In the vast and intricate landscape of finance, options trading often stands as a beacon of opportunity. It offers traders the potential for significant returns, but it can also come with substantial risks. Navigating this complex terrain requires a deep understanding of options and a keen eye for value. But what if there was a way to minimize risk and maximize potential gains without breaking the bank? Enter least expensive options trading, a strategy that empowers traders with the tools they need to succeed without the hefty price tag.

Image: optionsprofitplanner.com

At its core, options trading involves speculating on the future price of an underlying asset, such as a stock or commodity. By purchasing an option contract, traders gain the right, but not the obligation, to buy or sell the asset at a predetermined price (known as the strike price) on or before a specified date (known as the expiration date). Traditional options trading, however, can be prohibitively expensive, often requiring significant upfront capital and ongoing maintenance fees.

Breaking Down Least Expensive Options Trading

Least expensive options trading challenges this paradigm by offering a more cost-effective alternative. It centers around the concept of buying deeply out-of-the-money (OTM) options. OTM options have a strike price significantly higher (in the case of calls) or lower (in the case of puts) than the current market price of the underlying asset. These options carry a much lower premium (price) than their at-the-money (ATM) or in-the-money (ITM) counterparts because their probability of expiring in the money (i.e., becoming profitable) is much lower.

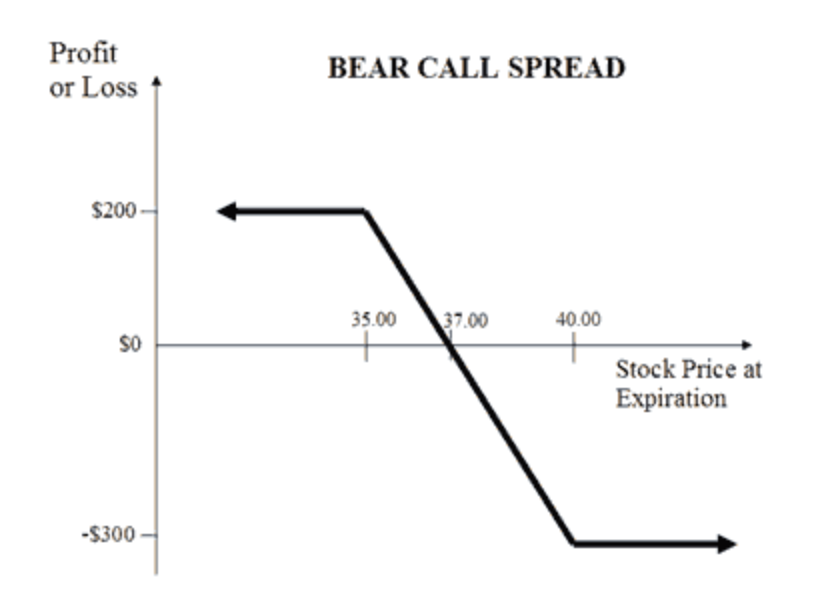

The strategy of least expensive options trading exploits the inherent asymmetry of options. By purchasing an OTM option, traders limit their potential downside risk to the premium paid for the contract. Yet, they retain the potential for significant upside gain if the underlying asset price moves in their favor. This risk-reward profile makes OTM options an attractive choice for traders seeking maximum leverage with minimal capital outlay.

Real-World Applications: Unlocking Value with OTM Options

To illustrate the power of least expensive options trading, let’s consider a real-world example. Suppose a trader believes that Apple stock has the potential to rise in the coming months. However, they are hesitant to purchase the stock directly due to the high current price. Instead, the trader could opt to buy a deeply OTM call option with a strike price significantly above the current market price. This option would have a much lower premium than an ATM or ITM call option, reducing the trader’s initial investment.

If the trader’s prediction holds true and Apple’s stock value increases, the OTM call option will appreciate in value at a potentially rapid pace. The trader can then sell the option at a profit, realizing a substantial return on their initial investment. Even if the stock price remains relatively flat or moves against them, the trader’s losses are capped at the premium paid for the option.

Key Considerations: Maximizing Success with OTM Options

While least expensive options trading offers significant potential, it’s essential to exercise caution and employ sound trading practices. Here are some key considerations to keep in mind:

1. Time Decay: OTM options are vulnerable to time decay as the expiration date approaches. Time decay represents the erosion of an option’s premium value over time. As an OTM option gets closer to expiration, its probability of expiring in the money decreases, leading to a decline in its premium.

2. Implied Volatility: Implied volatility (IV) is a crucial factor affecting option premiums. IV measures the market’s expectation of future price volatility in the underlying asset. Higher implied volatility translates into higher option premiums. Traders should consider IV levels when selecting OTM options, as higher IV can amplify potential gains but also increase the premium cost.

3. Patience and Discipline: Least expensive options trading often requires patience and discipline. OTM options have a lower probability of expiring in the money, so traders may need to hold them for an extended period before seeing significant returns. Adhering to a well-defined trading plan and avoiding emotional decision-making is paramount.

Image: www.linkedin.com

Least Expensive Options Trading

Image: www.catawiki.com

Conclusion: Leveraging Options with Minimal Investment

In the ever-evolving world of finance, least expensive options trading emerges as a compelling strategy for value-minded traders. By embracing deeply out-of-the-money options, traders can gain exposure to underlying assets with minimal capital outlay. While this strategy carries inherent risks, a thorough understanding of options dynamics and judicious trade management can unlock significant rewards. For those seeking a cost-effective way to navigate the options market, least expensive options trading offers a unique and powerful tool.