Introduction

:max_bytes(150000):strip_icc()/dotdash_Final_How_Traders_Use_CCI_Commodity_Channel_Index_to_Trade_Stock_Trends_Oct_2020-01-9775f34ab3b143a693c008905051193a.jpg)

Image: economiaenegocios.com

The global option trading volume has experienced a meteoric rise in recent years, solidifying options as an indispensable tool for investors and traders alike. Options, financial instruments that confer the right but not the obligation to buy or sell an underlying asset at a specified price, have emerged as powerful vehicles for managing risk, enhancing returns, and speculating on market movements. In this article, we delve into the fascinating world of global option trading volume, exploring its history, key trends, and implications for the financial landscape.

Historical Evolution: A Tale of Growth and Innovation

The origins of options can be traced back to the 17th century, when merchants sought ways to hedge against price fluctuations in commodity markets. Over time, options evolved and gained popularity, becoming a staple in the financial toolkit of investors. In the early 20th century, the establishment of organized exchanges marked a significant milestone, facilitating the standardized trading of options and enhancing their accessibility.

Modern Day: A Global Market in Constant Flux

Today, the global option trading volume is estimated to surpass trillions of dollars annually, reflecting the widespread adoption of options across various asset classes. Options are traded on a range of underlying assets, including stocks, indices, commodities, currencies, and bonds. The rapid proliferation of electronic trading platforms has further fueled market growth, making options accessible to a wider spectrum of participants, from institutional investors to individual traders.

Key Trends: Shaping the Future of Options Trading

The global option trading volume continues to be shaped by several key trends that are redefining the market landscape:

- Increased Market Volatility: Market volatility, driven by geopolitical uncertainties, economic fluctuations, and technological disruptions, has contributed to the surge in option trading as investors seek to hedge against risks and capitalize on market swings.

- Technological Advancements: The advent of advanced trading technology, including algorithmic trading and automated execution platforms, has revolutionized option trading, enabling faster trade execution, reduced trading costs, and improved risk management capabilities.

- Growing Retail Participation: The emergence of retail trading platforms and the increased affordability of options have made them accessible to a broader audience. Retail investors have embraced options for everything from hedging against potential losses to speculating on market movements.

- Expansion into New Markets: The global option trading volume is not limited to traditional financial hubs. Emerging markets are witnessing significant growth in option trading, driven by increasing investor sophistication and the need for risk management tools.

Implications: A Transformative Force in the Financial Landscape

The soaring global option trading volume has profound implications for the financial ecosystem:

- Enhanced Liquidity: Options provide liquidity to the underlying markets, allowing investors to enter and exit positions more efficiently. This enhanced liquidity facilitates smoother price discovery and reduced market volatility.

- Risk Mitigation: Options serve as a powerful tool for risk mitigation. Investors can use them to hedge against adverse price movements or limit potential losses. This risk-management aspect has made options indispensable for portfolio diversification and asset protection.

- Speculative Opportunities: Options offer speculators opportunities to profit from market movements without the need for direct ownership of the underlying asset. Speculative trading has contributed to the significant growth of the global option trading volume.

- Regulatory Considerations: The surge in option trading volume has drawn the attention of regulators worldwide. Concerns over market manipulation and systemic risks have led to increased regulatory scrutiny and the implementation of measures to ensure market integrity.

Conclusion

The global option trading volume is a testament to the versatility and widespread adoption of options in today’s financial markets. As the market continues to evolve, driven by technological advancements and the increasing sophistication of participants, options are poised to play an even more pivotal role in global finance. By providing investors with tools for risk management, return enhancement, and speculative opportunities, options empower them to navigate market complexities and make informed investment decisions. Understanding the trends and implications of global option trading volume is essential for participants to capitalize on the opportunities and mitigate the risks associated with this dynamic financial instrument.

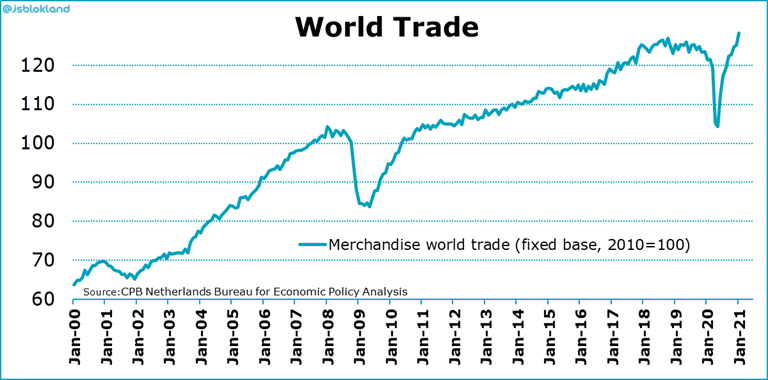

Image: thesoundingline.com

Global Option Trading Volume

:max_bytes(150000):strip_icc()/dotdash_final_Price_by_Volume_Chart_PBV_Dec_2020-01-fa603cf762884966b3011aab59426e24.jpg)

Image: www.investopedia.com