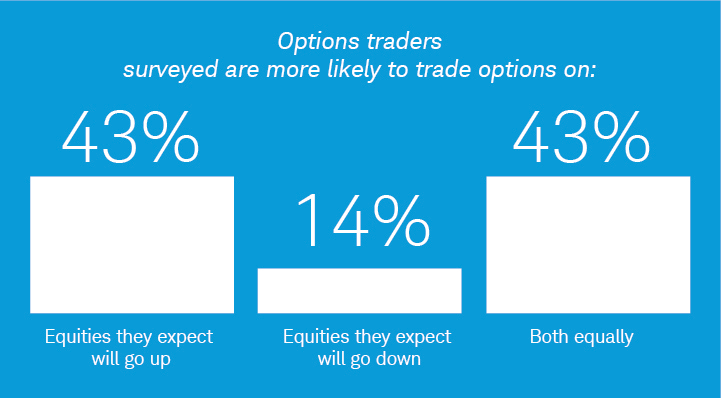

I received a call from Charles Schwab out of the blue, inviting me to participate in a quiz on options trading. At first, I was taken aback, as options trading had always seemed like a complex and intimidating concept to me. Yet, intrigued by the prospect of expanding my knowledge, I agreed to take the challenge.

Image: content.schwab.com

As I entered the virtual quiz room, I was greeted by a friendly and knowledgeable Schwab representative. The quiz consisted of a series of multiple-choice questions designed to assess my understanding of options concepts, risks, and potential rewards. I found myself answering questions about strike prices, expirations, and Greeks, terms that I had previously only glanced at in passing.

Deciphering the Enigmatic World of Options Trading

Through the quiz, I realized that options trading is not as daunting as I had initially perceived. In essence, options are contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. This flexibility offers traders various strategies to speculate on the future direction of the market.

However, it’s crucial to recognize that options trading carries significant risks, and traders must be aware of these before entering into any transactions. The value of options can fluctuate rapidly, and there’s always the possibility of losing the entire investment. Proper due diligence and risk management techniques are essential to mitigate these risks.

A Deep Dive into Options Strategies

As I progressed through the quiz, I was introduced to a range of options strategies that traders employ to pursue different investment objectives. Some of the most common strategies include: buying calls to capitalize on expected stock appreciation, selling puts to generate income from a stock’s decline, and using straddles and strangles to bet on increased volatility.

Understanding these strategies and their nuances is vital for options traders. Each strategy has its own set of potential rewards and risks, and selecting the right strategy for a particular market outlook is fundamental to successful options trading.

Trading Options: Navigating the Information Landscape

In today’s digital age, there’s an abundance of information available on options trading. While this can be valuable, it’s important for traders to discern reputable sources from unreliable ones. Seeking advice from experienced professionals, reading reliable websites and books, and actively participating in online forums can contribute to developing a sound understanding of options trading.

Additionally, staying updated with the latest market news and trends is crucial for options traders. By monitoring economic indicators, geopolitical events, and corporate earnings reports, traders can make informed decisions and adjust their strategies accordingly.

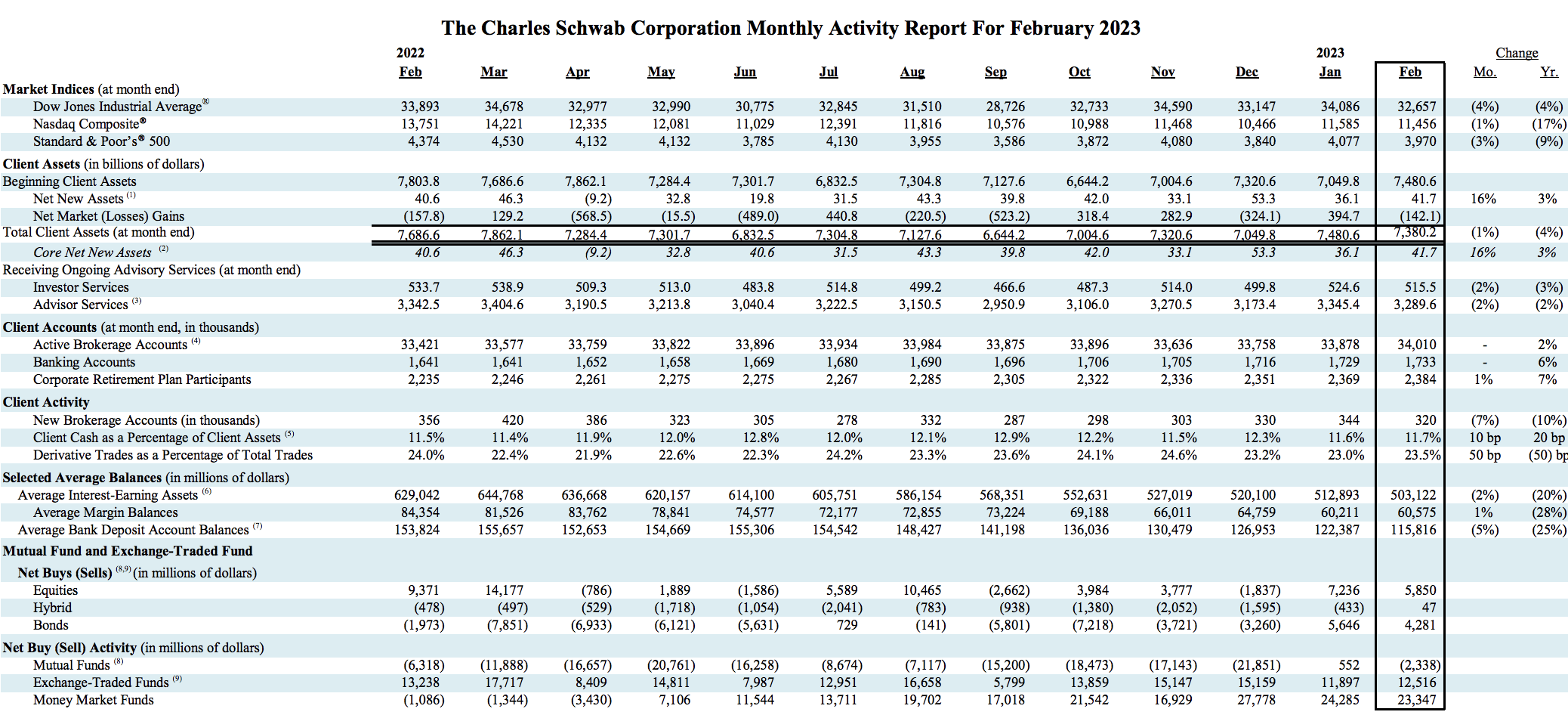

Image: seekingalpha.com

Expert Insight and Time-Tested Advice

When it comes to options trading, seeking guidance from experienced traders and financial advisors can be invaluable. They can provide insights into market dynamics, share successful strategies, and help you avoid common pitfalls.

One key piece of advice from experienced traders is to start small and gradually increase your position size as you gain more experience and confidence. It’s also essential to set clear trading goals and stick to them, avoiding impulsive decisions driven by greed or fear.

Frequently Asked Questions about Options Trading

Q: What is the difference between a call option and a put option?

A: A call option gives the buyer the right to buy an underlying asset at a certain price, while a put option gives the buyer the right to sell an underlying asset at a certain price.

Q: Can options trading make me rich quickly?

A: While options trading has the potential for high returns, it’s not a get-rich-quick scheme. There are significant risks involved, and it requires knowledge, skill, and discipline to achieve consistent success.

Q: What is a good starting point for learning about options trading?

A: Consider taking online courses, reading books and articles, and seeking guidance from reputable sources. It’s also helpful to practice trading in a simulation environment before risking real capital.

Charles Schwab Called Me To Quiz Me On Options Trading

Image: www.reddit.com

Conclusion: Embracing the Options Landscape

My quiz experience with Charles Schwab was an eye-opening journey into the world of options trading. It helped me debunk misconceptions, gain practical insights, and appreciate the potential rewards and risks involved. Armed with this newfound knowledge, I will continue to explore options trading, seeking to refine my understanding and make informed investment decisions.

Are you interested in learning more about options trading? Connect with me today for personalized guidance and comprehensive resources.