Introduction:

Image: iqbroker.com

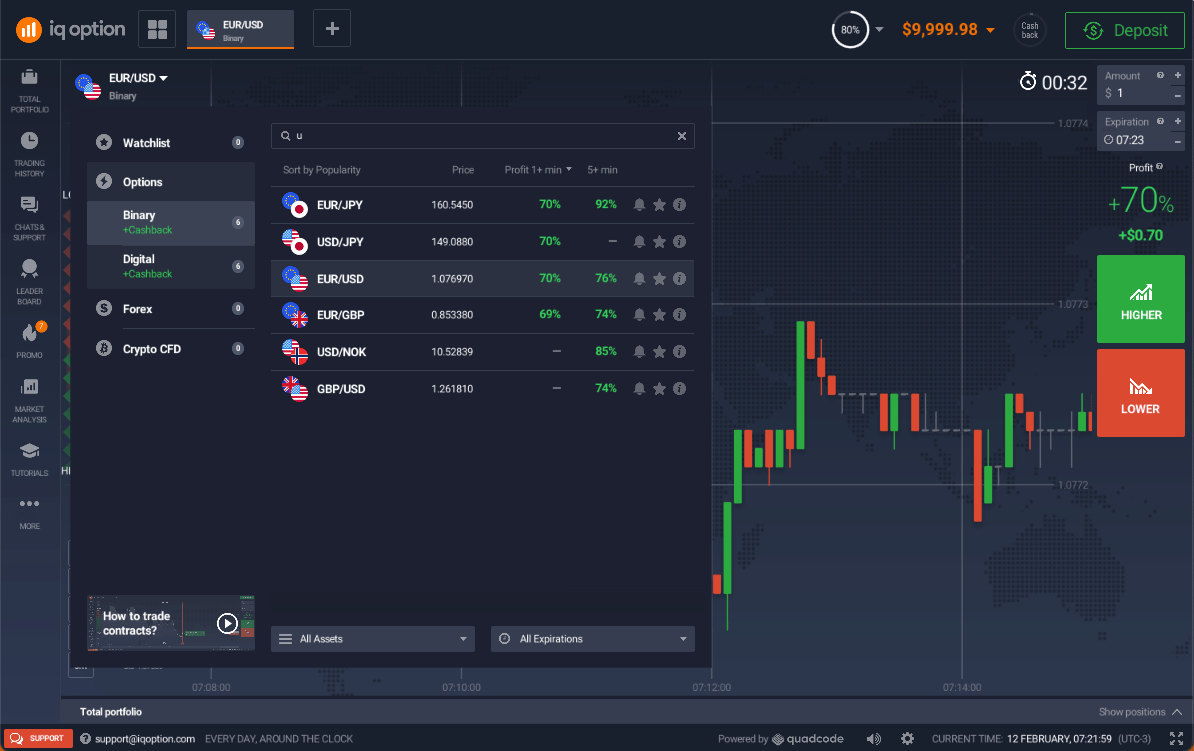

The world of financial trading can be complex and confusing, especially when navigating different trading instruments. Two popular options are binary options and options trading, each with its unique characteristics and complexities. This article aims to shed light on the fundamental differences between binary options vs. options trading, empowering you to make informed decisions based on your financial goals and risk tolerance.

Understanding Binary Options

Binary options are a specific type of option contract that offers a simplified approach to trading. It involves predicting the direction of an underlying asset’s price movement (up or down) within a specified time frame. If your prediction matches the actual market outcome, you receive a fixed payout. Otherwise, you lose the entire investment. Binary options are often criticized for their high risk and potential for loss, as the outcome is either all or nothing.

Exploring Options Trading

Options trading, on the other hand, is a more flexible and multifaceted approach. Options provide traders with the right but not the obligation to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This allows for various trading strategies, such as hedging, speculation, and income generation. Options trading requires a comprehensive understanding of market behavior, risk management, and trading strategies to be successful.

Key Differences: Risk, Reward, and Complexity

The fundamental difference between binary options and options trading lies in risk, reward, and complexity. Binary options carry a higher risk of losing the entire investment due to their all-or-nothing nature. Options trading, while still carrying risk, offers the flexibility to manage risk through varying strategies and the potential for greater reward with higher complexity.

Market Behavior and Underlying Assets

Binary options are typically traded on various asset classes, including forex pairs, stocks, commodities, and indices. Options trading, however, encompasses a wider range of underlying assets, including individual stocks, stock indices, ETFs, bonds, and futures contracts. Understanding the market behavior of these assets is crucial for successful trading in both binary options and options trading.

Expert Insights and Practical Tips

Expert Insight:

- “Binary options offer a simple and accessible way to speculate on market movements, but traders should be aware of the high risk involved.” – Tim Sykes, renowned trading expert

Practical Tips:

- Start small and gradually increase trading volume as your experience and knowledge grow.

- Focus on understanding the underlying assets and market dynamics before placing trades.

- Develop a trading strategy and stick to it rather than making impulsive decisions.

- Seek guidance from reputable and experienced mentors to accelerate your learning curve.

Conclusion

Binary options and options trading are distinct financial instruments that cater to different trading goals, risk tolerances, and levels of complexity. Binary options appeal to those seeking a simplified approach with potentially high returns but come with significant risk. Options trading offers more flexibility, strategic options, and the potential for greater rewards but requires a deeper understanding of market mechanics and risk management. Ultimately, the choice between the two depends on your individual circumstances and financial objectives. By understanding the key differences and navigating the complexities, you can make informed decisions and embark on a successful trading journey.

Image: wealthfit.com

Binary Options Vs Options Trading

Image: forex-station.com