Harnessing the capabilities of spreadsheets can elevate your options trading strategy to new heights. Remember that pivotal trade I executed, capitalizing on a promising market trend? I owe it all to the meticulous planning and analysis I conducted using a spreadsheet. Today we’ll delve into this indispensable tool, transforming a spreadsheet into a financial wizardry wand.

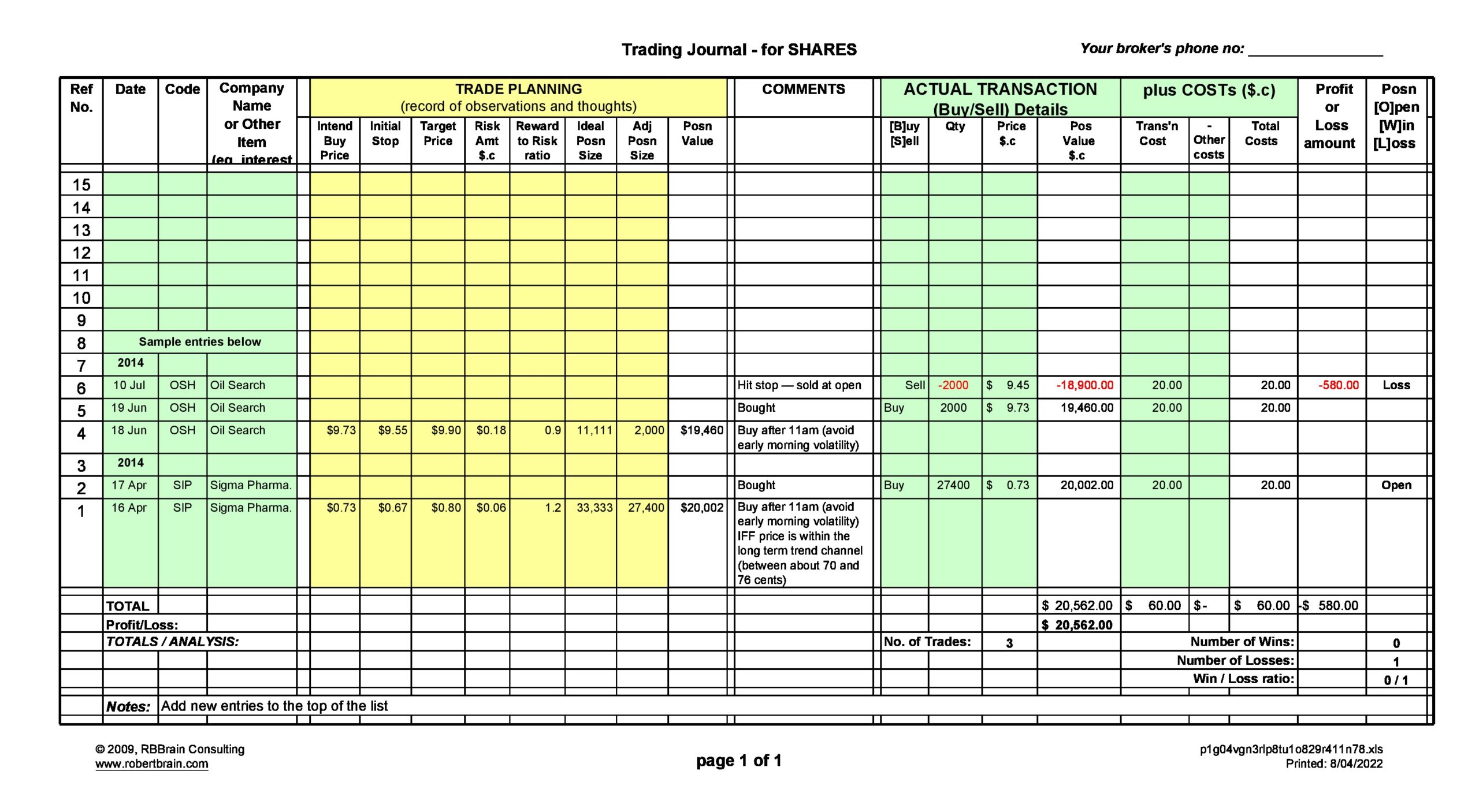

Image: templatearchive.com

Spreadsheets: Your Personalized Financial Observatory

Spreadsheets are your personal financial command center, empowering you to crunch numbers, analyze data, and identify opportunities like never before. Think of them as your strategic dashboard, providing a comprehensive snapshot of your trades. By harnessing the versatility of spreadsheets, you can simulate trading scenarios, evaluate potential outcomes, and identify entry and exit points with precision.

Understanding Options Trading and Spreadsheets

Options trading involves acquiring contracts that grant the right, not the obligation, to buy or sell an underlying asset at a specified price. Spreadsheets become your trusted ally in navigating this complex landscape. They allow you to define trade parameters, such as strike price, expiration date, and premiums. This structured approach provides a clear framework for your trading decisions.

Navigating the Maze of Options Trading Strategies

Spreadsheets serve as a versatile canvas for concocting and testing various options trading strategies. Whether you’re a seasoned veteran or a budding trader, spreadsheets empower you to:

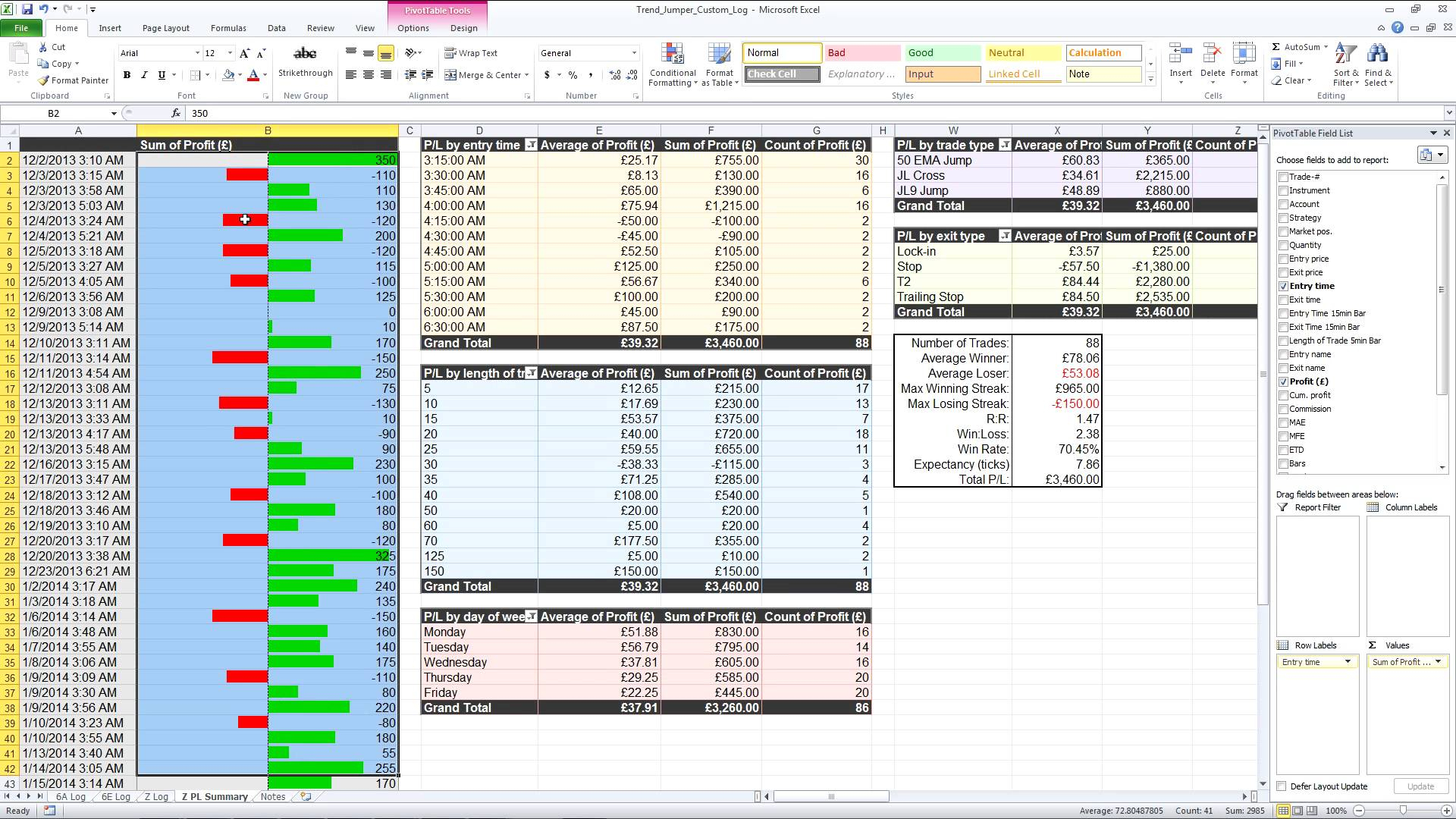

- Visualize your trading strategy: Depict complex strategies, including multi-leg options trades, using charts and graphs.

- Calculate potential profit and loss: Quantify your potential returns and risks in real-time.

- Optimize your trades: Analyze past trades and identify areas for improvement, optimizing your approach.

Image: db-excel.com

Incorporating Risk Management

Spreadsheets also serve as your risk mitigation compass. By incorporating risk management principles, you can make informed decisions, safeguarding your capital:

- Track your risk exposure: Calculate Greeks, such as Delta and Theta, to monitor risk in real-time.

- Create scenarios and stress tests: Simulate market volatility and unfavorable conditions to test your strategy’s resilience.

Expert Tips and Advice

Elevate your spreadsheet mastery with these invaluable tips:

- Customize your spreadsheet: Adapt it to your specific trading style and requirements.

- Stay updated on market trends: Integrate real-time data feeds to stay abreast of the latest market movements.

- Seek expert guidance: Consult with a financial advisor or attend workshops to enhance your spreadsheet proficiency.

Frequently Asked Questions on Spreadsheets for Options Trading

- Q: How can I get started with spreadsheets for options trading?

- A:Begin with a basic spreadsheet template, adapting it to suit your needs as you gain experience.

Q: Which spreadsheet software is best for options trading?

A:Microsoft Excel and Google Sheets are popular choices among options traders.

Q: Can spreadsheets replace the need for a trading platform?

A:Spreadsheets complement trading platforms, providing additional analytical capabilities.

Spreadsheets For Trading Options

Image: db-excel.com

Conclusion

Spreadsheets are an indispensable tool in the arsenal of successful options traders. By incorporating them into your trading strategy, you can navigate market complexities, optimize your approach, and mitigate risks. Embrace the power of spreadsheets today and watch your options trading soar to new heights.

Tell us, fellow traders, how have spreadsheets transformed your options trading journey? Share your experiences in the comments below.