Unlock the Doors to Options Trading with Robinhood: A Step-by-Step Guide

Image: www.youtube.com

In the adrenaline-pumping realm of finance, few paths are as alluring yet intimidating as options trading. With the advent of Robinhood, the once-elusive world of options is now within reach for the everyday investor. But before you dive into this thrilling arena, it’s crucial to equip yourself with the knowledge to navigate its complexities. And with this comprehensive guide, you’ll be confidently trading options like a seasoned pro on Robinhood.

Unveiling the Nuances of Options Trading

Options, simply put, are financial instruments that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. Unlike stocks, which represent ownership in a company, options offer a more flexible and potentially lucrative way to engage in the financial markets.

Charting Your Course: Getting Your Robinhood Account Options-Ready

To unlock the doorway to options trading on Robinhood, you’ll need to follow these simple steps:

-

Meet Robinhood’s Eligibility Criteria: Ensure you’re at least 18 years old, have a U.S. Social Security number, and maintain a valid bank account.

-

Pass the Options Approval Process: Submit a detailed application to Robinhood, providing information about your investment experience, knowledge, and financial status. The approval process typically takes a few business days.

-

Enable Options Trading in Your Account: Once approved, navigate to the Robinhood app, tap the “Account” tab, and find the “Options Trading” section. Here, you can select the “Enable Options Trading” option and confirm your intent.

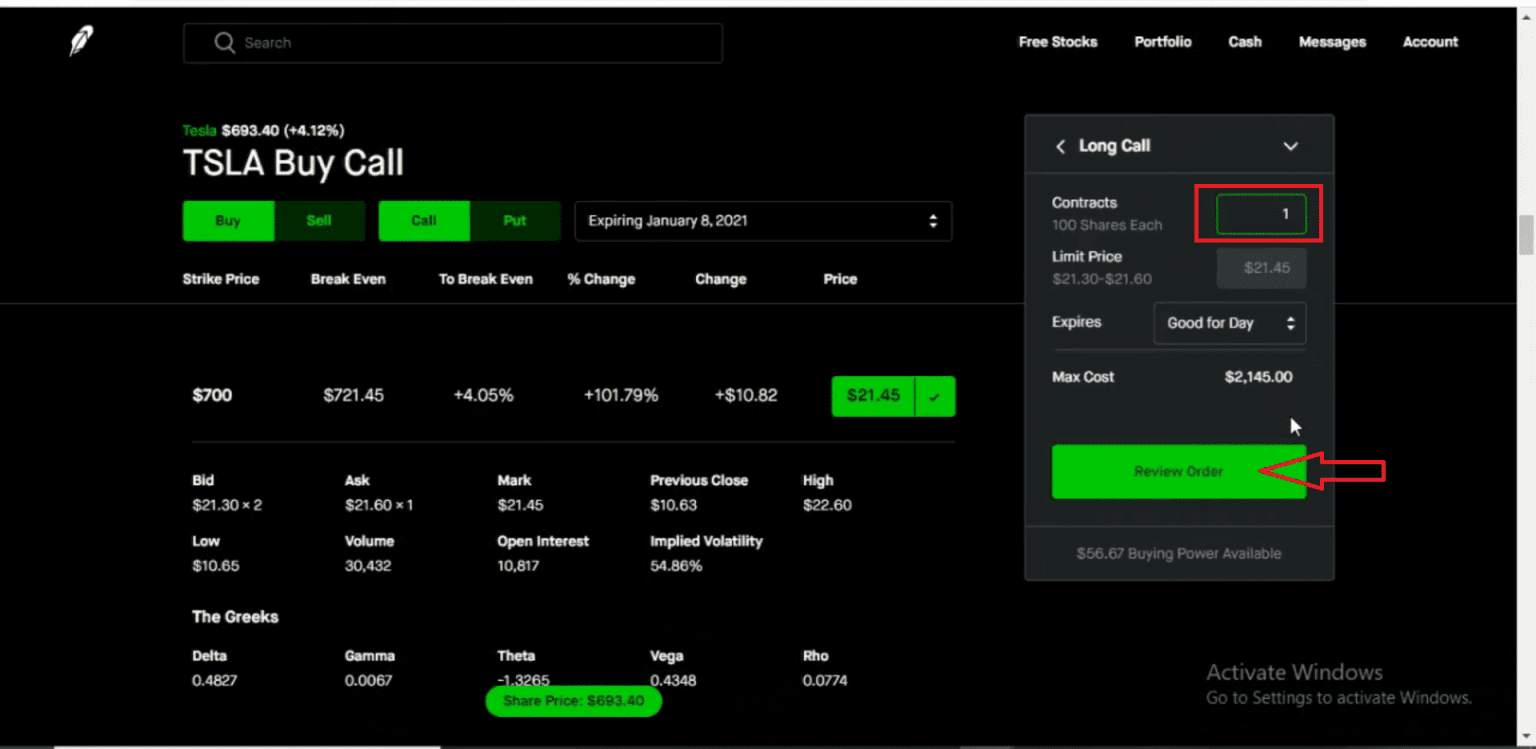

Navigating the Options Landscape: A Guide for Beginners

With your Robinhood account armed for options, it’s time to explore the basic concepts that shape this exhilarating world of trading.

-

Call vs. Put: Call options give you the right to buy an underlying asset at a specified price, while put options grant you the right to sell.

-

Strike Price: The predetermined price at which you can exercise your option.

-

Expiration Date: The day on which your option contract expires, marking the end of your trading window.

Expert Insights: Unveiling the Secrets of Options Success

Renowned options experts share their pearls of wisdom to elevate your trading skills:

-

Master Risk Management: Options trading involves inherent risks. Thoroughly understand each trade’s potential downside and adopt strategies to mitigate losses.

-

Study Historical Patterns: Analyze historical data and trends to make informed trading decisions. Volatility and liquidity are key indicators to monitor.

-

Stay Informed and Adapt: Constantly educate yourself about market news, economic indicators, and company announcements. The financial landscape is ever-changing, and adaptability is essential.

Conclusion: Empowering Your Financial Journey with Options Trading

Enabled with the knowledge, tools, and expert insights outlined in this guide, you’re well-equipped to embark on your options trading journey on Robinhood. Remember to approach this exhilarating path with prudence, mindfulness, and a thirst for learning. Embrace the potential for financial freedom and diversification that options offer, while remaining aware of the risks involved. With each trade, you’ll not only accrue financial experience but also sharpen your analytical abilities, building a solid foundation for long-term success in the markets.

Image: marketxls.com

How Do I Enable Options Trading In Robinhood

Image: www.youtube.com