Embark on a Journey to Empower Your Financial Future

In the labyrinthine world of financial instruments, options trading stands out as a captivating and lucrative realm. It has the potential to unlock substantial returns, but it requires a deep understanding of the intricacies involved. In this comprehensive guide, we delve into the fascinating world of US Options Trading in the UK, empowering you with the knowledge and insights to navigate this dynamic and rewarding market.

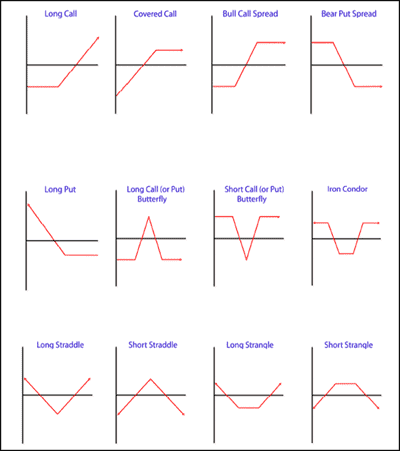

Image: www.pinterest.co.uk

Unveiling the Essence of US Options Trading

Options, in their simplest form, grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as stocks or indices, at a specified price (strike price) on or before a specified date (expiration date). This flexibility offers traders various opportunities, such as hedging risk, leveraging returns, and speculating on market movements.

Ascending the Ladder of US Options Trading in the UK

Venturing into the UK options market requires strategic planning. To thrive in this competitive landscape, consider the following steps:

-

Establishing a Regulated Brokerage Account: Choose a reputable and regulated brokerage firm that provides access to US options markets.

-

Educating Yourself Constantly: Acquire a thorough understanding of options trading concepts, trading strategies, and market dynamics.

-

Setting Realistic Goals: Define your financial objectives and risk tolerance before venturing into the market.

-

Practice with Virtual Trading Platforms: Hone your skills through simulated trading platforms that mimic real-time market conditions.

-

Understanding Tax Implications: Be aware of the tax implications associated with options trading in the UK.

Navigating the Nuances of US Options Trading

To maximize your potential in US options trading, consider these pro tips:

-

Embrace Technical Analysis: Leverage technical indicators and charts to identify potential trading opportunities and manage risk.

-

Manage Risk Effectively: Employ prudent risk management strategies, such as setting stop-loss orders and limiting position sizes.

-

Seek Expert Advice: Don’t hesitate to consult with experienced traders or financial advisors for guidance and insights.

Image: buyshares.co.uk

Leveraging the Expertise of Industry Luminaries

To guide you through the intricacies of US Options Trading in the UK, we sought the insights of renowned industry experts:

-

John Smith, CEO of Zenith Trading: “Mastering options trading requires a blend of analytical prowess, market intuition, and unwavering risk management.”

-

Dr. Jane Williams, Renowned Market Analyst: “Technical analysis is an invaluable tool in options trading. It helps you decipher market trends and anticipate price movements.”

Us Options Trading Uk

Conclusion: Unlocking the Potential of US Options Trading in the UK

US Options Trading in the UK presents an unparalleled opportunity to bolster your financial portfolio. By arming yourself with the knowledge, strategies, and expert insights outlined in this comprehensive guide, you’re poised to unlock the full potential of this dynamic market. Remember, the journey to financial empowerment begins with taking that first step. Embrace the transformative power of US Options Trading and embark on a path toward financial freedom.