Options trading, a sophisticated investment strategy, involves the buying and selling of options contracts, which represent the right but not the obligation to buy or sell an underlying asset at a specified price on or before a certain date. Understanding the time and sales aspect is critical for successful options trading, as it provides valuable insights into market behavior and helps traders make informed decisions.

Image: www.projectoption.com

Time and Sales: A Window into Market Dynamics

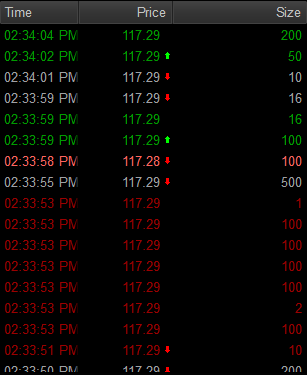

The time and sales feed provides a real-time snapshot of all executed trades in an options market. Each trade displays crucial information such as the time of execution, the price at which the trade was made, the number of contracts traded, and the specific option contract involved. By analyzing this data, traders can gain insights into:

1. Market Sentiment:

Time and sales data reveals the prevailing market sentiment. A surge in buy orders at a particular price level may indicate bullish sentiment, while a spike in sell orders could signal bearish sentiment.

2. Market Depth:

The number of contracts traded at each price level indicates the depth of the market. High liquidity means that there are plenty of buyers and sellers willing to trade, which reduces the risk of slippage and ensures fair pricing.

Image: app.tradingsim.com

3. Price Discovery:

Time and sales data helps in price discovery, as it reflects the actual prices at which trades are executed. This information is essential for determining fair value and identifying potential trading opportunities.

Deciphering the Anatomy of a Trade

Each trade displayed in the time and sales feed represents a transaction between two parties: the buyer and the seller. The following parameters are crucial to understanding the trade:

1. Time:

The exact time of execution is recorded in the time and sales feed. This timestamp is pivotal for analyzing market movements and identifying trends or patterns.

2. Price:

The price at which the trade is executed is displayed in the time and sales feed. Traders can observe how the price fluctuates over time and identify key support and resistance levels.

3. Size:

The number of contracts traded in the transaction is known as the size. Large trades may indicate institutional involvement or significant market movement.

4. Option Contract:

The time and sales feed also displays the specific option contract that was traded. This information includes the underlying asset, the strike price, the expiration date, and the option type (call or put).

Leveraging Time and Sales for Profitable Options Trading

Traders can leverage time and sales data to enhance their options trading strategies. Here are some valuable applications:

1. Identifying Trend Reversals:

By analyzing the time and sales feed, traders can spot changes in market momentum. A sudden increase in the number of trades at a particular price level, accompanied by a shift in buy-sell orders, may signal a potential trend reversal.

2. Scalping Opportunities:

Time and sales data can reveal short-term price discrepancies. Quick-thinking traders can seize scalping opportunities by buying or selling contracts at advantageous prices and quickly exiting the position to capitalize on immediate price movements.

3. Market Timing:

The time and sales feed provides insights into market psychology and momentum. Traders can adjust their trading strategies based on the observed market conditions. For instance, during periods of low volatility, they may opt for longer-term options, while during volatile markets, short-term strategies may be more suitable.

Options Trading L Time And Sales

Image: ge2r0a.blogspot.com

Conclusion

In the dynamic world of options trading, time and sales data is an indispensable tool. By deciphering the intricate details of each trade, traders can gain valuable information, such as market sentiment, market depth, and price discovery. Mastering the art of interpreting time and sales data empowers traders to make informed decisions, identify promising opportunities, and navigate the complexities of options trading effectively.