Options trading is a complex yet potentially lucrative endeavor that involves speculating on the future movement of an underlying asset, such as stocks, bonds, or currencies. One of the most common options strategies is selling puts, which grants the seller the obligation to buy an asset at a predetermined price by a certain date. While this strategy can bring substantial returns, it also comes with risks that traders should be aware of.

Image: tme.net

Understanding the Mechanics of Selling Puts

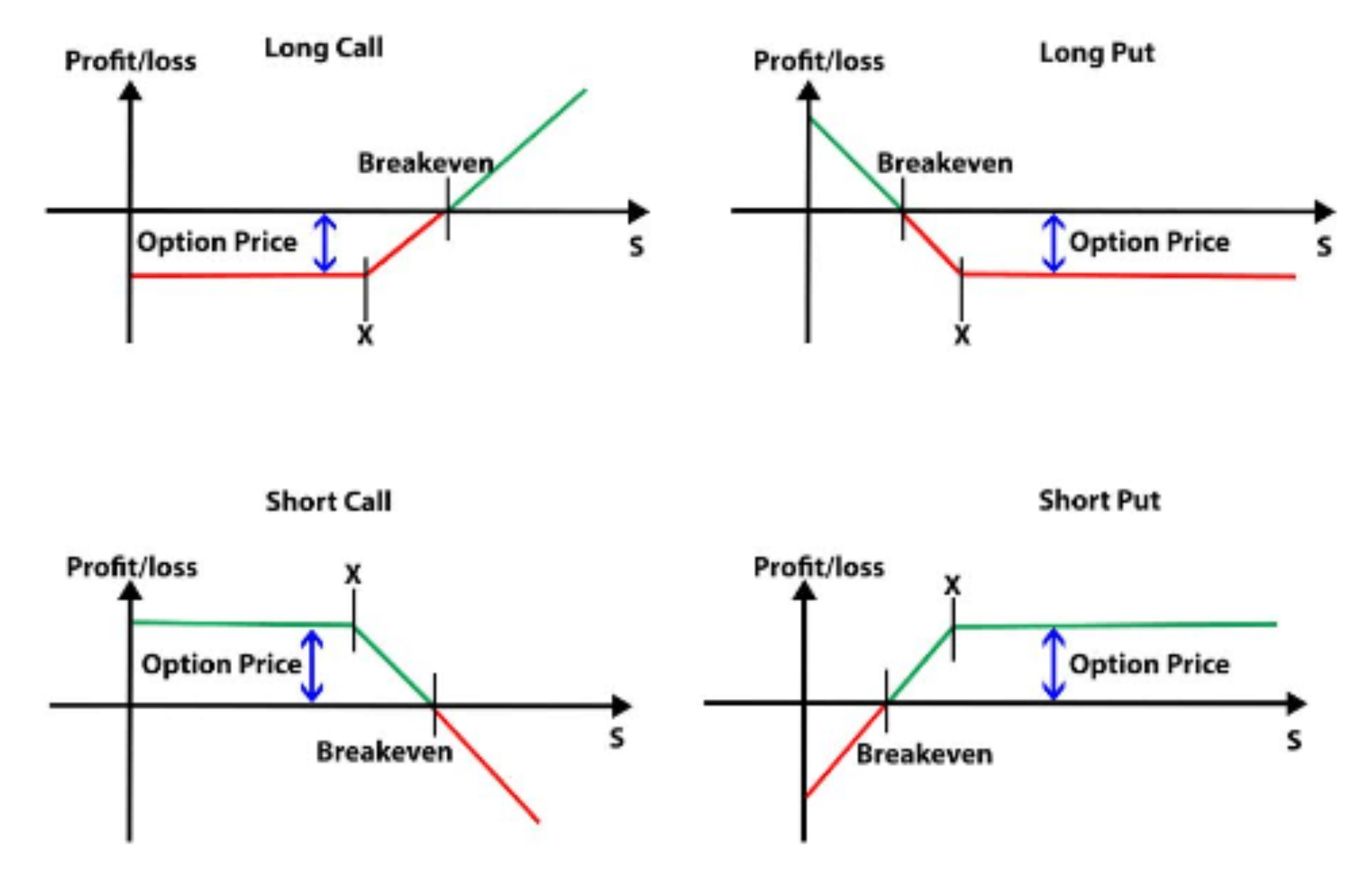

When selling a put option, the seller receives a premium payment from the buyer in exchange for granting them the right (not the obligation) to sell a specified number of shares or units of an asset to the seller at a specific strike price on or before a specified date. The seller is obligated to buy the asset at the strike price if the buyer exercises the option.

For instance, if an investor sells a 100-share put option for a certain stock with a strike price of $50 and an expiration date of one month, they agree to buy 100 shares of the stock at $50 per share should the buyer exercise the option. In return, the investor receives a premium payment.

Profit Potential and Risk

Selling puts can be a profitable strategy when the stock price remains above the strike price until the option expires. In such cases, the seller keeps the premium payment without any obligation to purchase the asset. However, if the stock price falls below the strike price, the buyer could exercise the option, forcing the seller to buy the asset at a higher price than its current market value, resulting in a loss.

Factors to Consider

Before engaging in selling puts, traders should consider several key factors:

- Underlying asset: The stability and volatility of the underlying asset directly impact the risk and potential reward of the strategy.

- Strike price: Choosing a strike price that matches the trader’s outlook on the asset’s price movement is crucial.

- Expiration date: The length of time until option expiration influences the premium earned and the potential risk involved.

- Volatility: Higher market volatility implies wider price swings, which can affect the option’s value.

Image: www.pinterest.com

Suitability

Selling puts is generally considered a suitable strategy for investors with a neutral-to-bullish outlook on the underlying asset who are willing to take on moderate risk for potential gains. It can be used to generate premium income or hedge against the risk of an asset’s price decline.

Example

Let’s consider an example to illustrate the mechanics of selling puts. Suppose an investor sells one contract (100 shares) of a put option for the XYZ stock with a strike price of $20 and an expiration date two months from now. They receive a premium payment of $2.50 per share, totaling $250.

If XYZ stock’s price remains above $20 at expiration, the option will expire worthless, and the seller will keep the premium payment. On the other hand, if the stock price falls below $20 byexpiration, the buyer could exercise the option, obligating the seller to buy 100 shares at $20 per share, resulting in a loss.

Options Trading Selling Puts

Conclusion

Selling puts is a significant options trading strategy that offers potential rewards but also carries risks. By carefully considering the underlying asset, strike price, expiration date, volatility, and suitability, traders can develop a well-informed strategy that aligns with their investment goals and risk tolerance.