As an options trader, it’s crucial to have a firm grasp of open interest and volume, two essential metrics that provide valuable insights into market dynamics. Let’s delve into the differences between these two concepts and their significance in the world of options trading.

Image: www.newtraderu.com

Understanding Open Interest

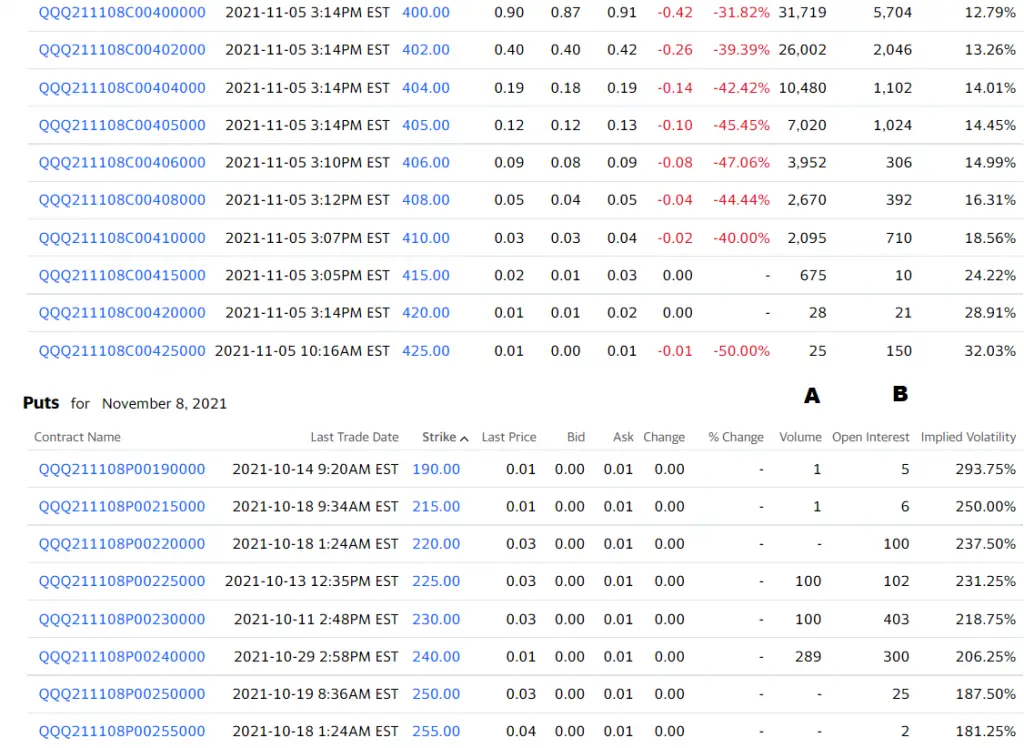

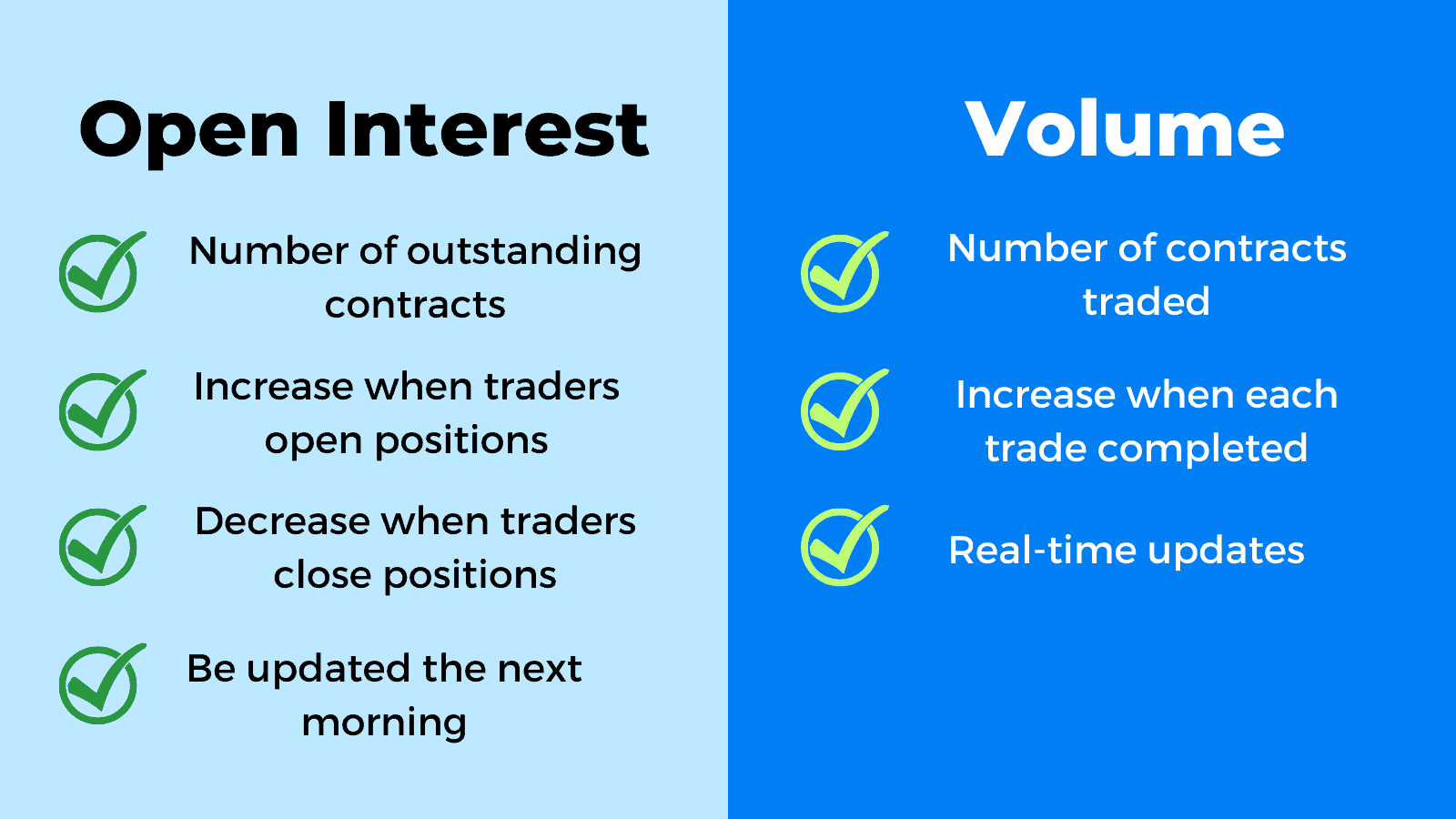

Open interest represents the total number of options contracts that are currently outstanding in the market. These contracts haven’t yet been exercised or closed out. Monitoring open interest can provide insights into the overall positioning and sentiment of market participants.

For instance, a high open interest often indicates that there is a substantial amount of interest in a particular option, potentially signaling an anticipated price movement. Conversely, low open interest suggests a lack of activity and can point to a low level of interest in the underlying asset.

Defining Volume

Volume, on the other hand, measures the number of options contracts that are traded over a specific period. It reflects the intensity of trading activity and indicates the volume of contracts changing hands in the market.

High volume typically implies increased liquidity and market volatility, as more traders are actively participating. Conversely, low volume suggests a less active market with potentially limited liquidity.

Relationship between Open Interest and Volume

While open interest and volume are distinct metrics, they are closely intertwined. An increase in volume often leads to a corresponding increase in open interest, as new contracts are created to participate in the trading activity. Conversely, a decrease in volume can result in a reduction in open interest when existing contracts are closed out.

Image: cannytrading.com

Tips for Options Traders

1. Monitor open interest to identify market interest: High open interest indicates strong market participation, while low open interest suggests a lack of interest.

2. Pay attention to volume to assess liquidity: High volume implies increased liquidity, while low volume indicates potentially limited liquidity.

3. Consider the relationship between open interest and volume to gauge market dynamics: A consistent rise or fall in both open interest and volume can provide insights into market sentiment and potential price action.

4. Use options with higher open interest for liquidity: Contracts with high open interest tend to have greater liquidity and narrower bid-ask spreads.

5. Monitor open interest changes over time: Significant changes in open interest can signal shifts in market sentiment or expectations.

FAQ on Open Interest and Volume

Q: What is the difference between open interest and volume in options trading?

A: Open interest represents the total number of outstanding contracts, while volume measures the number of contracts traded over a period.

Q: Why is open interest important?

A: Open interest provides insights into market positioning and sentiment.

Q: How does volume affect open interest?

A: Increased volume generally leads to increased open interest, while decreased volume can result in reduced open interest.

Options Trading Difference Open Interest Vs Volume

Image: seekingalpha.com

Conclusion

Understanding the nuances of open interest and volume is essential for successful options trading. By monitoring both these metrics, traders can better gauge market sentiment, identify potential opportunities, and make informed trading decisions. Remember, a comprehensive analysis of market data empowers you as a trader. Are you ready to dive deeper into the world of options trading?