Introduction:

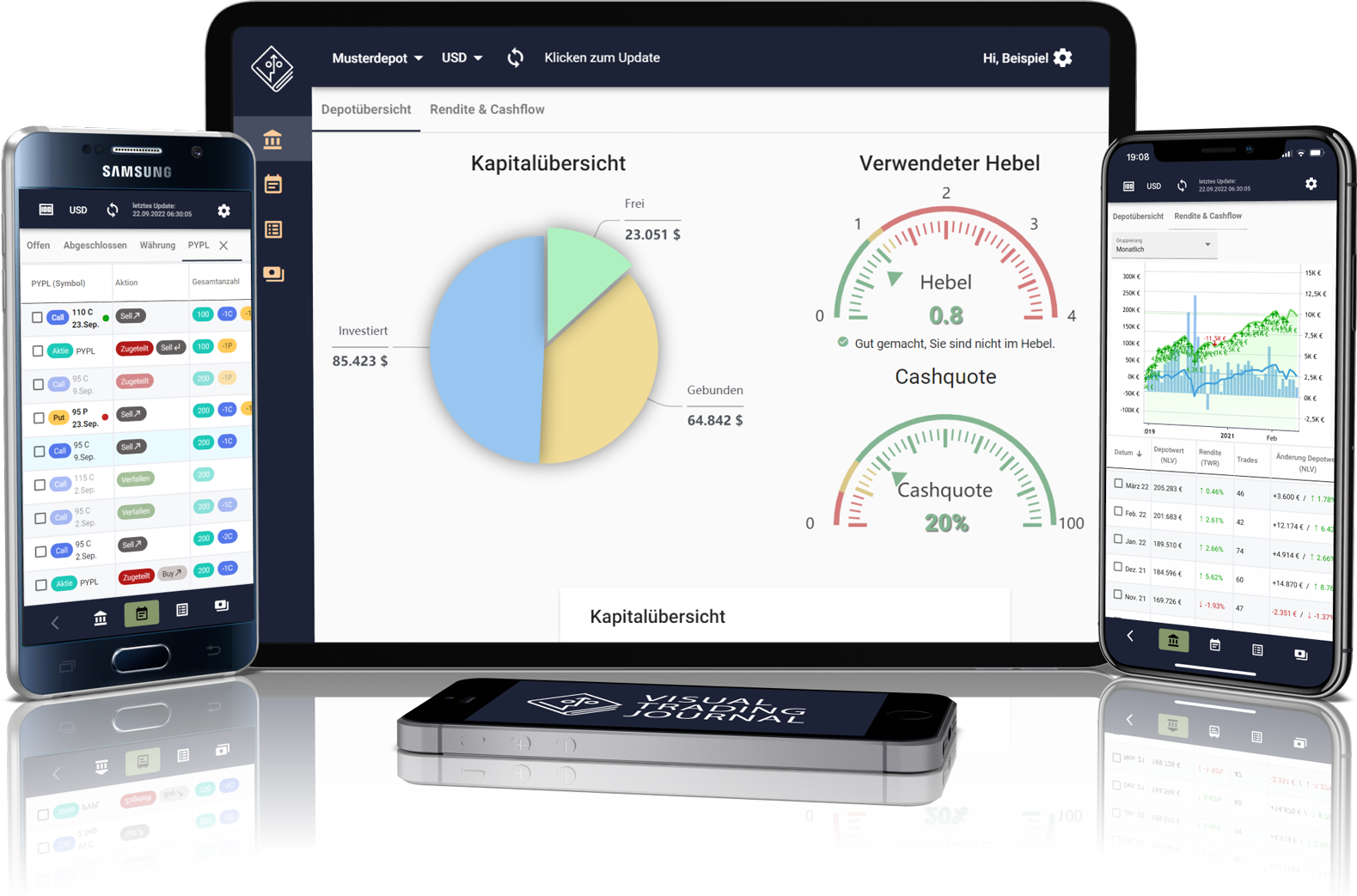

Image: visualtradingjournal.com

In the realm of financial trading, the path to success often lies in meticulous record keeping and thorough analysis. For option traders, an option trading journal serves as an indispensable tool, enabling them to monitor their trades, track their progress, and identify areas for improvement. By meticulously recording every trade executed, traders can gain valuable insights into their trading strategies, adjust their approach accordingly, and maximize their profitability.

Understanding an Option Trading Journal:

An option trading journal is a systematic and organized record of all the option trades conducted by a trader. It captures critical details such as the underlying asset, option type, strike price, expiration date, premium paid, and the entry and exit prices. Besides these fundamental elements, traders may also include additional information, such as the rationale behind each trade, market conditions, trading strategies employed, and any observations or insights gained.

Benefits of Using an Option Trading Journal:

1. Performance Tracking: An option trading journal serves as a detailed chronicle of a trader’s performance. It provides a consolidated view of all trades, allowing traders to assess their overall profitability, identify winning and losing patterns, and gauge the effectiveness of their strategies.

2. Learning from Mistakes: A trading journal allows traders to scrutinize their past trades and identify mistakes made. By reviewing unsuccessful trades, traders can pinpoint the reasons for their losses and take steps to avoid such errors in the future, leading to continuous improvement and enhanced trading decisions.

3. Risk Management: A comprehensive trading journal assists traders in managing risk effectively. By analyzing historical trades, traders can identify the sources of risk and develop appropriate risk mitigation strategies tailored to their individual risk tolerance.

4. Enhancing Strategies: An option trading journal facilitates the evaluation and refinement of trading strategies. By studying the factors that contributed to successful trades and the pitfalls that led to losses, traders can refine their strategies, fine-tune entry and exit criteria, and optimize their approach in accordance with evolving market conditions.

5. Emotional Control: Regular journaling helps traders cultivate emotional discipline by objectively recording their trades. It eliminates the bias of hindsight and provides traders with a structured tool for reflecting on their trading decisions, thereby reducing the impact of emotions on future trades.

Conclusion:

For option traders seeking to elevate their performance and achieve sustained profitability, an option trading journal is an invaluable resource. It provides a comprehensive record of all trades, enabling traders to monitor their progress, analyze results, identify areas for improvement, fine-tune strategies, and manage risk effectively. By meticulously recording and analyzing their trades, traders can gain a deeper understanding of the markets and elevate their trading acumen to new heights.

Image: cagodong.blogspot.com

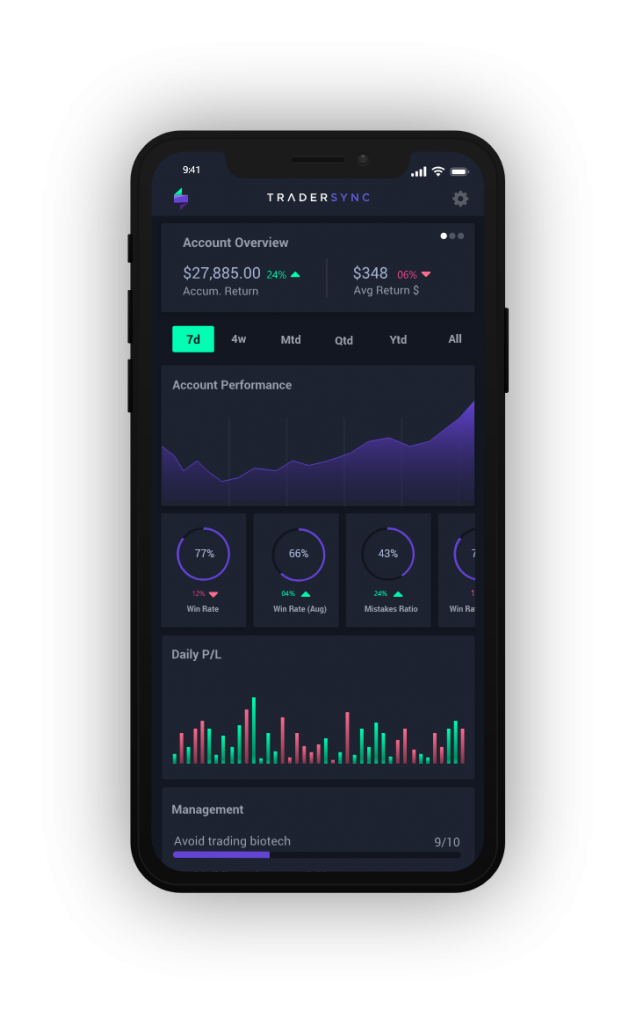

Option Trading Journal App

Image: tradersync.com