Introduction

Stock options trading can be a lucrative yet complex endeavor, requiring a comprehensive understanding of the market, trading strategies, and risk management. One essential tool that can significantly enhance your trading performance is a stock options trading journal.

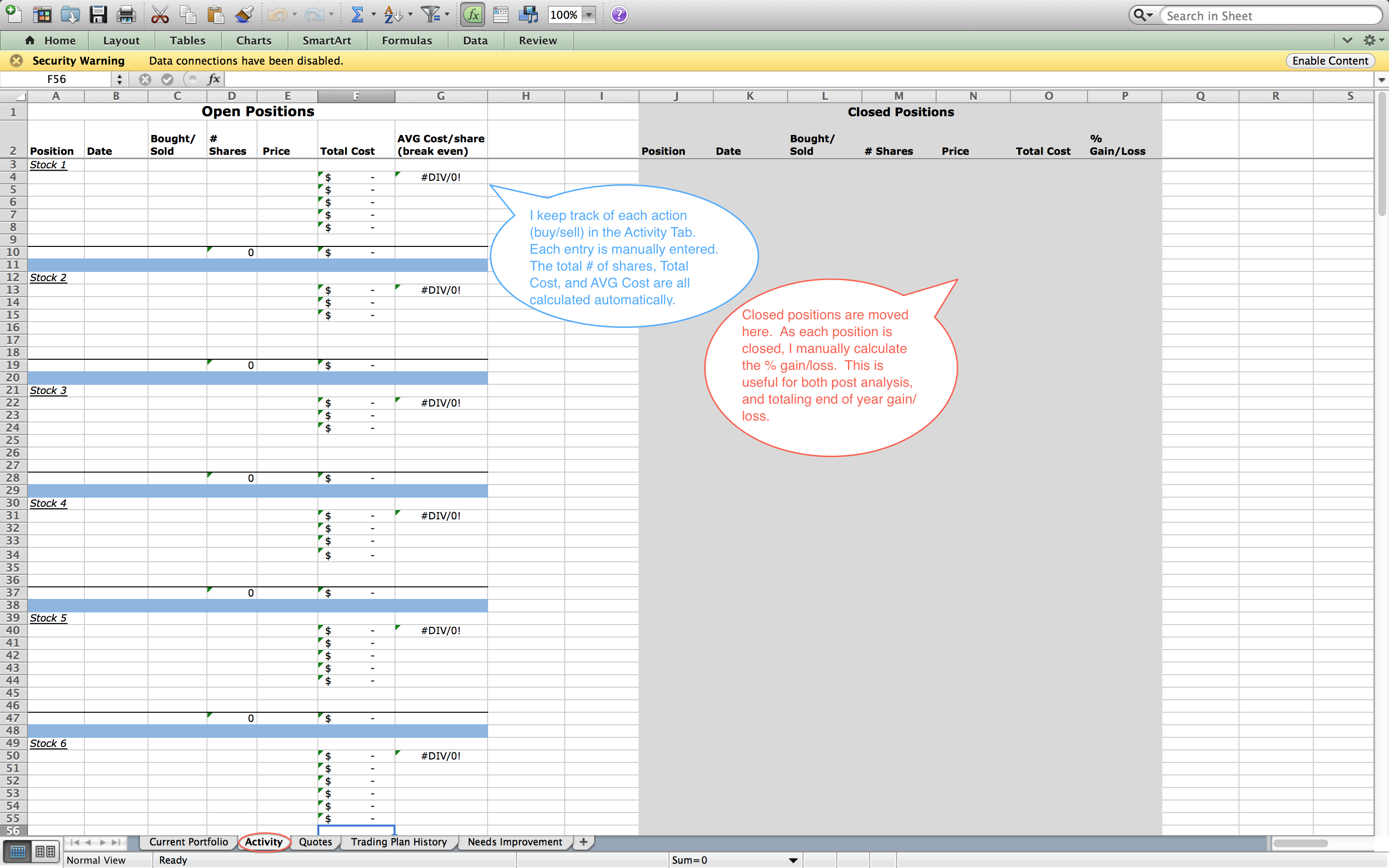

Image: chartyourtrade.com

A stock options trading journal is a detailed record of all your trades, including entries, exits, profit/loss, and analysis. It serves as a valuable tool for tracking your trading decisions, identifying patterns, and improving your overall trading strategy. This article will guide you through the importance of maintaining a stock options trading journal, the essential elements it should contain, and how to use it effectively to maximize your profits.

What is a Stock Options Trading Journal?

A stock options trading journal is a systematic record of all your options trades. It includes information such as the date and time of the trade, the underlying stock symbol, the option type (call or put), the strike price, the expiration date, the premium paid or received, and the quantities bought or sold.

Beyond the bare minimum, you should also include detailed notes about your trading rationale, risk assessment, profit/loss calculations, and any other relevant observations or insights.

Importance of a Stock Options Trading Journal

Maintaining a comprehensive stock options trading journal offers numerous benefits:

- Trade Tracking: It provides a concise summary of your trading activities, allowing you to review and monitor all your trades in one place.

- Performance Analysis: By tracking your trades, you can analyze your overall performance, identify winning and losing strategies, and assess your strengths and weaknesses.

- Pattern Recognition: A trading journal allows you to identify recurring patterns in your trading behavior, such as emotional biases or common errors. This enables you to make corrections and improve your decision-making process.

- Risk Management: By documenting your risk assessments, you can evaluate your risk tolerance and determine areas where you may be overleveraged.

- Trading Plan Refinement: A trading journal helps you refine your trading plan by identifying areas for improvement and adjusting your strategies accordingly.

Essential Elements of a Stock Options Trading Journal

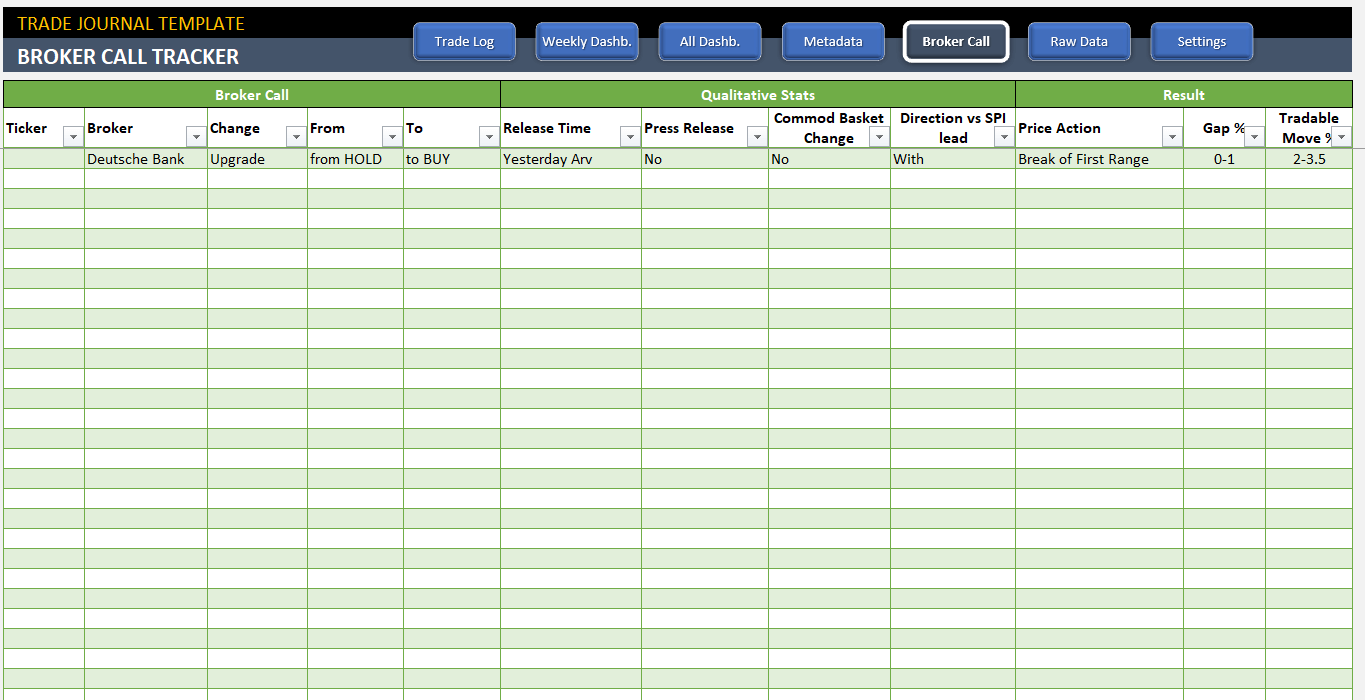

Your stock options trading journal should be tailored to meet your specific needs. However, there are a few essential elements that should be included:

- Trade Date: The date when the trade was executed.

- Underlying Symbol: The ticker symbol of the underlying security.

- Option Type: Whether it is a call or a put option.

- Strike Price: The strike price of the option.

- Expiration Date: The date on which the option expires.

- Premium: The premium paid or received for the option.

- Quantities: The number of contracts bought or sold.

- Trade Rationale: A brief explanation of your reasons for entering the trade.

- Risk Assessment: An assessment of the risks involved in the trade.

- Target Profit/Loss: Your target profit or loss for the trade.

- Trade Status: The current status of the trade (open, closed, or expired).

- Exit Date: The date when the trade was closed.

- Actual Profit/Loss: The realized profit or loss from the trade.

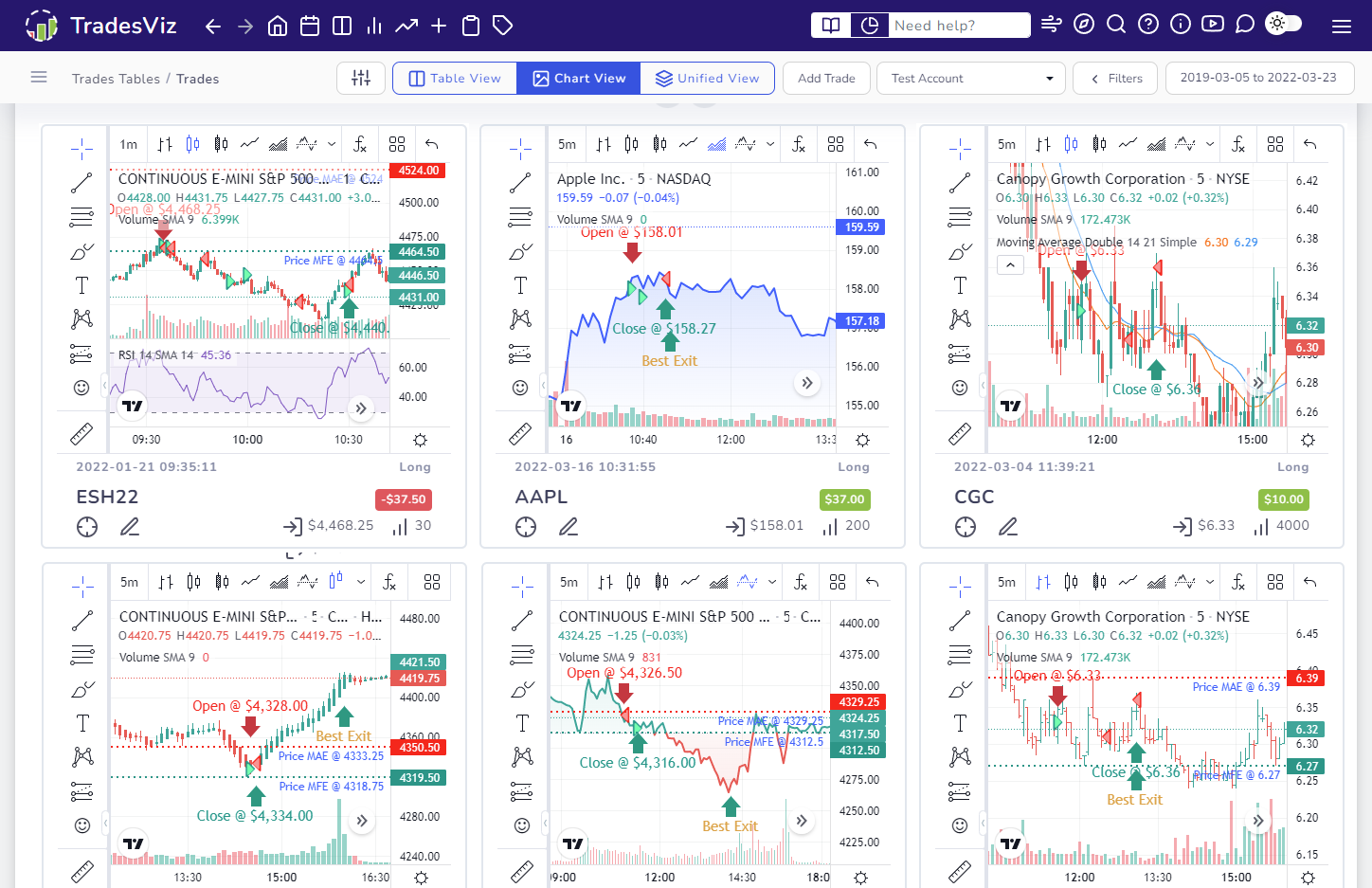

- Trade Analysis: A detailed analysis of the trade, including insights gained and lessons learned.

Image: www.tradesviz.com

How to Use a Stock Options Trading Journal Effectively

To derive maximum benefit from your stock options trading journal, follow these best practices:

- Regular Maintenance: Enter all your trades into the journal as soon as possible after execution to ensure accuracy and completeness.

- Detailed Notes: Provide as much detail as possible in your trading rationale, risk assessments, and trade analysis to maximize the potential for learning.

- Periodic Review: Regularly review your journal to identify patterns, evaluate performance, and make adjustments to your trading plan.

- Emotional Detachment: Be objective and honest in your journal entries, avoiding emotional biases or justifications for poor trades.

- Confidentiality: Keep your trading journal secure to maintain the privacy of your trading decisions and strategies.

Stock Options Trading Journal

Image: www.someka.net

Conclusion

Maintaining a comprehensive stock options trading journal is an invaluable tool for serious traders. It provides a centralized repository of your trading history, enabling you to track your decisions, analyze your performance, and identify areas for improvement. By following the guidance outlined in this article, you can leverage the power of a trading journal to enhance your options trading skills and increase your profitability.

Remember, a trading journal is not a passive document; it is an active tool that requires regular maintenance and thoughtful reflection. By committing to the discipline of journaling, you will gain a wealth of insights that will propel you towards trading excellence.