Options trading offers a unique opportunity to leverage volatility and capitalize on market swings. But what exactly is options day trading? In this comprehensive guide, we delve into the intricacies of options day trading, empowering you with the knowledge and strategies to succeed in this dynamic market.

Image: www.pinterest.co.uk

Understanding Options: The Foundation of Day Trading

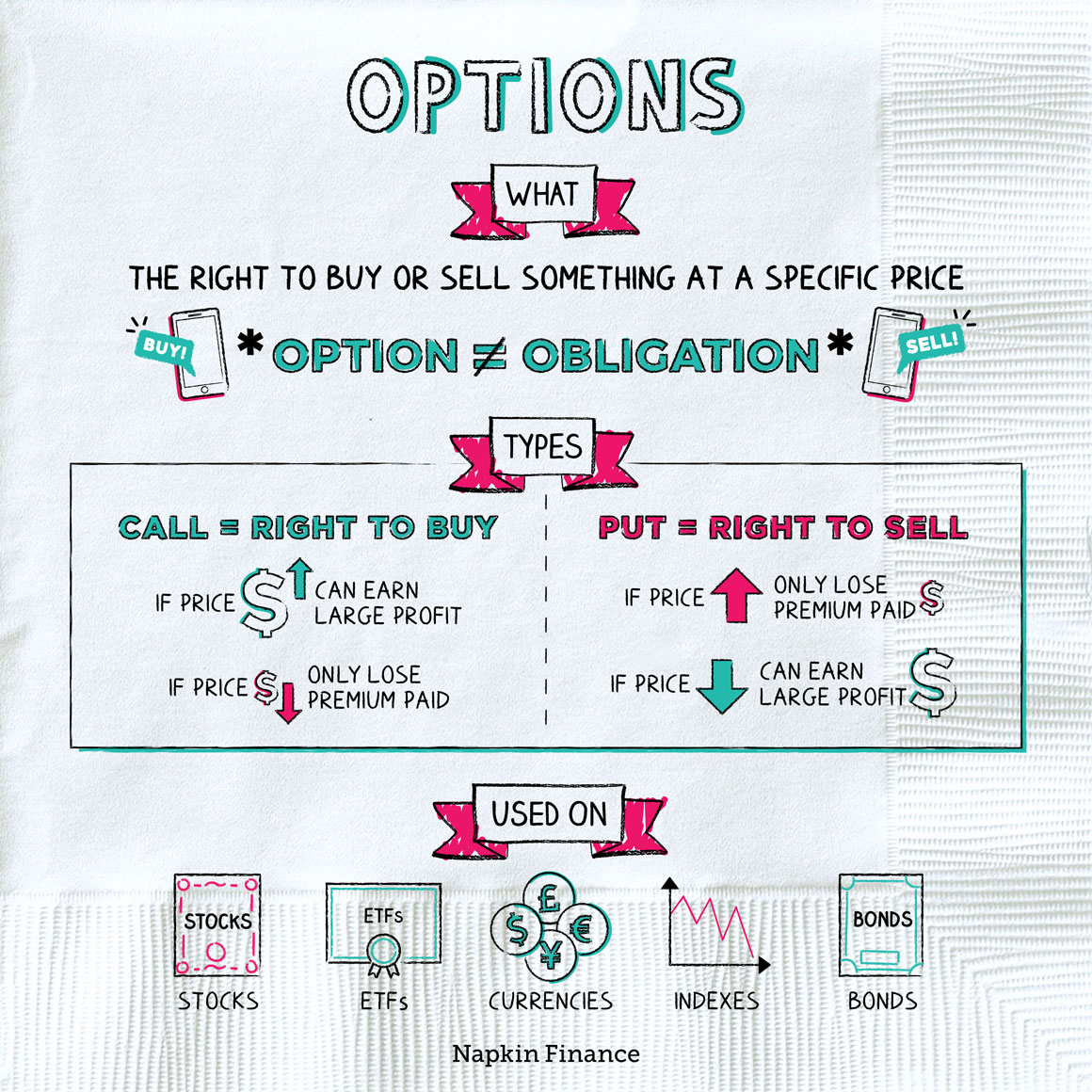

In essence, an option is a contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or ETF, at a predetermined price on or before a specific date. The buyer of an option pays a premium to the seller who assumes the obligation to fulfill the contract if exercised.

Options day trading is the short-term buying and selling of options within the same trading day. Day traders aim to capitalize on short-term price fluctuations by leveraging the leverage offered by options. However, it’s crucial to note that day trading options involves a higher level of risk and requires a thorough understanding of options trading.

Key Concepts: Unlocking the World of Options

To navigate the world of options day trading effectively, it’s essential to grasp fundamental concepts:

-

Strike Price: The predetermined price at which the underlying asset can be bought or sold.

-

Expiration Date: The last date on which the option contract can be exercised.

-

Premium: The price paid by the option buyer to the option seller for the right to exercise the option.

-

Intrinsic Value: The difference between the strike price and the current market price of the underlying asset.

-

Time Decay: The gradual erosion of the option’s premium as the expiration date approaches.

Trading Strategies: Secrets to Success

Successful options day trading hinges on employing effective strategies, such as:

-

Scalping: Trading small fluctuations in options prices to accumulate small but frequent profits.

-

Day Trading: Buying and selling options multiple times within the same trading session, capturing multiple market swings.

-

Hedging: Using options to reduce risk and protect existing positions.

-

Iron Condor: A neutral strategy that involves buying a call and selling another call at a higher strike price, while also buying a put and selling another put at a lower strike price.

Image: www.projectfinance.com

Expert Insights: Wisdom from the Trading Masters

Experienced options day traders impart valuable insights:

-

“Master the basics of options and the underlying assets you’re trading.” – John Carter, author of “Mastering the Trade”

-

“Manage your risk and trade with discipline.” – Nassim Taleb, author of “The Black Swan”

-

“Identify trading opportunities based on market sentiment and technical analysis.” – Tom DeMark, technical analyst and trader

Options Day Trading Definition

Image: napkinfinance.com

Conclusion: Embark on Your Options Day Trading Journey

Options day trading can be a lucrative but challenging endeavor. By comprehending options fundamentals, adopting proven strategies, and seeking guidance from seasoned traders, you can enhance your chances of success. Remember, discipline and risk management are paramount. Embrace the challenge, master the art of options day trading, and unlock the potential for exceptional returns.