Embarking on the Journey of Options Trading at U of T

As an undergraduate at the University of Toronto, I stumbled upon the captivating world of options trading. It piqued my interest, promising a realm of financial potential and intellectual stimulation. With a keen eye for market movements and an insatiable thirst for knowledge, I delved into the world of options trading at U of T.

Image: fintrakk.com

Options trading offers students a unique opportunity to not only enhance their understanding of financial markets but also to potentially generate significant returns. By comprehending the intricacies of options contracts and leveraging the resources available at U of T, students can empower themselves in the financial arena.

Unveiling the Essence of Options Trading

Options trading involves the exchange of standardized contracts that grant the purchaser the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. These contracts empower traders with flexibility and the ability to potentially amplify their returns while managing risk.

Options contracts are characterized by two key attributes: **strike price** and **expiration date**. The strike price represents the price at which the underlying asset can be bought or sold, while the expiration date defines the timeframe within which the contract can be exercised.

Navigating the Options Market: A Comprehensive Overview

The options market is a dynamic and intricate landscape, presenting numerous opportunities and challenges for traders. To navigate this market effectively, it is imperative to possess a comprehensive understanding of its intricacies.

Traders must discern between call options, which grant the holder the right to buy an asset, and put options, which provide the right to sell an asset. Moreover, they must grasp the concepts of option premiums, the price paid to acquire an option contract, and implied volatility, a measure of the anticipated price fluctuations of the underlying asset.

Contemporary Trends and Innovations Transforming Options Trading

The options market is constantly evolving, propelled by technological advancements and shifting market dynamics. Traders must stay abreast of these trends to adapt their strategies accordingly.

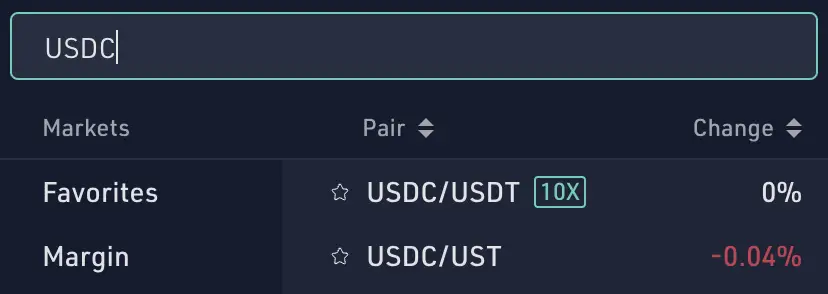

The advent of robo-advisors has automated the process of options trading, enabling even novice investors to participate in this arena. Additionally, the rise of cryptocurrency options has opened up new avenues for speculation and investment.

Image: www.tradingview.com

Expert Advice and Strategies

Seasoned options traders possess a wealth of knowledge and expertise that can prove invaluable for aspiring traders. Here are some key insights and expert advice:

• **Seek professional guidance:** Consider consulting with a financial advisor to gain bespoke advice tailored to your specific financial goals and risk tolerance.

• **Start small and gradually increase your investment:** Avoid putting all your eggs in one basket. Gradually grow your portfolio as you gain experience and confidence.

Frequently Asked Questions on U of T Options Trading

**Q: Is options trading suitable for all U of T students?**

A: While options trading can be a lucrative opportunity, it is essential to recognize the inherent risks. It is crucial to conduct thorough research and comprehend the potential consequences before venturing into this arena.

**Q: What resources are available at U of T for students interested in options trading?**

A: U of T offers various resources to support students in their options trading pursuits. The Rotman School of Management provides courses and workshops, while the Finance Club organizes seminars and events tailored specifically towards options trading.

Conclusion: Igniting the Passion for Financial Empowerment

U of T options trading presents a compelling opportunity for students to delve into the fascinating world of finance. By harnessing the knowledge and resources available at their fingertips, students can empower themselves in this dynamic arena. Remember, the pursuit of financial knowledge is an ongoing journey, and continuous learning is the key to success.

Whether you are a seasoned trader or aspiring to make your mark in the world of options, I encourage you to embrace the potential that lies before you. Invest in yourself, embrace the learning curve, and embark on a transformative journey towards financial empowerment.

U Of T Options Trading

Image: thefipharmacist.com

Are you ready to dive into the world of U of T options trading? Leave a comment below and let’s discuss this incredible opportunity!