In the intricate financial landscape, where strategies and opportunities intertwine, the realm of interest rate options trading beckons ambitious professionals seeking both intellectual stimulation and financial recompense. Join us as we delve into the captivating world of interest rate options, examining its history, fundamental concepts, and the rewarding career prospects it offers.

Image: lorettamyers147headline.blogspot.com

Unveiling Interest Rate Options: A Bridge to Financial Flexibility

Interest rate options, sophisticated financial instruments, empower market participants to navigate the volatile waters of interest rate fluctuations. These versatile contracts provide the right, but not the obligation, to buy or sell an underlying asset—an interest rate security—at a predetermined price and date. By leveraging options, traders gain the flexibility to mitigate risk, speculate on future rate movements, and tailor investment portfolios to align with their risk tolerance and market outlook.

A Rich History: Tracing Interest Rate Options’ Evolution

The roots of interest rate options trace back to the Chicago Board of Trade (CBOT) in the mid-1970s. The introduction of Treasury bond futures provided a bedrock for the creation of options on these futures, marking the genesis of interest rate options. Over time, these instruments evolved to encompass options on a broader range of interest rate-linked assets, including Treasury notes, Eurodollar futures, and interest rate swaps.

Interest Rate Options: A Foundation of Key Concepts

To master the art of interest rate options trading, a solid understanding of fundamental concepts is paramount. Calls and puts constitute the two primary types of options. Call options confer the right to buy, while put options provide the right to sell the underlying asset. Intrinsic value, which reflects the difference between the underlying asset’s spot price and the option’s strike price, plays a crucial role in determining an option’s worth.

Image: blueberrymarkets.com

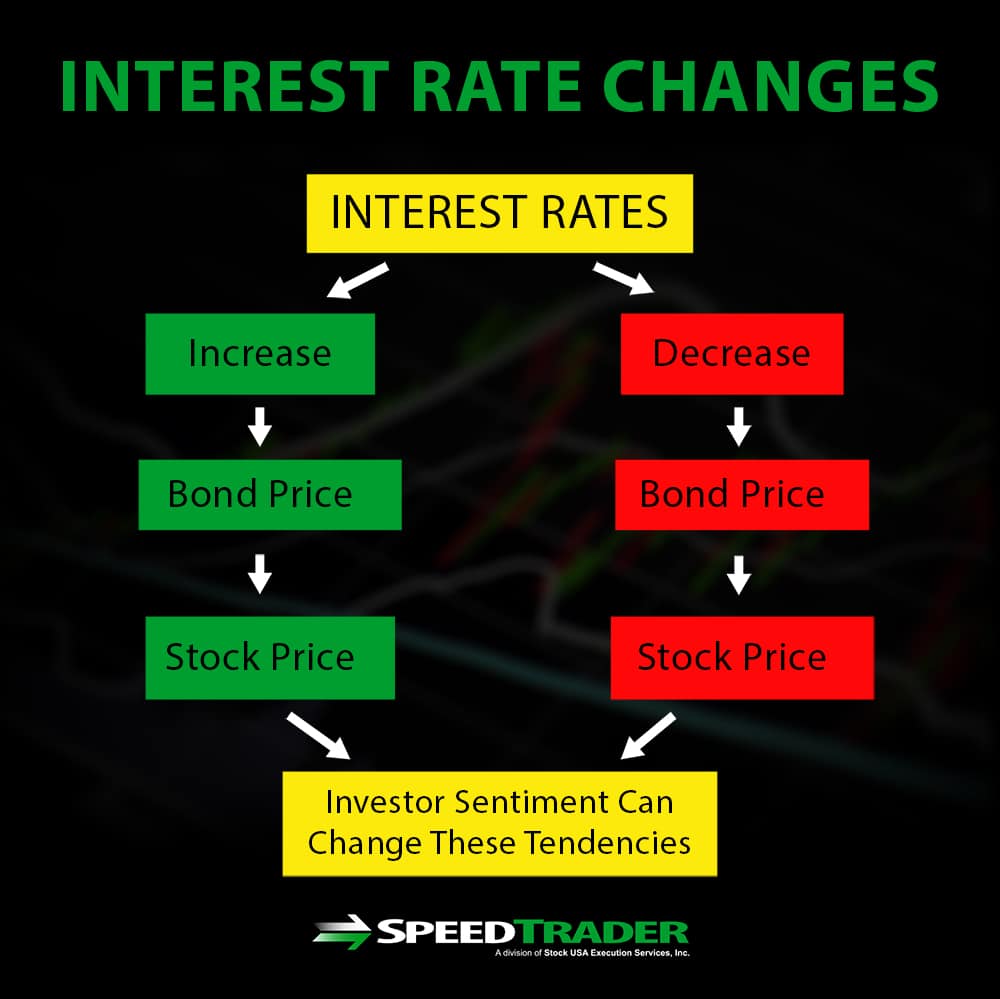

Delving into Interest Rate Options Trading Strategies

Seasoned traders employ diverse interest rate options trading strategies to navigate market complexities. Simple strategies, such as buying or selling calls and puts, offer straightforward risk and reward profiles. More sophisticated strategies, such as spreads, combinations, and calendar trades, introduce greater complexity and require a higher level of market expertise. The choice of strategy hinges upon the trader’s risk tolerance, market outlook, and investment timeframe.

Careers in Interest Rate Options Trading: Expertise and Opportunity

For individuals seeking a challenging and rewarding career in finance, interest rate options trading offers a compelling path. As an interest rate options trader, you will analyze market trends, develop trading strategies, and execute trades to capitalize on interest rate movements. This role demands an in-depth understanding of financial markets, a keen eye for risk management, and the ability to thrive in high-pressure environments.

The Skills of a Successful Interest Rate Options Trader

Aspiring interest rate options traders should possess a diverse skillset to succeed in this demanding field. Strong analytical abilities are imperative for deciphering complex market data and identifying trading opportunities. Quantitative expertise, including proficiency in mathematics and statistics, is essential for risk analysis and pricing models. Excellent communication skills are paramount for conveying market insights and building strong relationships with clients and colleagues.

Interest Rate Options Trading Jobs

Image: www.mijnntfu.nl

Conclusion

The world of interest rate options trading presents a unique and lucrative opportunity for financial professionals seeking intellectual stimulation and financial success. With a solid grasp of fundamental concepts, a deep understanding of trading strategies, and a commitment to honing one’s skills, aspiring traders can embark on a rewarding career path. As the financial markets continue to evolve, interest rate options will undoubtedly remain an indispensable tool for managing risk, speculating on future rate movements, and tailoring investment portfolios to achieve financial objectives.