Have you ever wondered if there’s a way to generate a steady stream of income from the stock market without actually owning the underlying stocks? The answer lies in options trading. In this comprehensive guide, we will explore the ins and outs of dividend income options trading, empowering you to harness this powerful strategy for financial success.

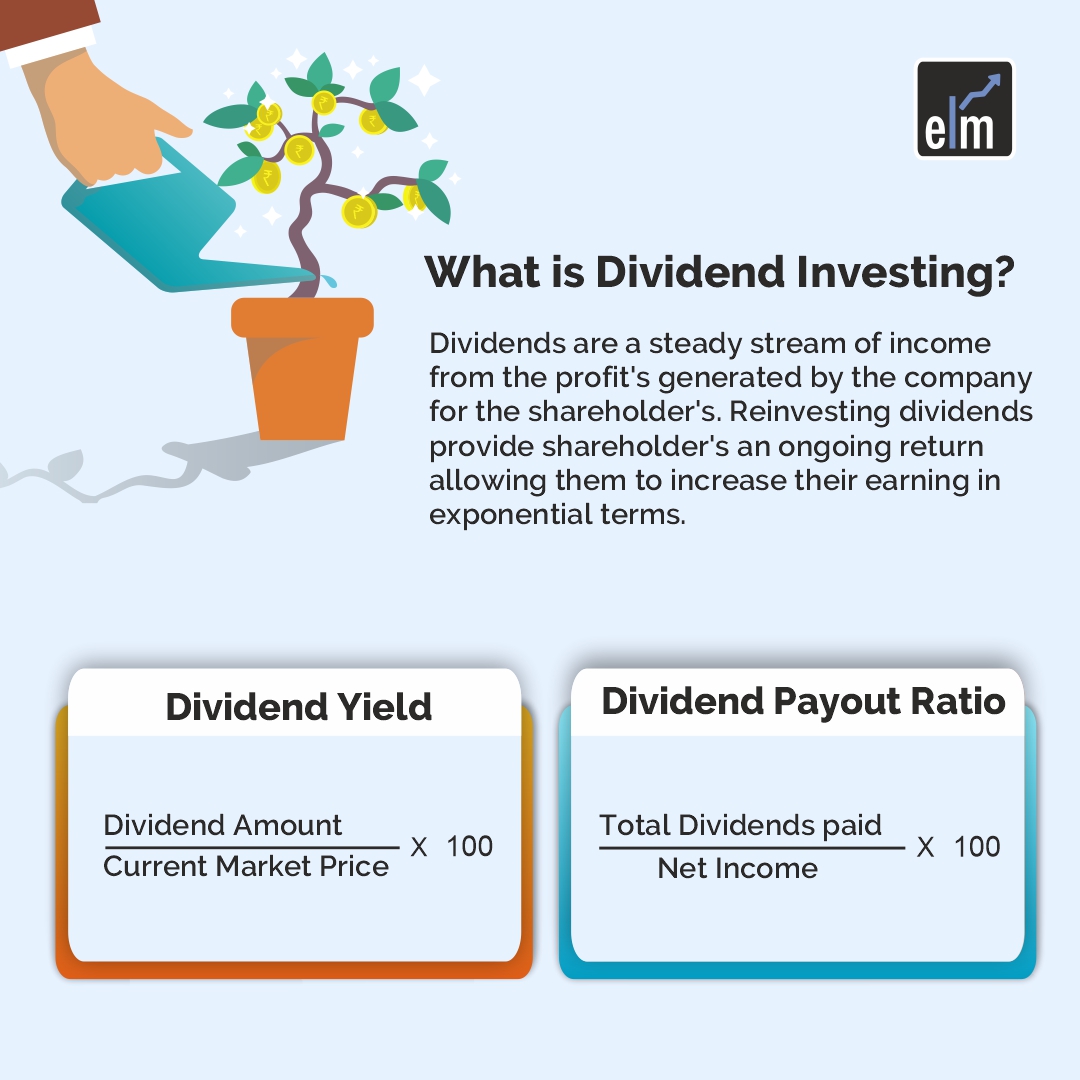

Image: blog.elearnmarkets.com

Understanding Options Trading

Options trading involves the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell a specific stock at a pre-determined price on or before a certain date. Options trading allows investors to speculate on future price movements and potentially generate substantial profits.

Types of Dividend Options

Dividend options are options contracts that pay dividends to their holders. There are two main types of dividend options:

- Covered Dividends: These are options that are sold against a position in the underlying stock. The holder of the option receives the dividend if it is declared during the life of the option.

- Naked Dividends: These are options that are sold without a position in the underlying stock. The holder of the option is still entitled to receive the dividend, but they assume the risk of the stock price falling below the strike price before the dividend is paid.

How to Trade Dividend Options

Trading dividend options involves a few key steps:

- Identify an underlying stock that is expected to pay dividends.

- Choose an options contract that has a:

- Strike price close to the current stock price.

- Expiration date that aligns with the dividend payment date.

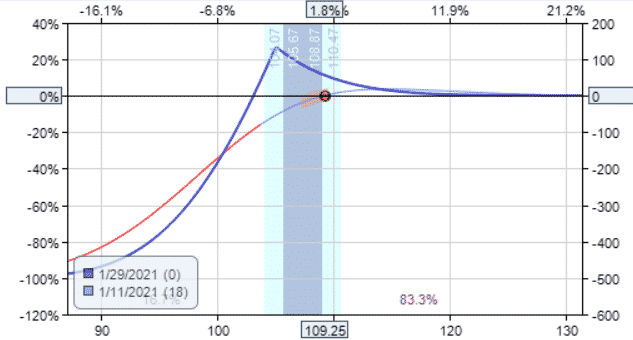

- Buy a call option if you believe the stock price will rise before the dividend payment date.

- Sell a put option if you believe the stock price will fall before the dividend payment date.

Image: www.prospertrading.com

Tips and Expert Advice

Here are some tips and expert advice to help you maximize your success in dividend options trading:

- Research and Due Diligence: Conduct thorough research on the underlying stock and the options market before trading.

- Understand Risk: Options trading involves significant risk. Always limit your risk based on your risk tolerance.

- Manage Your Position: Monitor your options positions closely and adjust or close them as needed.

- Use Trading Tools: Leverage trading platforms that offer real-time data, charting tools, and advanced trading strategies.

- Learn from Others: Join online forums, attend webinars, and consult with experienced traders to gain insights.

Frequently Asked Questions (FAQs) on Dividend Options Trading

Here are a few common FAQs on dividend options trading:

- What is an ex-dividend date?: This is the date on which the stock no longer qualifies for the current dividend payment.

- How can I find out if an options contract will pay a dividend?: Check the options chain for the underlying stock. Options contracts that pay dividends are typically marked with a “D” or “DIV” symbol.

- What is dividend capture strategy?: This strategy involves selling an at-the-money covered call option to capture the premium and the dividend while holding the underlying stock.

- What are the risks of dividend options trading?: The main risks include stock price fluctuations, dividend cuts, and expiration risk.

Options Trading Dividends

Image: talkmarkets.com

Conclusion

Dividend options trading offers a unique and powerful way to generate income from the stock market. By leveraging the concepts and strategies discussed in this guide, you can unlock the potential of dividend income and potentially achieve your financial goals.

Are you ready to dive into the world of dividend options trading? Share your thoughts and experiences in the comments section below. Together, we can unlock the power of the financial markets and empower financial success.