Have you ever heard of single payment options trading? It’s a relatively new financial instrument that allows you to speculate on the future price of an asset without having to buy or sell the underlying asset itself.

Image: inai.io

I first learned about single payment options trading a few years ago, and I was immediately intrigued. I had been trading traditional options for some time, and I saw the potential for single payment options to provide me with even greater flexibility and profit potential.

What is Single Payment Options Trading?

Single payment options trading is a type of binary options trading. Binary options are financial instruments that allow you to speculate on the future price of an asset, such as a stock, commodity, or currency pair. With single payment options, you have the option to buy or sell a single payment option that gives you the right, but not the obligation, to buy or sell the underlying asset at a specified price on a specified date.

How Does Single Payment Options Trading Work?

When you buy a single payment option, you are essentially betting that the price of the underlying asset will move in your favor. If the price of the asset moves in your favor, you can exercise your option and buy or sell the asset at the specified price. If the price of the asset moves against you, you have the option to let your option expire worthless.

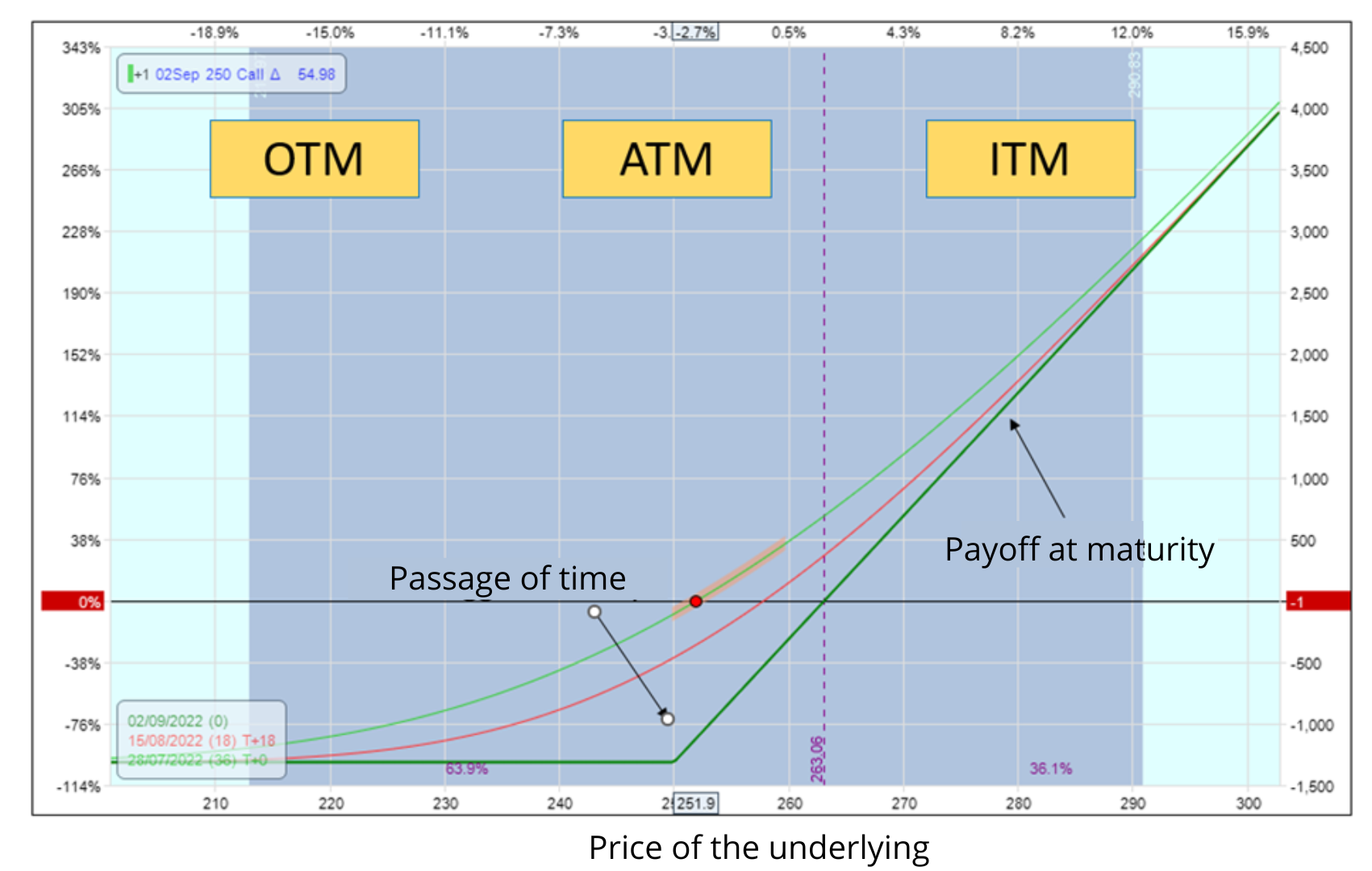

Image: ungeracademy.com

The Benefits of Single Payment Options Trading

There are a number of benefits to single payment options trading, including:

- Flexibility: Single payment options trading offers greater flexibility than traditional options trading. With traditional options, you are obligated to buy or sell the underlying asset if your option is exercised. With single payment options, you have the option to let your option expire worthless if the price of the asset moves against you.

- Profit potential: Single payment options trading offers the potential for greater profit than traditional options trading. With single payment options, you can profit from both short-term and long-term price movements in the underlying asset.

- Low risk: Single payment options trading is a relatively low-risk investment. With single payment options, you only risk the amount of money that you invest in the option.

What Are the Different Types of Single Payment Options?

There are two main types of single payment options:

- Call options: Call options give you the right, but not the obligation, to buy the underlying asset at a specified price on a specified date.

- Put options: Put options give you the right, but not the obligation, to sell the underlying asset at a specified price on a specified date.

How to Trade Single Payment Options

To trade single payment options, you will need to open an account with a binary options broker. Once you have opened an account, you can start trading by selecting the underlying asset that you want to trade, the type of option that you want to buy or sell, the strike price, and the expiration date.

Tips for Trading Single Payment Options

Here are a few tips for trading single payment options:

- Do your research: Before you start trading single payment options, it is important to do your research and understand how they work. You should also research the underlying asset that you want to trade.

- Start with a small amount of money: When you are first starting out, it is important to start with a small amount of money. This will help you to minimize your risk and learn the ropes of single payment options trading.

- Set realistic profit targets: It is important to set realistic profit targets when you are trading single payment options. Do not expect to make a lot of money overnight.

Manage your risk: Risk management is an important part of single payment options trading. You should always know how much you are willing to risk on each trade.

Frequently Asked Questions About Single Payment Options Trading

Here are some frequently asked questions about single payment options trading:

What is the difference between single payment options and traditional options?

The main difference between single payment options and traditional options is that with single payment options, you only have the right, but not the obligation, to buy or sell the underlying asset. With traditional options, you are obligated to buy or sell the underlying asset if your option is exercised.

What are the risks of single payment options trading?

The main risk of single payment options trading is that you can lose the entire amount of money that you invest in the option.

How much money can I make trading single payment options?

The amount of money that you can make trading single payment options depends on a number of factors, including the price of the underlying asset, the volatility of the market, and your trading strategy.

Single Payment Options Trading

Image: www.billdu.com

Conclusion

Single payment options trading is a versatile financial instrument that can be used to speculate on the future price of an asset. Single payment options offer greater flexibility, profit potential, and lower risk than traditional options. If you are interested in learning more about single payment options trading, I encourage you to do your research and speak with a financial advisor.

Are you interested in learning more about single payment options trading?