Understanding the intricacies of option trading can be daunting, especially for beginners navigating the complex world of financial derivatives. Among the key concepts to grasp is the “sell to open” strategy, which plays a crucial role in option trading. In this comprehensive guide, we will delve into the ins and outs of “sell to open,” explaining its mechanics, applications, and implications in the financial markets.

Image: truyenhinhcapsongthu.net

Introduction to Option Trading and “Sell to Open”

Option trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, commodity, or currency) at a specified price on or before a predetermined date. “Sell to open” refers to a specific trading strategy where an investor sells an option contract to another party, granting them the right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at the strike price on or before the expiration date.

Unlike buying an option, selling to open gives the investor the role of the option writer, obligating the seller to fulfill the contract’s terms if the buyer exercises their option. In return for assuming this obligation, the option seller receives a premium from the buyer, which represents the price paid to acquire the option contract.

Mechanics of “Sell to Open”

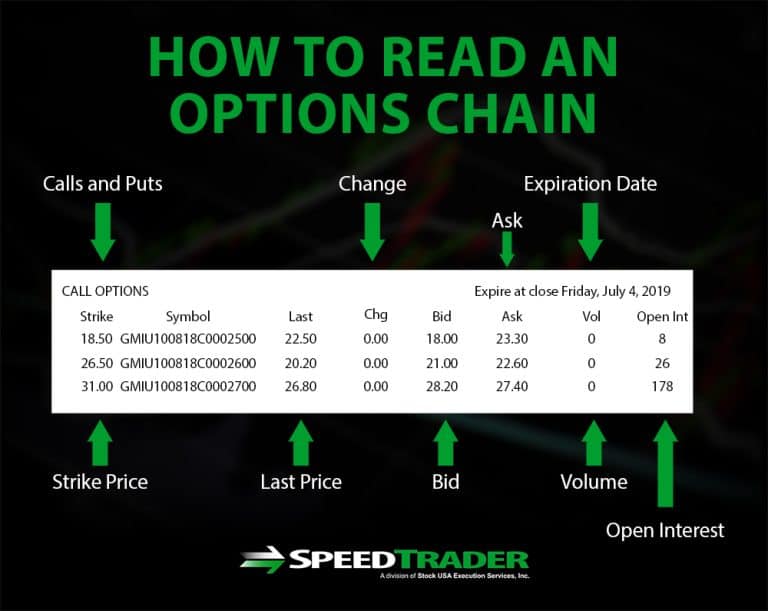

When an investor sells to open an option contract, they are essentially creating an obligation to deliver the underlying asset (if selling a call option) or to take delivery of the underlying asset (if selling a put option) if the buyer exercises the option. The option contract specifies the strike price (the price at which the underlying asset can be bought or sold), the expiration date (the date by which the option must be exercised), and the premium received by the option seller.

In the case of a “sell to open” strategy, the option seller is betting that the underlying asset’s price will not reach the strike price before the expiration date. If the option buyer exercises the option, the seller must fulfill the contract by delivering or taking delivery of the underlying asset at the strike price, regardless of its current market price.

Underlying Assets in “Sell to Open”

The underlying asset in an option contract can be any tradable financial instrument, such as stocks, bonds, commodities, or currencies. When selling an option to open, the investor must carefully consider the characteristics and price movements of the underlying asset to assess the risk and potential profitability of the strategy.

Image: www.asktraders.com

Risks and Rewards of “Sell to Open”

The potential rewards of selling to open an option contract are limited to the premium received upfront. The option seller profits if the option expires worthless, meaning the underlying asset’s price never reaches the strike price. However, the risks are potentially unlimited, particularly for uncovered option writing (selling options without owning the underlying asset).

If the underlying asset’s price moves against the option seller’s expectations and reaches or exceeds the strike price before expiration, the buyer may exercise the option, forcing the seller to fulfill the contract at a potentially unfavorable price. This can result in substantial losses for the option seller.

Practical Applications of “Sell to Open”

Option traders employ the “sell to open” strategy for various purposes, including:

-

Generating Income: Option sellers receive a premium for selling the option contract, which can provide regular income if the option expires worthless.

-

Hedging Risk: Option selling can help manage risk in existing portfolio positions by creating offsetting exposures to the underlying asset.

-

Speculating on Price Movement: Option sellers bet on the future direction of the underlying asset’s price and can profit if their predictions are correct.

-

Strategy Combinations: “Sell to open” is often combined with other options strategies to create more complex and sophisticated trading plans.

What Does Sell To Open Mean In Option Trading

Image: speedtrader.com

Conclusion

Understanding the concept of “sell to open” is essential for option traders looking to navigate the complex and potentially rewarding world of options trading. Whether employed for income generation, hedging risk, speculation, or strategy combinations, “sell to open” plays a crucial role in the financial markets. Traders must carefully consider the mechanics, risks, and potential rewards before implementing this strategy in their own portfolios. By approaching option trading with knowledge and an informed strategy, investors can harness the power of option contracts to meet their financial goals.