In the realm of investing, dividends reign supreme as a steady stream of passive income. But did you know that options trading can amplify your dividend returns? By tapping into stocks that boast both high dividend yields and active options markets, you can unlock a world of income-generating possibilities. So buckle up and embark on our exploration of dividend stocks with soaring options trading!

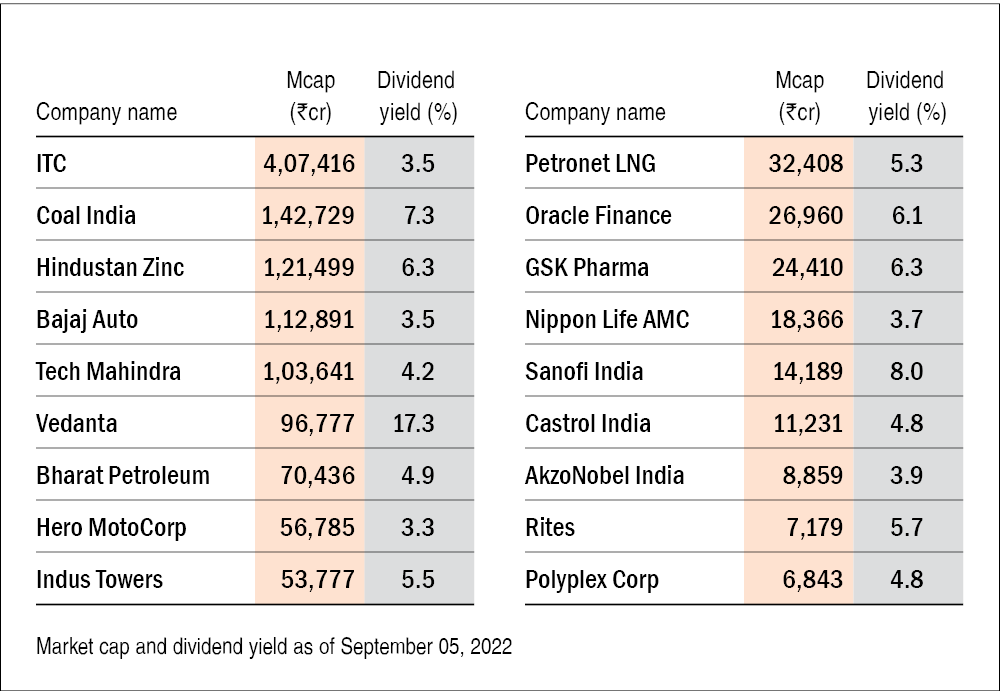

Image: www.valueresearchonline.com

Riding the Options Wave

Options are contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. Harnessing the power of options on stocks with high dividend yields offers a tantalizing proposition. The active trading of options creates liquidity, which can drive up the stock’s price. This upward momentum often leads to increased dividend payments, translating into a double bonus for dividend-hungry investors.

A Historical Perspective on Dividend Options

The use of options to enhance dividend yields has a storied past. In the early 1900s, savvy investors realized the potential to combine stock ownership with options strategies. As options markets matured, the practice gained wider acceptance, and today it’s a cornerstone of many dividend investing portfolios.

The Mechanics of Options Magic

At the heart of this strategy lies the flexibility of options. By purchasing call options, which give you the right to buy a stock at a specific price, you can essentially lock in a potential dividend yield higher than the stock’s current yield. If the stock price surges before the option expires, you can exercise your right to buy and enjoy both the dividend and the capital appreciation.

On the other hand, writing (selling) call options creates a different dynamic. By granting someone else the right to buy your shares at a set price, you receive a premium upfront. However, if the stock price rises above the strike price, you may be obligated to sell and miss out on potential dividend payments. Weigh the risks and rewards carefully before engaging in such strategies.

Image: www.fool.com

Latest Trends and Developments

The world of dividend stocks and options trading is constantly evolving. Here are some key trends to watch:

Expert Advice and Proven Tips

Harnessing the power of dividend stocks coupled with options trading requires both knowledge and prudence. Here are some expert tips to guide you:

Navigating the Forex Landscape

Trading forex involves speculating on the relative values of different currencies. By understanding the factors influencing currency movements and employing effective trading strategies, you can harness the potential of foreign exchange markets for financial gain.

FAQs about Dividend Stock Options

Q: Are dividend stocks with high options trading always a good investment?

A: Not necessarily. While they offer potential upside, it’s crucial to consider factors like the company’s fundamentals and overall market conditions before investing.

Q: How do I choose the right dividend stock with high options trading?

A: Strong fundamentals, a stable dividend history, and active options volume are key factors to look for. Consider using financial screening tools to identify suitable candidates.

Q: What are the risks of combining dividend stocks and options trading?

A: Options trading carries inherent risks, such as the possibility of losing your investment. Additionally, dividend payments may fluctuate or be suspended, impacting your yield expectations.

Dividend Stocks With High Options Trading

Image: myemail.constantcontact.com

Conclusion

Dividend stocks with high options trading can unlock a world of income-generating opportunities. By blending the stability of dividends with the flexibility of options, you can potentially enhance your returns and navigate market fluctuations more effectively. Remember to research thoroughly, manage your risks wisely, and seek expert advice when necessary to maximize your dividend-earning potential.

Are you intrigued by the possibilities of dividend stock options? Embark on your journey today and discover the transformative power of combining dividends with options strategies. Remember, knowledge is key, so arm yourself with the necessary information to make informed decisions and reap the rewards of passive income generation.