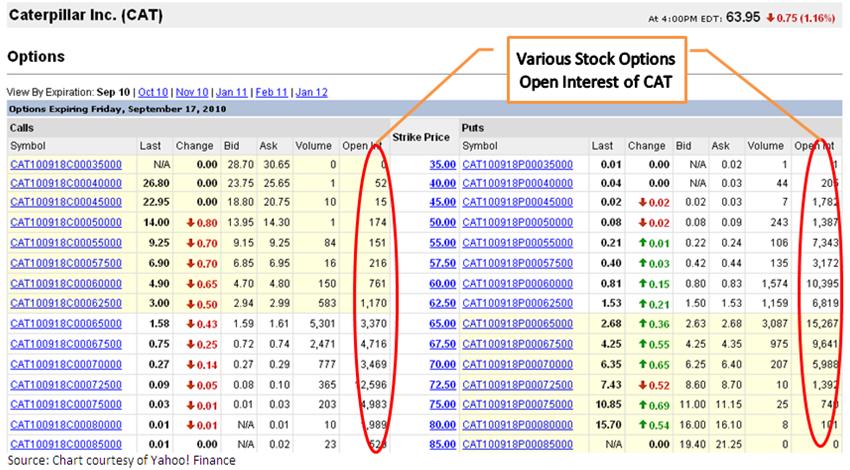

Options trading is a powerful financial tool that allows investors to speculate on price movements without owning the underlying assets. Open interest measures the number of outstanding options contracts, indicating the volume of trading activity.

Image: www.trade-stock-option.com

Importance of Open Interest in Options Trading

Open interest is crucial for options traders because it:

- Shows market sentiment: High open interest indicates strong demand for the option, implying that the market expects a price movement in the underlying security.

- Measures liquidity: Traders prefer options with high open interest as they offer tighter bid-ask spreads and better pricing.

- Highlights potential price movements: An increase in open interest can signal an increase in trading volume, which can further push the price in the direction of the options bets.

Understanding Open Interest in Options

Open interest is measured in terms of the number of contracts, with each contract representing 100 shares of the underlying security. It is calculated as the total number of outstanding calls minus the total number of outstanding puts.

Example:

If a stock has 500 open call contracts and 200 open put contracts, the open interest is 500 – 200 = 300 contracts. This indicates that there are 300 outstanding contracts that bet on a price increase.

Image: fipocuqofe.web.fc2.com

Factors Affecting Open Interest

Open interest is influenced by several factors:

- Market volatility: Increased volatility leads to higher open interest as traders seek to hedge against price fluctuations.

- Expiration date: Open interest typically increases in the run-up to expiration as traders close their positions or roll them over to the next month.

- News and events: Market-moving news or events can cause a sudden spike in open interest as traders adjust their positions.

Tips and Expert Advice for Open Interest Trading

Leveraging open interest for profitable options trading requires careful consideration:

- Consider both high and low open interest: While high open interest indicates strong market sentiment, it can also suggest limited room for further growth. Conversely, low open interest may offer opportunities for undervalued options.

- Monitor open interest changes: Pay attention to significant increases or decreases in open interest, as they can signal potential price movements.

- Use open interest in conjunction with other indicators: Combine open interest with technical analysis, price charts, and news flow for a comprehensive trading strategy.

FAQ on Options Trading Open Interest

- Q: What is open interest in options trading?

A: Open interest refers to the total number of outstanding options contracts on a specific underlying security. - Q: How is open interest calculated?

A: Open interest is calculated by subtracting the total number of outstanding puts from the total number of outstanding calls. - Q: Why is open interest important for options traders?

A: Open interest provides insights into market sentiment, liquidity, and potential price movements.

Options Trading Open Interest

Image: teknologya.com

Conclusion

Options trading open interest is a vital indicator for assessing market sentiment and identifying trading opportunities. By carefully monitoring open interest and incorporating it into your trading strategy, you can gain a competitive edge in the options market.

Are you interested in learning more about options trading open interest and how it can enhance your trading performance? Join our upcoming webinar or contact our team of experts for a personalized consultation.