Navigate the Dynamic Options Market with Confidence

In today’s rapidly evolving financial landscape, option trading has emerged as a sophisticated yet lucrative investment strategy. Options contracts, derived from underlying assets such as stocks, bonds, commodities, or indices, offer investors a flexible and potentially rewarding way to enhance returns, manage risk, and speculate on price movements. To navigate this dynamic market effectively, it’s essential to understand the fundamental principles of option trading and stay abreast of the latest trends and developments. This weekly guide will delve into the intricate world of options, providing insightful analysis, actionable strategies, and practical tips to help you make informed decisions and maximize your potential in the options market.

Image: www.pinterest.com.mx

The Basics: What Are Options and How Do They Work?

Options contracts grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. The two main types of options are calls and puts. Calls give the buyer the right to buy the underlying asset, while puts provide the right to sell it. Each contract represents 100 shares of the underlying security. The premium paid for the option represents the cost of acquiring this right.

Understanding Key Concepts: Strike Price, Expiration, and In/Out-of-the-Money

The strike price is the predetermined price at which the buyer can buy or sell the underlying asset. The expiration date is the last day the option can be exercised. An option is said to be “in-the-money” if its strike price is favorable for the buyer, allowing them to exercise it profitably. Conversely, it’s considered “out-of-the-money” when the strike price is unfavorable, resulting in a loss if exercised.

Strategies for Success: A Spectrum of Options Trading Approaches

Option traders can choose from a wide range of strategies, each catering to specific market conditions and risk tolerances. Covered calls involve selling a call option while owning the underlying asset, allowing investors to generate income while limiting potential upside. Cash-secured puts involve selling a put option while holding cash to purchase the underlying asset if the put is exercised, providing income generation with limited risk. Spreads involve combining multiple options contracts to create more complex positions, enabling investors to fine-tune their risk-reward profiles and enhance profit potential.

Image: www.asptur.com

Market Analysis: Monitoring Trends and Identifying Opportunities

Staying informed about market trends and economic developments is crucial for successful option trading. Technical analysis involves studying historical price patterns, support and resistance levels, and moving averages to identify potential trading opportunities. Fundamental analysis focuses on evaluating the underlying company’s financial health, industry outlook, and macroeconomic factors that can influence its stock price. Combining these analytical approaches provides a comprehensive understanding of the market dynamics and enhances decision-making.

Risk Management: Mitigating Losses and Preserving Capital

Risk management is paramount in option trading to safeguard capital and avoid substantial losses. Careful consideration should be given to position sizing, ensuring that the amount invested in any single trade is proportionate to the investor’s risk tolerance and financial goals. Stop-loss orders can be used to automatically sell options contracts if they reach a predetermined unfavorable price level, limiting potential losses. Diversification by trading options on multiple underlying assets can also reduce overall portfolio risk.

Trading Psychology: Overcoming Biases and Making Sound Decisions

Emotions and biases can often cloud judgment in trading, leading to poor decision-making. It’s essential to develop a sound trading psychology based on discipline, patience, and risk management principles. Sticking to well-defined trading plans helps limit impulsive actions and prevents emotional trading based on fear or greed. Backtesting strategies using historical data can also provide valuable insights into strategy effectiveness and potential outcomes.

Option Trading Weekly

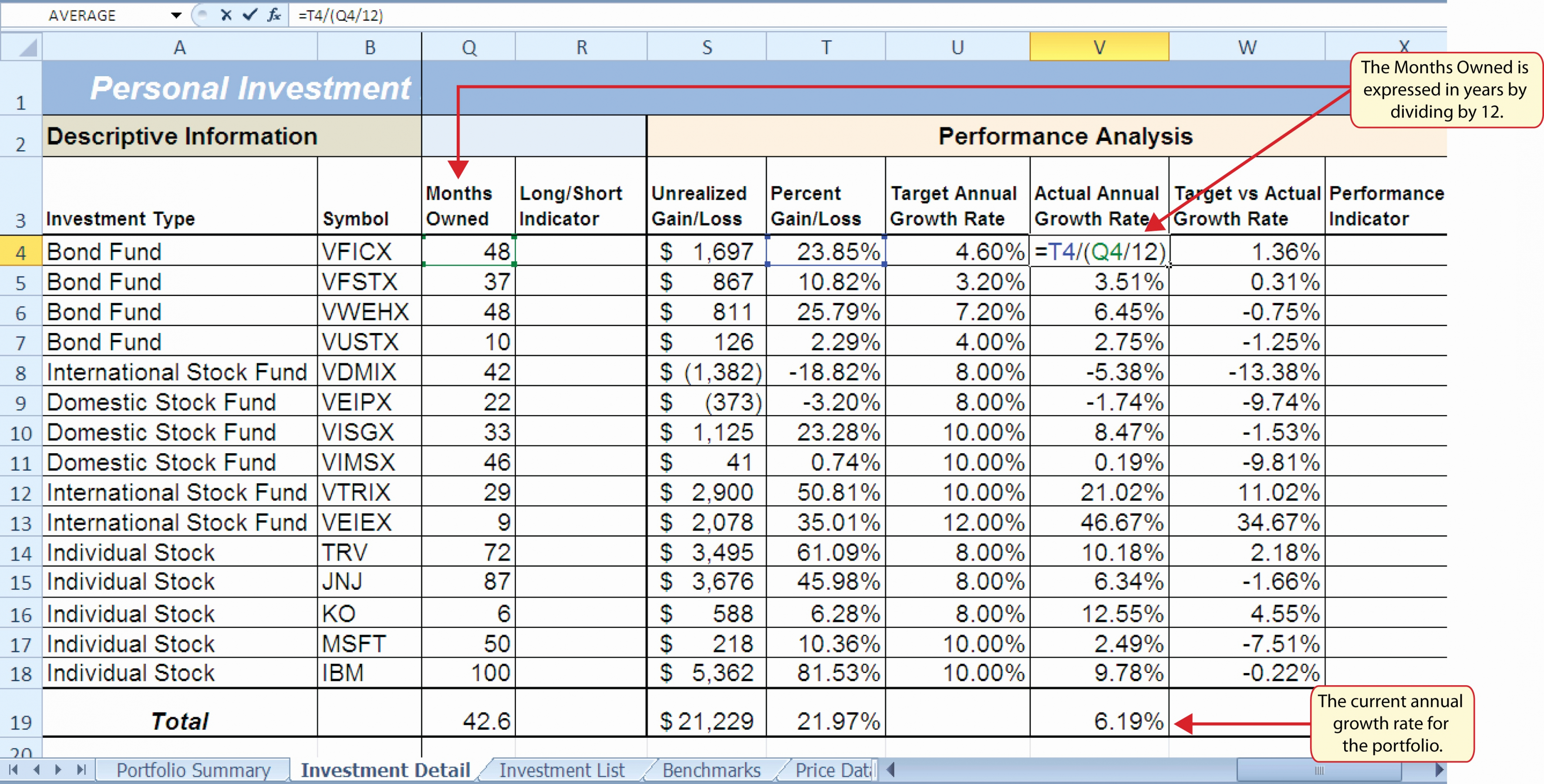

Image: db-excel.com

Conclusion: A Gateway to Informed Option Trading

Option trading offers a powerful tool for savvy investors to generate income, manage risk, and enhance returns. By grasping the fundamental principles outlined in this weekly guide, staying abreast of market trends, and implementing sound risk management strategies, investors can navigate the dynamic options market with increased confidence and potential for success. Remember, knowledge is power in the world of finance, and continuous learning and adapting to market evolution are the keys to unlocking your full potential as an option trader.