The automotive industry has experienced unprecedented growth in recent years, fueled by technological advancements and the rising demand for personal mobility. Among the leading players in this dynamic landscape, Volkswagen has emerged as a global powerhouse, capturing the attention of investors worldwide. Options trading has become a popular strategy for investors seeking to harness the potential of Volkswagen’s stock performance and capitalize on market volatility.

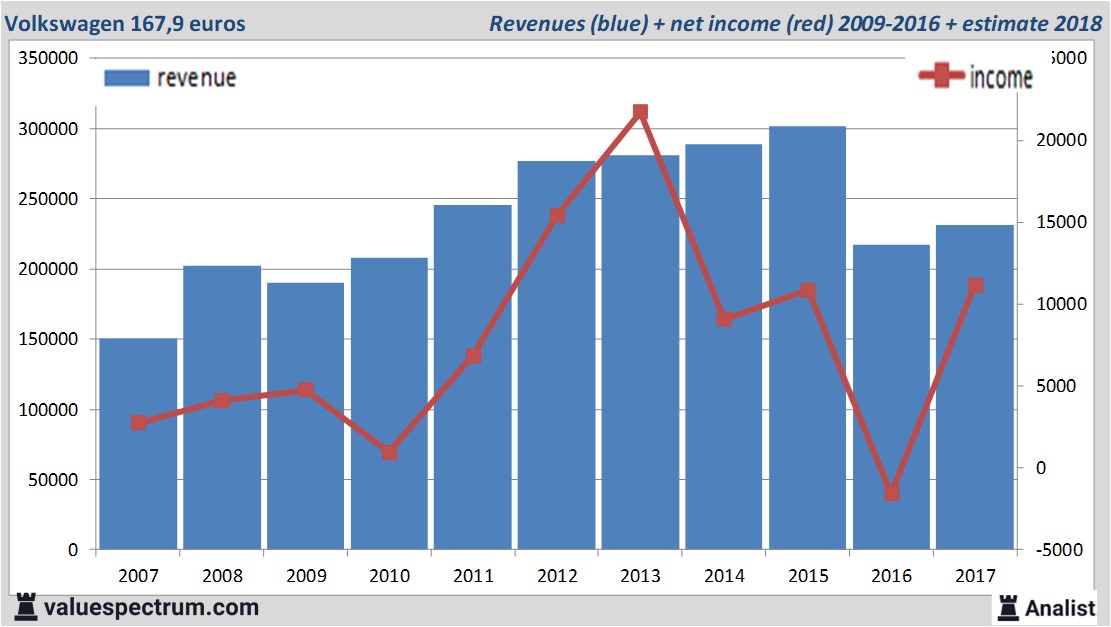

Image: www.valuespectrum.com

Volkswagen options provide investors with a potent tool to manage risk, speculate on future price movements, and enhance their portfolio returns. To successfully navigate the world of Volkswagen options trading, a thorough understanding of the fundamental concepts, strategies, and potential risks is essential. This comprehensive guide delves into the intricacies of Volkswagen options trading, empowering you with the knowledge and insights to make informed decisions.

Delving into Volkswagen Options: A Historical Perspective

Volkswagen’s roots can be traced back to the early 20th century, and the company has consistently played a pivotal role in shaping the automotive industry. Founded in 1937, Volkswagen quickly gained prominence by introducing the iconic Beetle, a car that revolutionized personal transportation. Over the decades, Volkswagen expanded its product portfolio, acquiring esteemed brands such as Audi, Porsche, and Lamborghini. Today, the Volkswagen Group stands as one of the largest automakers globally, with a vast portfolio of vehicles catering to diverse consumer needs.

Understanding Options: A Gateway to Market Versatility

Options are financial instruments that bestow upon their holders the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price on or before a specified date. This flexibility allows investors to tailor their trading strategies to their individual risk tolerance and market outlook. By leveraging options, investors can potentially amplify their returns, mitigate losses, and enhance their portfolio’s overall performance.

Applying Options to Volkswagen: Unveiling Trading Opportunities

Applying options to Volkswagen trading unlocks a vast array of opportunities for savvy investors. Call options empower investors to bet on future price increases, while put options offer a hedge against potential declines. Moreover, investors can employ complex multi-leg strategies, such as spreads and butterflies, to further refine their risk-reward profiles. A comprehensive understanding of Volkswagen’s stock dynamics, industry trends, and economic conditions is vital for making informed trading decisions.

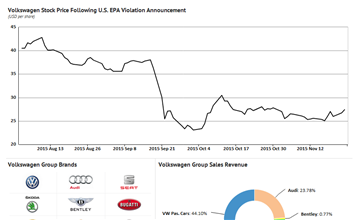

Image: in.thptnganamst.edu.vn

Trading Volkswagen Options: Unveiling Strategies for Success

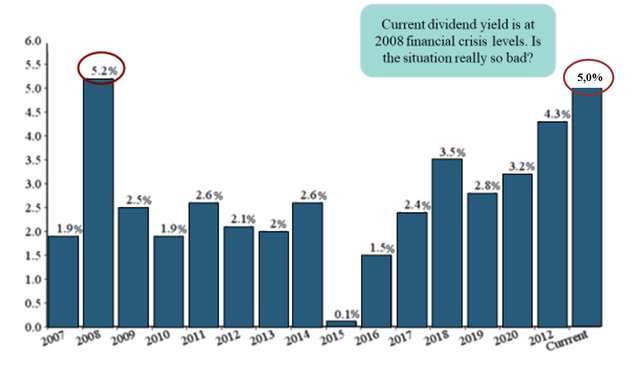

To successfully trade Volkswagen options, investors must embrace a methodical and informed approach. Fundamental and technical analysis of Volkswagen’s financials, macroeconomic factors, and market sentiment play a crucial role in gauging the company’s future prospects. Additionally, monitoring Volkswagen’s earnings reports, product launches, and industry news can provide valuable insights into its performance trajectory. By employing a disciplined trading plan and adhering to sound risk management practices, investors can enhance their chances of achieving long-term success.

Navigating Volatility: Mastering Risk in Volkswagen Options Trading

Volkswagen options trading is inherently exposed to market volatility, which can fluctuate rapidly and unpredictably. Investors should be cognizant of the potential risks and allocate their capital prudently. Employing well-defined risk management strategies, such as setting stop-loss orders and position sizing, is crucial for preserving capital and limiting potential losses. Furthermore, investors should avoid the temptation of overleveraging, as this can exacerbate losses during market downturns.

Embracing Innovation: Exploring Advanced Options Trading Techniques

The advent of advanced options trading techniques has opened up new possibilities for investors seeking to maximize their returns while managing risk. Strategies such as covered calls, bull put spreads, and iron condors provide investors with sophisticated tools to capitalize on various market scenarios. By mastering these techniques, investors can enhance their profitability and fine-tune their portfolios to meet their specific objectives.

Volkswagen Options Trading

Image: seekingalpha.com

Conclusion: Empowering Investors Through Volkswagen Options Trading

Volkswagen options trading presents investors with a powerful mechanism to amplify their portfolio returns and capitalize on market opportunities. By grasping the fundamental principles of options trading, thoroughly assessing Volkswagen’s strengths and weaknesses, and employing effective risk management strategies, investors can navigate market complexities with greater confidence. However, it is imperative to remember that options trading involves inherent risks, and investors should exercise due diligence to mitigate potential losses. With a deep understanding of the market, a disciplined approach, and a commitment to continuous learning, investors can harness the potential of Volkswagen options trading and achieve financial success.