Options Trading: Navigating Time and Sales with Precision

Image: www.barchart.com

Introduction:

Imagine controlling the winds of financial markets, predicting their movements like a skilled navigator. Options trading offers this exhilarating power, empowering traders to capitalize on market volatility and secure their financial futures. Understanding the intricate interplay between time and sales is the key to unlocking this trading realm.

Options, financial instruments derived from underlying assets like stocks and indices, grant traders the right but not the obligation to buy or sell an asset at a predefined price on a specific date. Timing and sales volume are crucial factors that determine the profitability of these trades.

Unveiling Options Time and Sales:

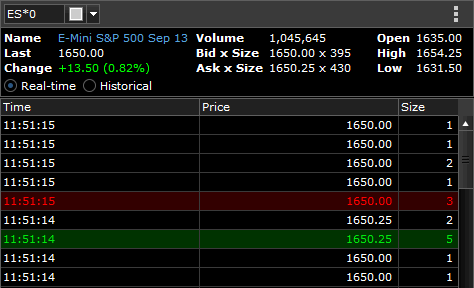

Time, in the context of options trading, refers to the duration before the contract’s expiration. It’s like a ticking clock, dictating the value of the option. Sales, on the other hand, represent the volume of options contracts bought and sold at a given time.

Time Value and Options Premiums:

The value of an option comprises two components: intrinsic value and time value. Intrinsic value is the difference between the underlying asset’s current price and the option’s strike price (the predetermined price at which the option can be exercised). Time value, however, arises from the option’s remaining time until expiration. As time passes, time value decays, ultimately reaching zero at expiration.

Sales Volume and Market Sentiment:

Sales volume provides valuable insights into market sentiment and potential price movements. High sales volume often indicates increased interest in an underlying asset, suggesting potential volatility and trading opportunities. Conversely, low sales volume points towards a lack of conviction or uncertainty in the market direction.

Using Time and Sales to Inform Trading Decisions:

Skilled options traders leverage time and sales data to gain a competitive edge. By analyzing the trend of sales volume over time, traders can identify potential breakouts or reversals in market direction. Higher sales volume preceding a move typically signals increased confidence and momentum, while declining volume may indicate indecision or profit-taking.

Expert Insights for Successful Time and Sales Trading:

In the wisdom of options trading legend Nassim Nicholas Taleb, “Time kills all uncertainties, but it also kills opportunities.” This underscores the importance of timely decision-making in this dynamic market.

Renowned options expert Dan Passero emphasizes the value of patience, advising traders to “wait until the right opportunity presents itself instead of chasing every single trade.” By exercising patience, traders can increase their chances of success and avoid unnecessary losses.

Actionable Tips for Empowered Trading:

- Track sales volume and identify trends to predict market direction.

- Monitor time value decay and adjust positions accordingly.

- Exercise patience and wait for high-probability trading setups.

- Set clear stop-loss orders to limit potential losses.

- Leverage trading tools and platforms that provide real-time time and sales data.

Conclusion: Time and Sales Mastery in Options Trading

Options trading is an empowering financial tool, offering the potential for market domination. By mastering the intricacies of time and sales data, traders can navigate the market with precision and secure their financial goals. Time is precious, and sales volume provides valuable insights. Embrace these principles, and you can unleash the transformative power of options trading in your financial journey.

Image: www.youtube.com

Options Trading Time And Sales

Image: profitnama.com