Introduction

The world of finance can seem like a labyrinthine maze, especially for those navigating its complexities for the first time. Options trading, in particular, is often veiled in an aura of mystery, leaving many investors feeling hesitant and intimidated. However, with a clear understanding of options and how they function, traders can unlock a powerful tool for managing risk and boosting returns. In this comprehensive guide, we will delve into the realm of options trading, simplifying its concepts and equipping you with indispensable knowledge to make informed decisions.

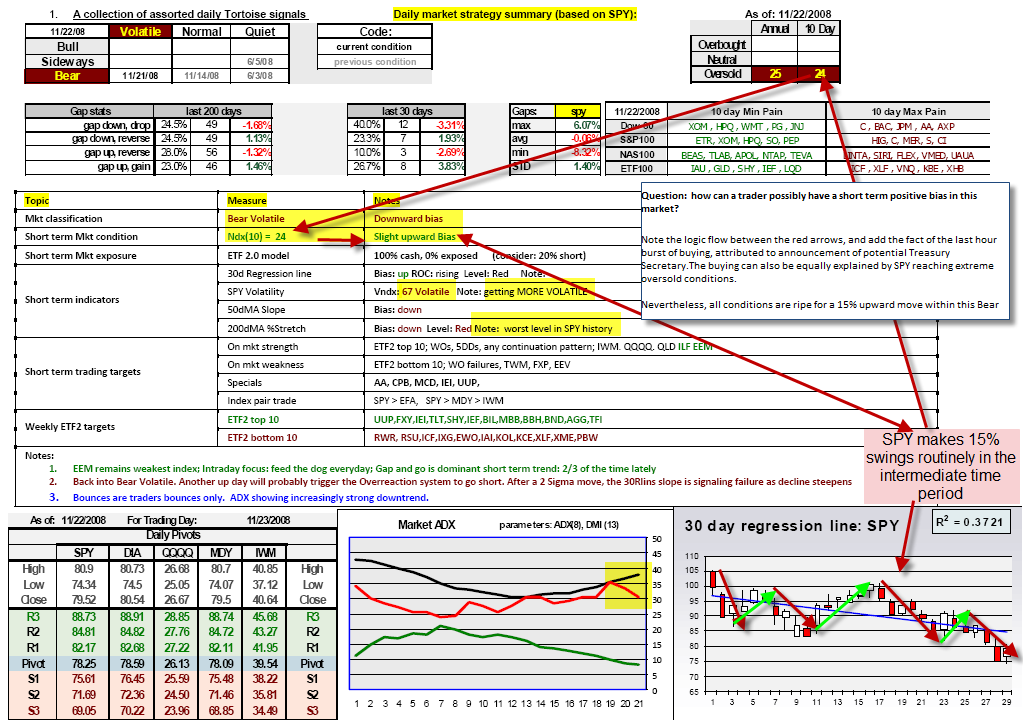

Image: www.xtremetrading.net

Options trading offers investors the ability to profit from potential market movements without having to commit to buying or selling an underlying asset. This flexibility makes options a versatile instrument for both hedging strategies and speculative plays. To illustrate, imagine you believe the stock price of your favorite company will increase significantly in the coming months. Instead of purchasing the stock outright, you could buy a call option, which gives you the right, but not the obligation, to buy the stock at a predetermined price (the strike price) on or before a specified date (the expiration date). If the stock price rises as anticipated, you can exercise your option to buy the stock at the strike price, capitalizing on the price difference.

Decoding Options: Fundamentals and Mechanics

Options contracts, the building blocks of options trading, represent an agreement between two parties: the buyer and the seller. The buyer of an option acquires the right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at a predetermined strike price on or before the expiration date. This right comes at a cost known as the option premium, which the buyer pays upfront to the seller of the option.

At the core of options trading lies the concept of time decay. As an option approaches its expiration date, its value diminishes until it becomes worthless at expiration. This time-sensitive nature of options adds a layer of complexity to trading, as traders must consider both the potential price movement of the underlying asset and the time remaining until expiration.

Navigating the Market Landscape: Volatility and Liquidity

Understanding the market conditions that influence options prices is paramount for successful trading. Volatility, a measure of how widely the underlying asset’s price fluctuates, plays a crucial role. Higher volatility generally equates to higher option premiums, as it implies a greater chance of the asset’s price moving in the desired direction. Liquidity, on the other hand, refers to the ease with which an option can be bought or sold in the market. Liquid options usually have tighter spreads between their bid and ask prices, making them more attractive for trading.

keeping abreast of real-time market updates, monitoring news and expert commentaries, and engaging in discussions on trading forums and social media platforms can provide invaluable insights into market sentiment and potential trading opportunities.

Expert Advice and Tips for Empowered Decision-Making

Navigating the intricacies of options trading demands a combination of knowledge, strategy, and discipline. Seasoned traders often emphasize the importance of clearly defining trading objectives, managing risk through proper position sizing, and not chasing after quick profits. Developing a comprehensive trading plan that outlines your risk tolerance, investment goals, and trading strategies is essential for long-term success.

Continuous education is indispensable in the ever-evolving world of finance. Stay informed about market trends and updates, study successful trading strategies, and seek guidance from experienced professionals to enhance your understanding and decision-making abilities. Remember, knowledge is power, especially in the realm of financial markets.

Image: www.visualcapitalist.com

FAQs: Common Questions Unearthed

- Q: Are options trading suitable for beginners?

A: while options offer immense potential, they are not recommended for novice traders due to their inherent complexity and risk. It’s advisable to gain a solid understanding of the financial markets and trading fundamentals before venturing into options trading. - Q: How do I calculate the potential profit and loss in options trading?

A: The potential profit or loss depends on several factors, including the strike price, option premium, underlying asset’s price movement, and time to expiration. Using an options profit calculator can provide a quick and accurate estimate. - Q: What are some of the risks associated with options trading?

A: Options trading involves the risk of losing the entire invested capital. Other risks include time decay, market volatility, and liquidity issues. Proper risk management strategies are crucial to mitigate these risks.

Options In Trading Example

Image: investpost.org

Conclusion

Options trading presents a powerful tool for investors seeking to navigate the complexities of the financial markets. By embracing the concepts outlined in this comprehensive guide, you are well-equipped to understand and utilize options strategically. Remember, knowledge and discipline are the cornerstones of successful trading. As you embark on your trading journey, remember that continuous learning and a disciplined approach will guide you toward making informed decisions and achieving your financial goals.

Tell us, are you ready to dive into the world of options trading? Share your thoughts and any lingering questions in the comments section below. Let’s continue the discussion and empower each other on this exciting financial adventure.