Image: money.stackexchange.com

Introduction:

In the labyrinthine world of financial markets, options trading stands out as a complex and potentially lucrative endeavor. Understanding the intricate interplay between the ask and bid prices is paramount to successful trading in this arena. This comprehensive guide will elucidate the concepts of ask vs. bid, equipping you with the knowledge to navigate these trading waters with confidence.

Delving into Ask vs. Bid

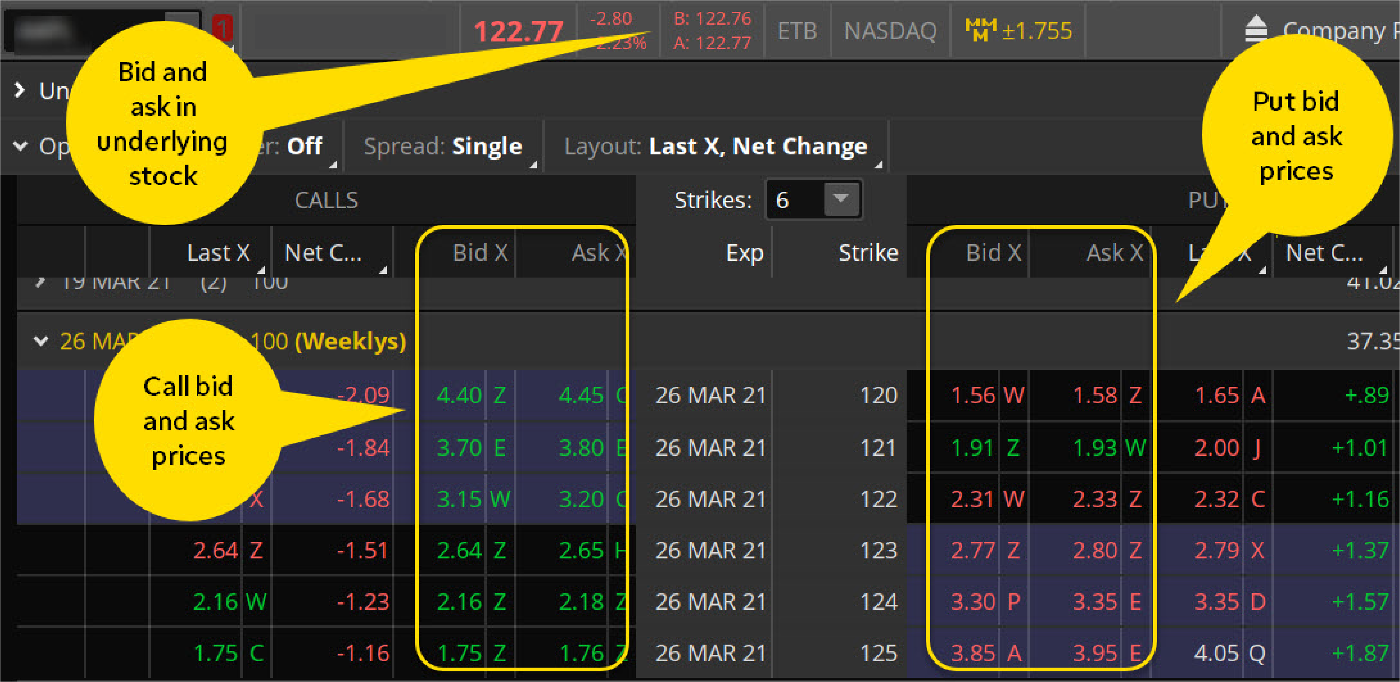

The ask price of an option contract represents the minimum amount a seller is willing to sell it for, while the bid price denotes the maximum amount a buyer is prepared to pay. This differential, known as the spread, determines the transaction cost and profitability.

Factors Influencing Ask and Bid Prices

Market forces such as supply and demand, market sentiment, volatility, time to expiration, and underlying asset prices all impact ask and bid prices. Higher demand or positive market sentiment tends to inflate the ask price, while an abundance of sellers or negative market sentiment can depress the bid price.

Calculating Trading Profits

To determine potential trading profits, consider the following:

- Long Position: Buying an option at the bid price and potentially selling it at a higher ask price.

- Short Position: Selling an option at the ask price and buying it back (covering) at a lower bid price.

The Significance of Spread

The spread, or the difference between the ask and bid prices, affects trading outcomes. A tighter spread offers higher liquidity but lower potential profits, while a wider spread reduces transaction costs but may limit trading opportunities.

Expert Insights

“Understanding the ask vs. bid spread is essential for effective risk management,” says renowned trader Mark Douglas. “By analyzing market conditions and the spread, traders can mitigate trading risks and maximize returns.”

Actionable Tips

- Monitor market conditions: Stay informed about market sentiment, economic events, and geopolitical news that may affect option prices.

- Compare multiple sources: Gather quotes from several brokers to ensure you’re getting the best ask and bid prices.

- Consider using limit orders: Place orders that specify a specific ask or bid price to secure favorable execution.

Conclusion

Comprehending the nuances of ask vs. bid is a critical skill for successful options trading. By leveraging the knowledge and insights provided in this guide, you can navigate the trading landscape, make informed decisions, and potentially achieve your financial goals. Remember to approach trading with caution, manage risk diligently, and seek professional guidance when necessary.

Image: stockoc.blogspot.com

Options Trading Ask Vs Bid

Image: tickertape.tdameritrade.com