Options trading, an intricate financial strategy, involves unique risks and opportunities. Understanding standard margin requirements is essential for navigating this volatile market. In this comprehensive guide, we will delve into the depths of options trading standard margin, empowering you with the knowledge and confidence to make informed trading decisions.

Image: www.fibogroup.com

What is Options Trading Standard Margin?

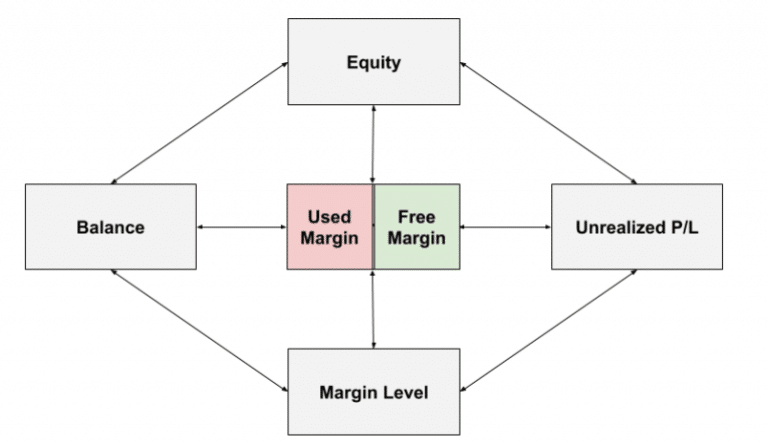

In the realm of options trading, a standard margin refers to the minimum amount of equity you need to maintain in your account to cover potential losses on your trades. Brokers set different standard margin requirements depending on the type of option contract and the underlying asset being traded. By maintaining standard margin, you demonstrate your financial commitment to the trade and protect the brokerage firm against potential defaults.

Calculating Options Trading Standard Margin

Calculating options trading standard margin is a crucial step in risk management. It involves understanding the concept of margin requirements and how they vary based on the type of option and the underlying asset. Brokers typically publish their own margin requirements, which can be easily accessible through their trading platforms or websites. Alternatively, you can consult a financial professional or broker for personalized guidance.

Impact of Standard Margin on Trading Decisions

Standard margin requirements significantly impact your trading decisions. By understanding these requirements, you can effectively allocate your capital and manage your risk exposure. Traders must carefully consider the margin requirements of each trade and ensure they maintain sufficient equity to cover potential losses. Failure to adhere to margin requirements can result in margin calls, forced liquidations, and financial setbacks.

Image: blog.injective.com

Expert Insights on Standard Margin Management

Seasoned traders and financial experts emphasize the importance of prudent standard margin management. They advise traders to always stay informed about margin requirements and to never overextend themselves financially.

“Standard margin requirements are essential safety nets in options trading,” says renowned trader Mark Douglas. “By respecting these requirements, you minimize your exposure to catastrophic losses and increase your chances of long-term success.”

Actionable Tips for Effective Risk Management

-

Monitor Margin Requirements: Regularly check your trading account to ensure you maintain sufficient margin to cover your current and potential losses.

-

Limit Position Size: Avoid overleveraging by carefully considering the margin requirements of each trade and adjusting your position size accordingly.

-

Diversify Your Portfolio: Diversify your options trades across different underlying assets or sectors to reduce your overall risk exposure.

-

Seek Professional Guidance: Consult with a broker or financial advisor who can provide personalized guidance on standard margin management tailored to your specific trading style and financial goals.

Options Trading Standard Margin

Image: forextraders.guide

Conclusion

Options trading standard margin is a critical aspect of risk management in this dynamic financial arena. By gaining a thorough understanding of standard margin requirements, traders can make well-informed decisions, safeguard their capital, and navigate the options market with greater confidence. Remember, prudent standard margin management is the key to unlocking the full potential of options trading while mitigating potential risks. Embrace these strategies, seek expert guidance when needed, and embark on your options trading journey with a robust foundation of knowledge and risk awareness.