Volume Surges as Investors Seek Strategies

The world of options trading has experienced a meteoric rise in recent times, as investors flock to these versatile financial instruments in search of alternative investment opportunities. The once-niche market has now become a bustling hub of activity, reaching record volume levels that continue to astound market analysts.

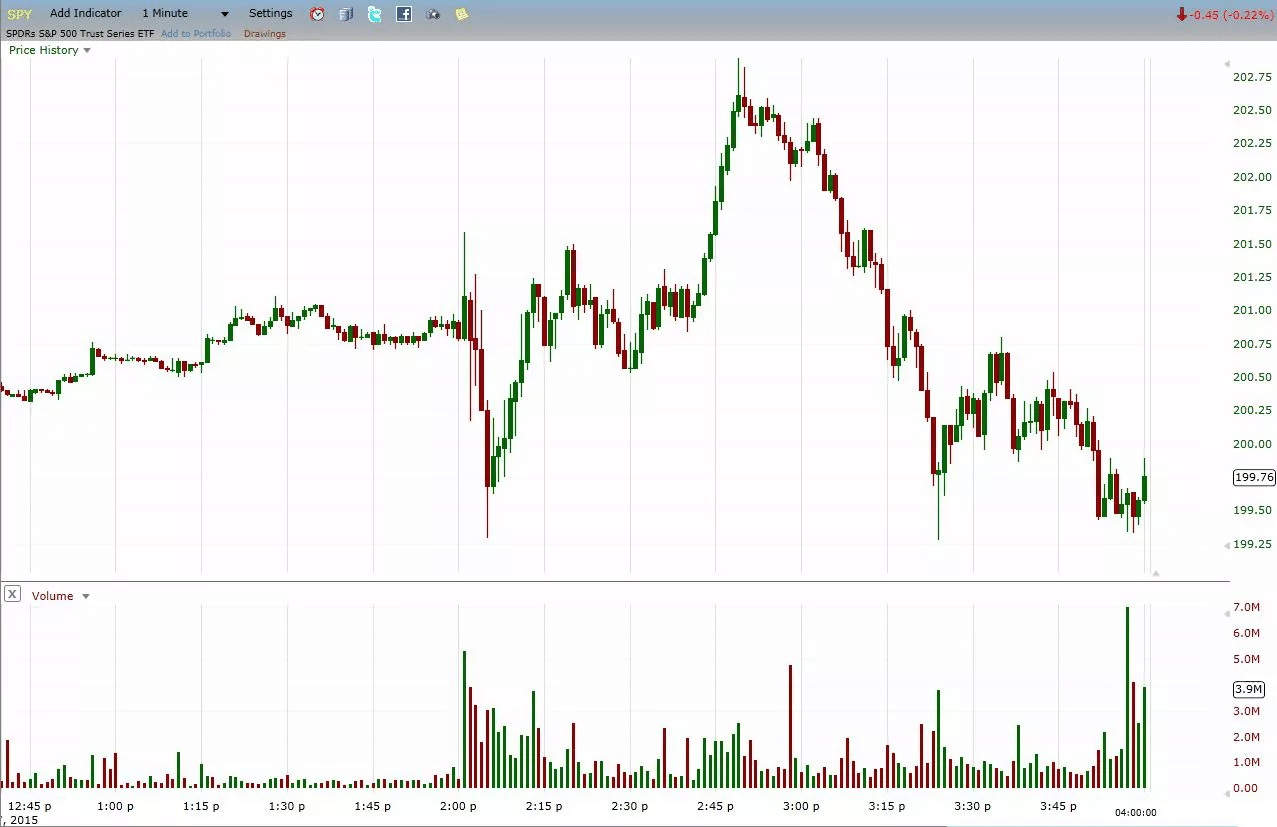

Image: marketxls.com

This surge in popularity can be attributed to several factors, including increased market volatility, the quest for yield in a low-interest-rate environment, and the proliferation of online trading platforms that make options more accessible to retail traders. As a result, option trading has emerged as a viable strategy for investors of all experience levels.

Understanding Options Trading

Options are financial contracts that provide the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility makes options a powerful tool for managing risk, speculating on price movements, and enhancing portfolio returns.

Key Trends and Developments

The options market is constantly evolving, with new trends and developments emerging all the time. One notable trend is the increased popularity of exchange-traded funds (ETFs) that track option indices. These ETFs provide investors with diversified exposure to the options market and can be a convenient way to manage risk.

Another trend is the rise of algorithmic trading, which uses computer algorithms to execute trades, including options. Algorithmic trading has become increasingly prevalent in the options market, and it is expected to continue to grow in the future.

Expert Tips and Advice

For those considering venturing into option trading, it is essential to proceed with caution and knowledge. Here are some valuable tips to consider:

- Understand your goals: Define your investment objectives and risk tolerance before entering the options market.

- Learn the basics: Familiarize yourself with option terminology, strategies, and risk management techniques.

- Start small: Begin with small trades and gradually increase your exposure as you gain experience.

- Use a reputable broker: Choose a broker that offers reliable trading platforms and educational resources.

- Manage your risk: Implement robust risk management strategies and consider diversification to mitigate potential losses.

Image: www.elearnmarkets.com

Frequently Asked Questions

Q: What is the difference between a call and a put option?

A: A call option gives the buyer the right to buy an underlying asset, while a put option confers the right to sell.

Q: What is the impact of time decay on option premiums?

A: Option premiums decrease over time as the expiration date approaches. This is known as time decay and should be factored into trading decisions.

Q: How can I calculate option premiums?

A: Option premiums are determined by complex mathematical models that consider various factors, including the underlying asset price, strike price, expiration date, and market volatility.

Option Trading Volume Increasing

Image: www.pinterest.com

Conclusion

The rise in option trading volume is a testament to the growing recognition of these instruments as a versatile investment tool. However, it is crucial to approach option trading with a comprehensive understanding of the risks and rewards involved. By following expert advice and sound risk management practices, investors can harness the potential of options to enhance their portfolios and achieve their financial goals.

Are you intrigued by the world of option trading? If you are ready to embark on this exciting journey, I encourage you to explore reputable resources and continue your education to equip yourself for success in this dynamic market.