A Guide to Understanding Options Market Depth

In the realm of options trading, one of the most important concepts to grasp is open interest. This metric provides valuable insights into the market dynamics and can greatly enhance your trading strategies. In this comprehensive guide, we will delve into the intricacies of open interest, explaining its significance, calculating it, and demonstrating how to use it effectively in your trading decisions.

Image: tradingtuitions.com

Understanding Open Interest

Simply put, open interest refers to the total number of option contracts that have been bought and not yet closed or exercised. It is a measure of the number of outstanding contracts for a particular option series or strike price. This information essentially tells you how many options are actively participating in the market.

Importance of Open Interest

Open interest serves as a barometer of market sentiment and trading activity. A high open interest indicates that there is a substantial amount of interest in a particular option contract or underlying security. It suggests that there are ample buyers and sellers actively engaged in trading that option.

Furthermore, open interest can provide clues about the direction of the underlying security. Rising open interest alongside a price increase in the underlying asset often signals a bullish sentiment, as traders are betting on further price appreciation. Conversely, falling open interest coupled with a declining price may indicate a bearish outlook.

Calculating Open Interest

Calculating open interest is a straightforward process. To determine the open interest for a specific option contract, you need to subtract the number of exercised contracts from the total number of contracts that have been traded. This can be expressed as:

Open interest = Total contracts traded – Exercised contracts

Image: www.projectfinance.com

Using Open Interest in Trading Decisions

Open interest is a versatile tool that can be used to refine your trading strategies in several ways:

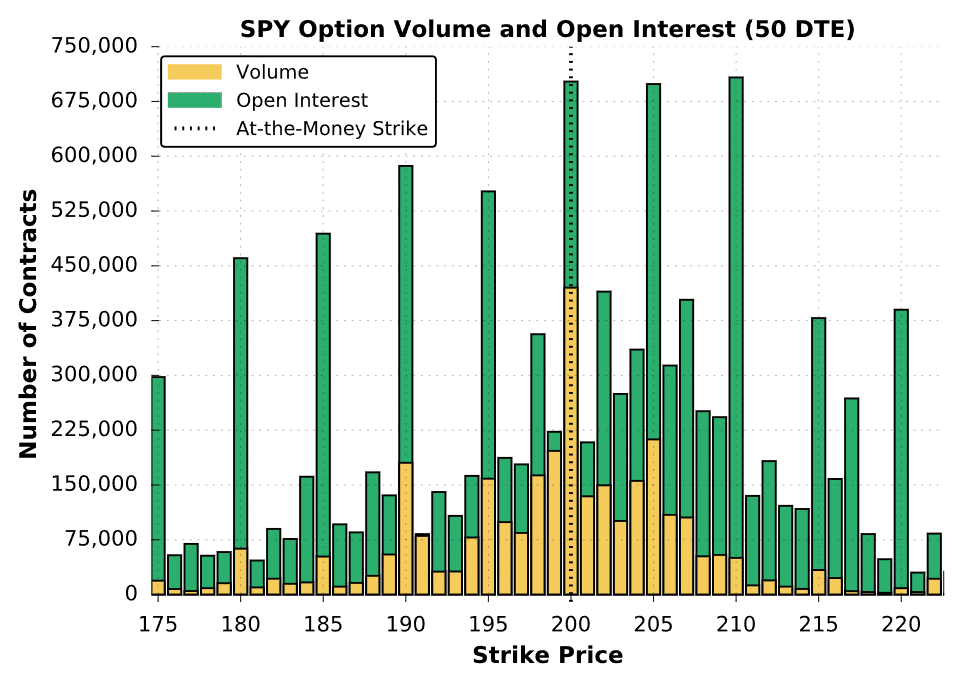

Measuring Market Depth: High open interest indicates a liquid option market with ample buyers and sellers, reducing the risk of price slippage and facilitating smooth trading.

Gauging Market Sentiment: Open interest can provide insight into the overall market sentiment surrounding a particular option contract or underlying security.

Validating Trading Signals: By comparing open interest to other technical indicators, you can validate your trading signals and enhance your confidence in making informed decisions.

What Is Open Interest In Options Trading

Conclusion

Understanding open interest is crucial for options traders seeking to make informed and profitable trades. By tracking and interpreting open interest, you can gain valuable insights into market depth, sentiment, and direction. Incorporating open interest into your trading strategies can help you identify potential opportunities, minimize risks, and navigate the options market with greater precision.