitive interface seamlessly integrates options trading functionality, enabling traders to execute complex strategies with ease.

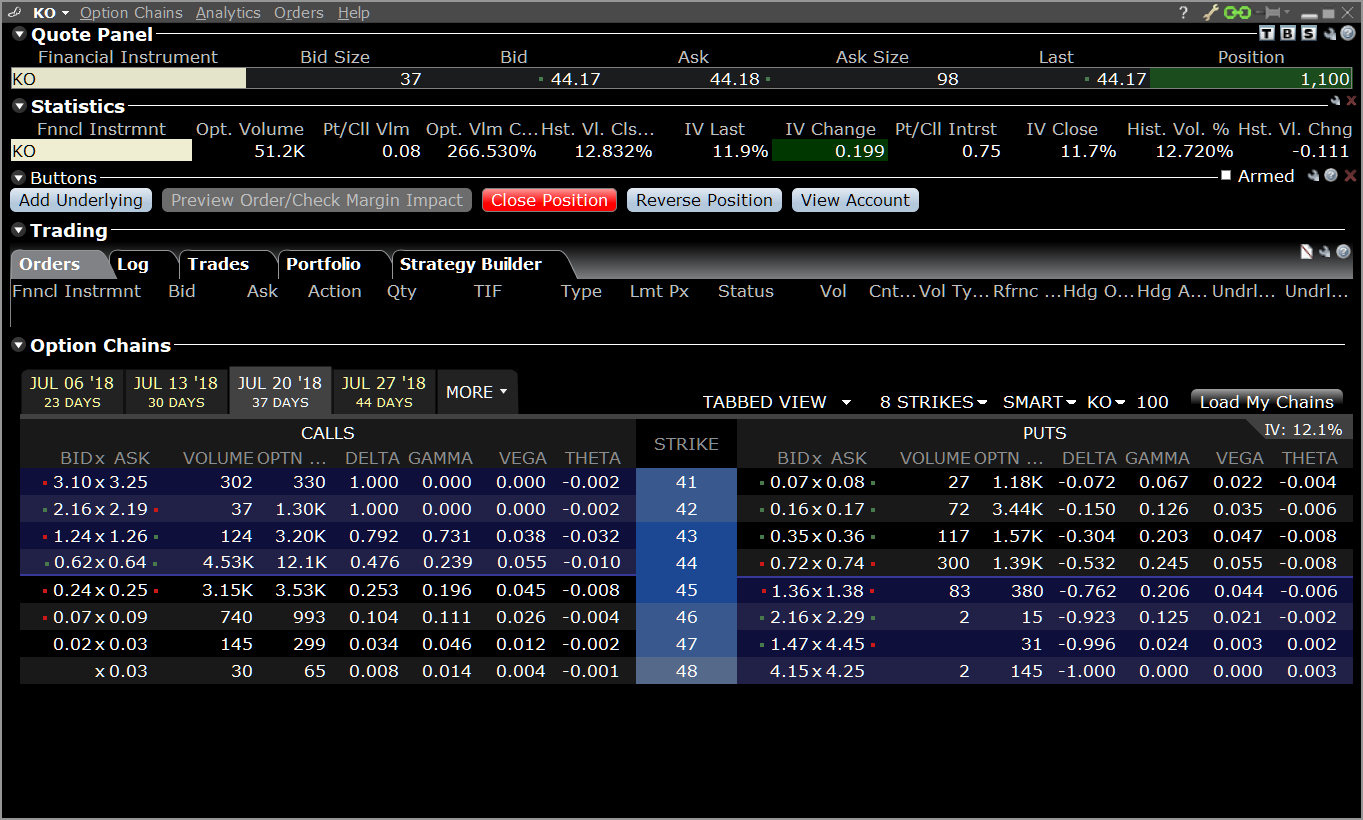

1. Comprehensive Option Chain Analysis

Interactive Brokers’ options chain analyzer provides a granular view of option contracts, encompassing key metrics such as implied volatility, Greeks, and historical data. This comprehensive analysis allows traders to make informed decisions, evaluating option premiums and potential risks.

2. Sophisticated Order Types

TWS supports a wide spectrum of option order types, including trailing stops, conditional orders, and complex multi-leg strategies. Traders can tailor their trading strategies with precision, leveraging advanced order types to maximize their outcomes.

Image: financialtalkies.com

3. Real-Time Market Data and News

Interactive Brokers provides real-time market data and news feeds, ensuring traders stay abreast of market fluctuations and breaking news. This real-time access empowers traders to make nimble trading decisions, capitalizing on market opportunities.

Interactive Brokers Option Trading Fees: A Comparative Analysis

Interactive Brokers’ fee structure is competitive within the industry. The platform charges per-contract fees, ranging from $0.50 to $1.50, depending on the contract type and volume. Margin rates for option trading are also competitive, starting at 4.5%. Comparative analysis reveals that Interactive Brokers’ fees are on par with or lower than industry peers.

Pros and Cons of Interactive Brokers Option Trading

Pros:

- Extensive range of option contract types

- Robust trading tools and platform capabilities

- Real-time market data and news updates

- Competitive fee structure and margin rates

Cons:

- Complex and feature-laden platform, requiring a learning curve

- Lack of educational resources tailored to beginner traders

Interactive Brokers Option Trading Review

Image: www.rockwelltrading.com

Who Should Use Interactive Brokers Option Trading?

Interactive Brokers’ option trading platform is primarily designed for experienced traders who seek advanced functionality and customization capabilities. The platform’s complexity may pose a barrier for novice traders who prefer simpler trading platforms.